Advanced Econometrics III

(Econometrics III)

Chapter 18. Why Should We Concern SEM?

Hu Huaping (胡华平)

huhuaping01 at hotmail.com

School of Economics and Management (经济管理学院)

2024-05-09

Part 2:Simultaneous-Equation Models (SEM)

Chapter 17. Endogeneity and Instrumental Variables

Chapter 18. Why Should We Concern SEM ?

Chapter 19. What is the Identification Problem?

Chapter 20. How to Estimate SEM ?

Chapter 18. Why Should We Concern SEM ?

18.1 The Nature of Simultaneous-Equation Models

18.1 The Nature of Simultaneous-Equation Models

Definition and basic format of SEM

Simultaneous Equations Models (SEM): A system of equations consisting of several equations with interrelated or jointly influence.

The basic and simple SEM is

\[ \begin{cases} \begin{align} Y_{1 i}=\beta_{10}+\gamma_{12} Y_{2 i}+\beta_{11} X_{1 i}+u_{i1} \\ Y_{2 i}=\beta_{20}+\gamma_{21} Y_{1 i}+\beta_{21} X_{1 i}+u_{i2} \end{align} \end{cases} \]

Macroeconomics SEM Examples

Demand-and-Supply System

Demand-and-Supply System:

\[ \begin{cases} \begin{align} \text { Demand function: } & {Q_{t}^{d}=\alpha_{0}+\alpha_{1} P_{t}+u_{1t}, \quad \alpha_{1}<0} \\ {\text { Supply function: }} & {Q_{t}^{s}=\beta_{0}+\beta_{1} P_{t}+u_{2t}, \quad \beta_{1}>0} \\ {\text {Equilibrium condition: }} & {Q_{t}^{d}=Q_{t}^{s}} \end{align} \end{cases} \]

Keynesian Model of Income Determination

Keynesian Model of Income Determination:

\[ \begin{cases} \begin{align} C_t &= \beta_0+\beta_1Y_t+\varepsilon_t &&\text{(consumption function)}\\ Y_t &= C_t+I_t &&\text{(income identity)} \end{align} \end{cases} \]

The IS Model

Macroeconomics goods market equilibrium model, also known as IS Model:

\[ \begin{cases} \begin{align} \text { Consumption function: } & C_{t}=\beta_{0}+\beta_{1} Y_{d t} +u_{1t} & <\beta_{1}<1 \\ \text { Tax function: } & T_{t}=\alpha_{0}+\alpha_{1} Y_{t} +u_{2t}& \quad 0<\alpha_{1}<1 \\ \text { Investment function: } & I_{t}=\gamma_{0}+\gamma_{1} r_{t} +u_{3t} \\ \text { Definition: } & \gamma_{d t}=Y_{t}-T_{t} \\ \text { Government expenditure: } & G_{t}=\bar{G} \\ \text { National income identity: } & Y_{t}=C_{t}+I_{t}+G_{t} \end{align} \end{cases} \]

where: \(Y=\) national income; \(Y_d=\) disposable income; \(r=\) interest rate; \(\bar{G}=\) given level of government expenditure

The LM Model

Macroeconomics money market equilibrium system, also known as LM Model:

\[ \begin{cases} \begin{align} {\text { Money demand function: }} & {M_{t}^{d}=a+b Y_{t}-c r_{t}} +u_{t} \\ {\text { Money supply function: }} & {M_{t}^{s}=\bar{M}} \\ {\text { Equilibrium condition: }} & {M_{t}^{d}=M_{t}^{s}} \end{align} \end{cases} \]

Where: \(Y=\) income; \(r=\) interest rate; \(\bar{M}=\) assumed level of money supply.

Klein’s model I

Klein’s model I:

\[ \begin{cases} \begin{align} \text { Consumption function: } & C_{t}=\beta_{0}+\beta_{1} P_{t}+\beta_{2}\left(W+W^{\prime}\right)_{t}+\beta_{3} P_{t-1}+u_{ t1} \\ \text { Investment function: } & I_{t} =\beta_{4}+\beta_{5} P_{t}+\beta_{6} P_{t-1}+\beta_{7} K_{t-1}+u_{ t2} \\ \text { Demand for labor: } & w_{t}= \beta_{8}+\beta_{9}\left(Y+T-W^{\prime}\right)_{t} +\beta_{10}\left(Y+T-W^{\prime}\right)_{t-1}+\beta_{11} t+u_{ t3} \\ \text { Identity: } & Y_{t} = C_{t}+I_{t}+C_{t} \\ \text { Identity: } & Y_{t}=W_{t}^{\prime}+W_{t}+P_{t} \\ \text { Identity: } & K_{t}=K_{t-1}+I_{t} \end{align} \end{cases} \]

Where: \(C=\) consumption expenditure; \(Y=\) income after tax; \(P=\) profits; \(W=\) private wage bill; \(W^{\prime}=\) government wage bill; \(K=\) capital stock; \(T=\) taxes.

Microeconomic SEM Examples

Murder Rates and Size of the police Force

Cities often want to determine how much additional law enforcement will decrease their murder rates.

\[ \begin{cases} \begin{align} \operatorname{murdpc} &=\alpha_{1} \operatorname{polpc}+\beta_{10}+\beta_{11} \text {incpc}+u_{1} \\ \text { polpc } &=\alpha_{2} \operatorname{murdpc}+\beta_{20}+\text { other factors. } \end{align} \end{cases} \]

Where : \(murdpc =\) murders per capita; \(polpc =\) number of police officers per capita; \(incpc =\) income per capita.

Housing Expenditures and Saving

For a random household in the population, we assume that annual housing expenditures and saving are jointly determined by:

\[ \begin{cases} \begin{align} \text {housing } & =\alpha_{1} \text {saving}+\beta_{10}+\beta_{11} \text {inc}+\beta_{12} e d u c+\beta_{13} \text {age}+u_{1} \\ \text {saving} &=\alpha_{2} \text {housing }+\beta_{20}+\beta_{21} \text {inc}+\beta_{22} e d u c+\beta_{23} \text {age}+u_{2} \end{align} \end{cases} \]

Where: \(inc =\) annual income; \(saving =\) household saving; \(educ =\) education measured in years; \(age =\) age measured in years.

Labor market of married, Working Women

Let’s consider the labor market for married women already in the workforce.

\[ \begin{alignedat}{8} \text { hours } & =\alpha_1 \log ( wage)+\beta_{10}+\beta_{11} { educ }+\beta_{12} age \\&+\beta_{13} { kidslt6 } +\beta_{14} { nwifeinc }+u_1 &\text{(supply)}\\ \log ({ wage }) &=\alpha_2 { hours }+\beta_{20}+\beta_{21} { educ }+\beta_{22} { exper } \\&+\beta_{23} { exper }^2+ u_2 & \text{(demand)}\\ \end{alignedat} \]

In the demand function, we write the wage offer as a function of hours and the usual productivity variables.

All variables except

hoursandlog(wage)are assumed to be exogenous.educmight be correlated with omittedabilityin either equation. Here, we just ignore the omitted ability problem.

The Nature of SEM

The essence of simultaneous equation model is endogenous variable problem:

Each of these equations has its economic causality effect.

Some of these equations contain endogenous variables.

Sample data is only the end result of various variables, which lies complex causal interaction behind them.

Estimation all of the parameters directly by OLS method may induce problems.

Truffles example

The story

Truffles are delicious food materials. They are edible fungi that grow below the ground. Consider a supply and demand model for truffles:

\[ \begin{cases} \begin{align} \text { Demand: } & Q_{di}=\alpha_{1}+\alpha_{2} P_{i}+\alpha_{3} P S_{i}+\alpha_{4} D I_{i}+e_{d i} \\ \text { Supply: } & Q_{si}=\beta_{1}+\beta_{2} P_{i}+\beta_{3} P F_{i}+e_{s i}\\ \text { Equity: } & Q_{di}= Q_{si} \end{align} \end{cases} \]

where: - \(Q_i=\) the quantity of truffles traded in a particular marketplace; - \(P_i=\) the market price of truffles; - \(PS_i=\) the market price of a substitute for real truffles; - \(DI_i=\) per capita monthly disposable income of local residents; - \(PF_i=\) the price of a factor of production, which in this case is the hourly rental price of truffle-pigs used in the search process.

Model variables

The data set

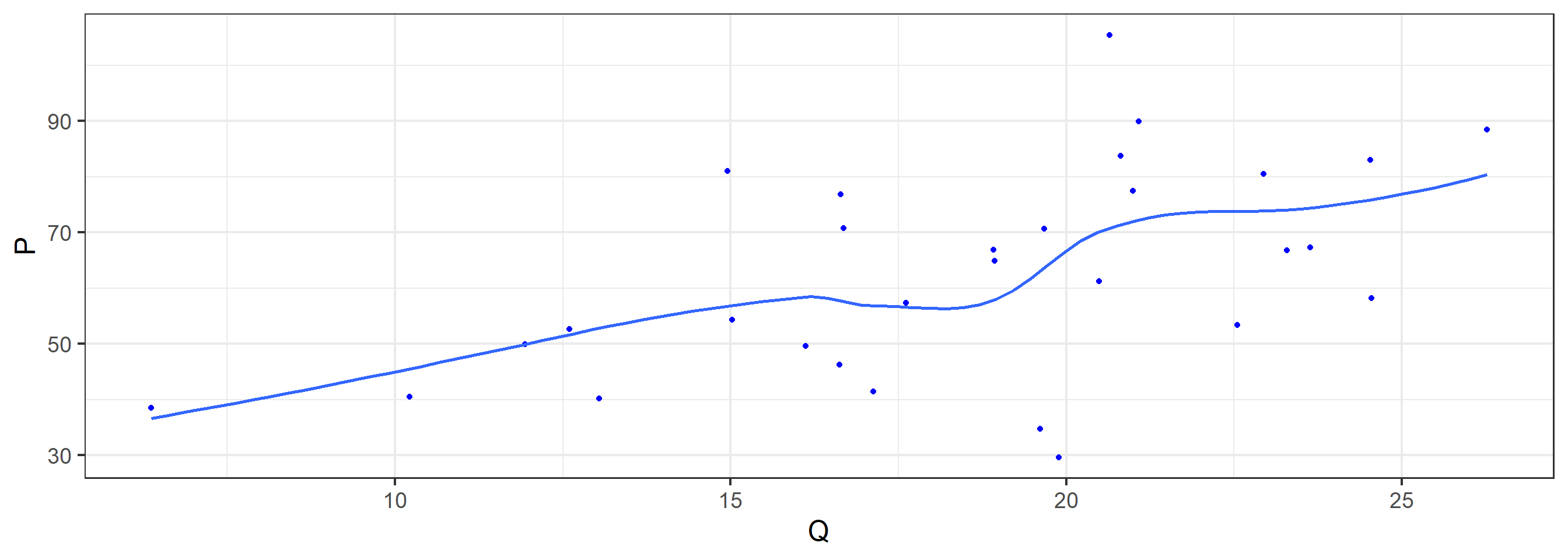

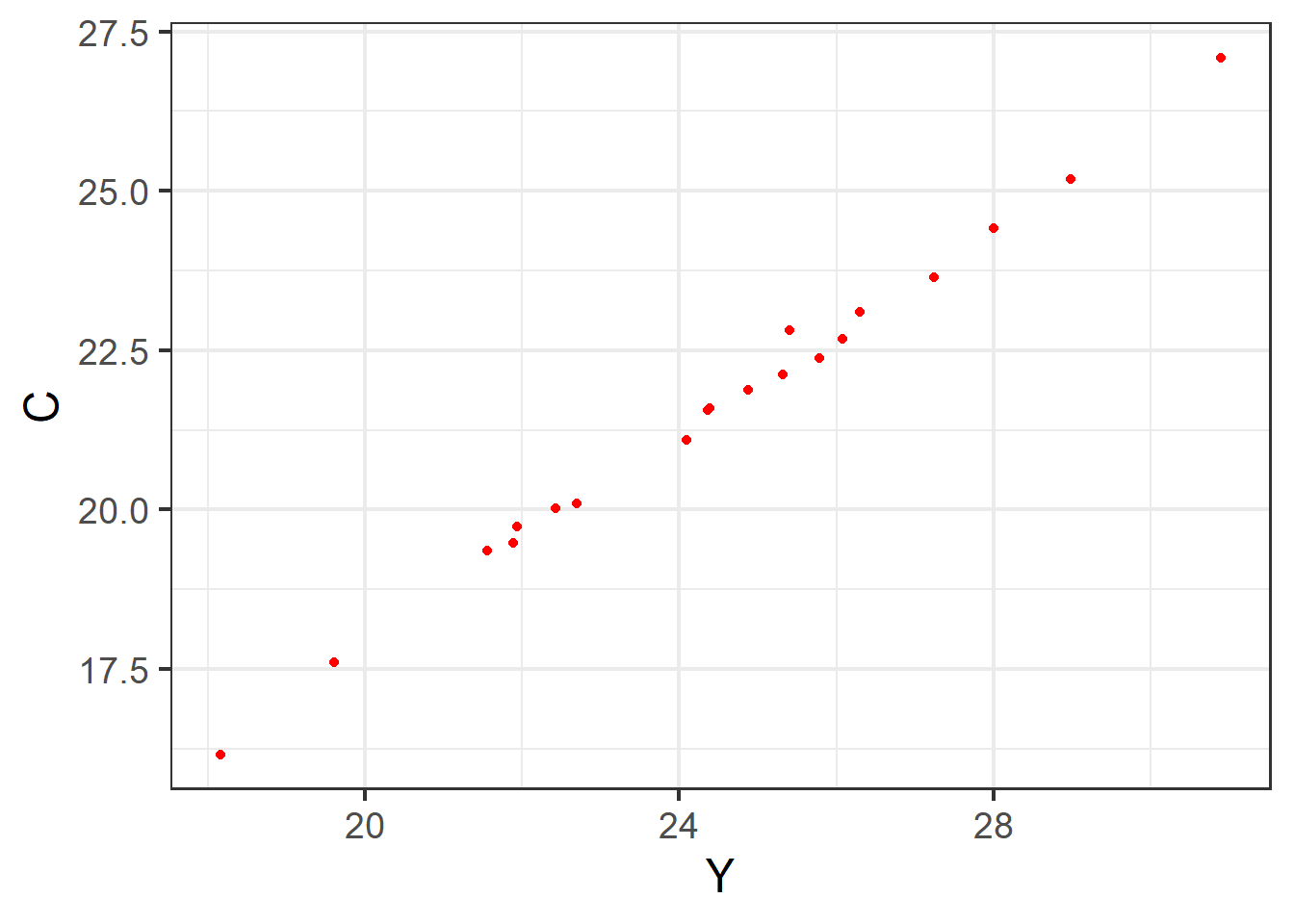

The Scatter plot (P VS Q)

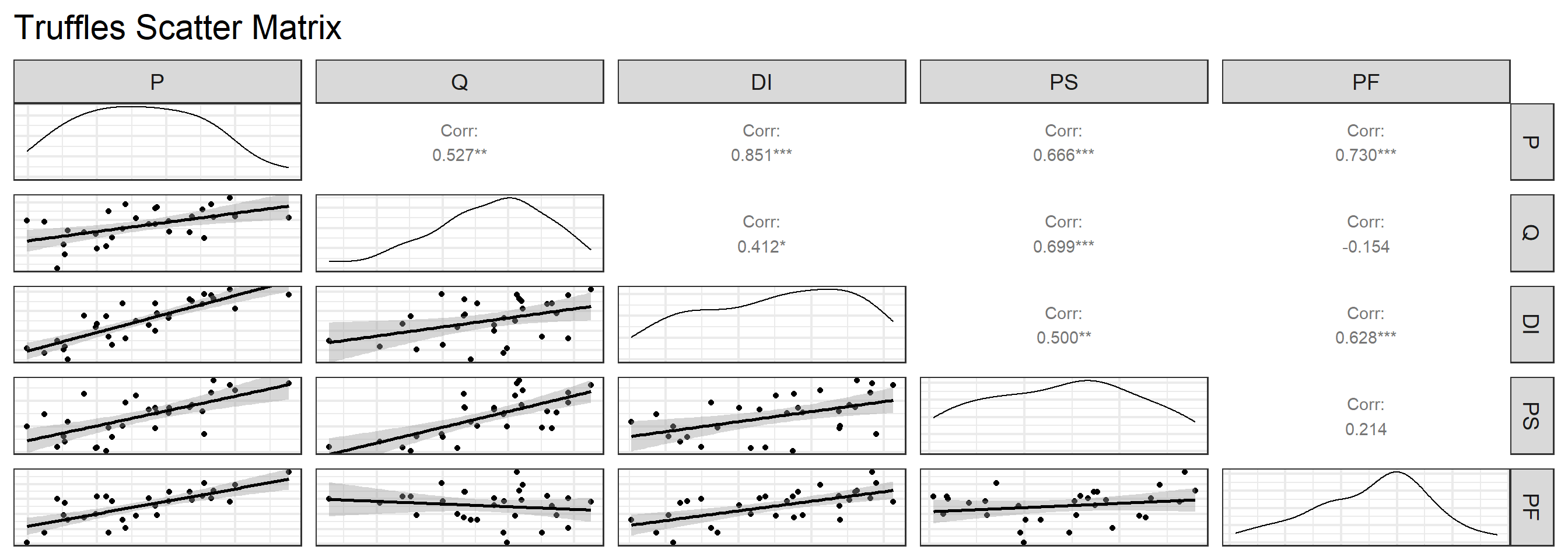

The Scatter matrix

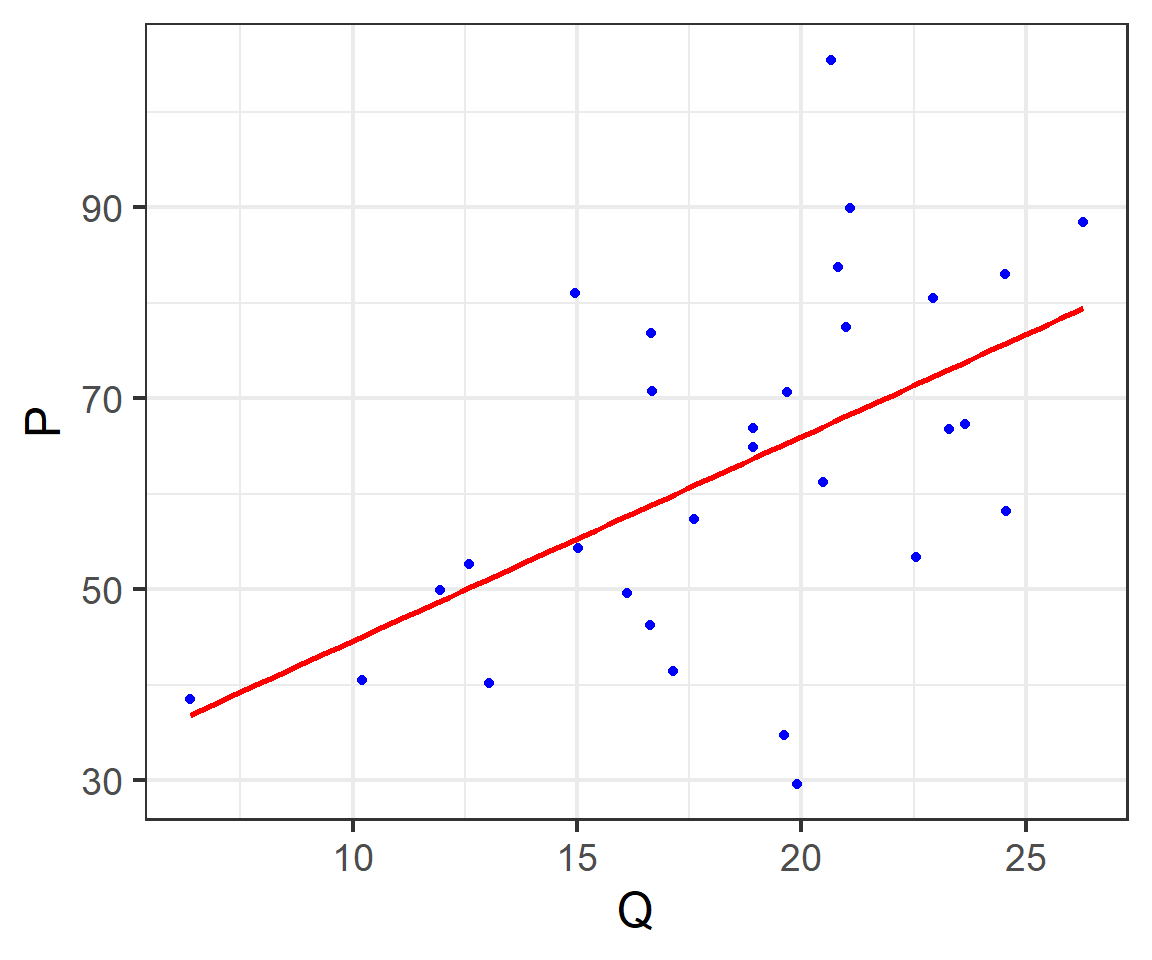

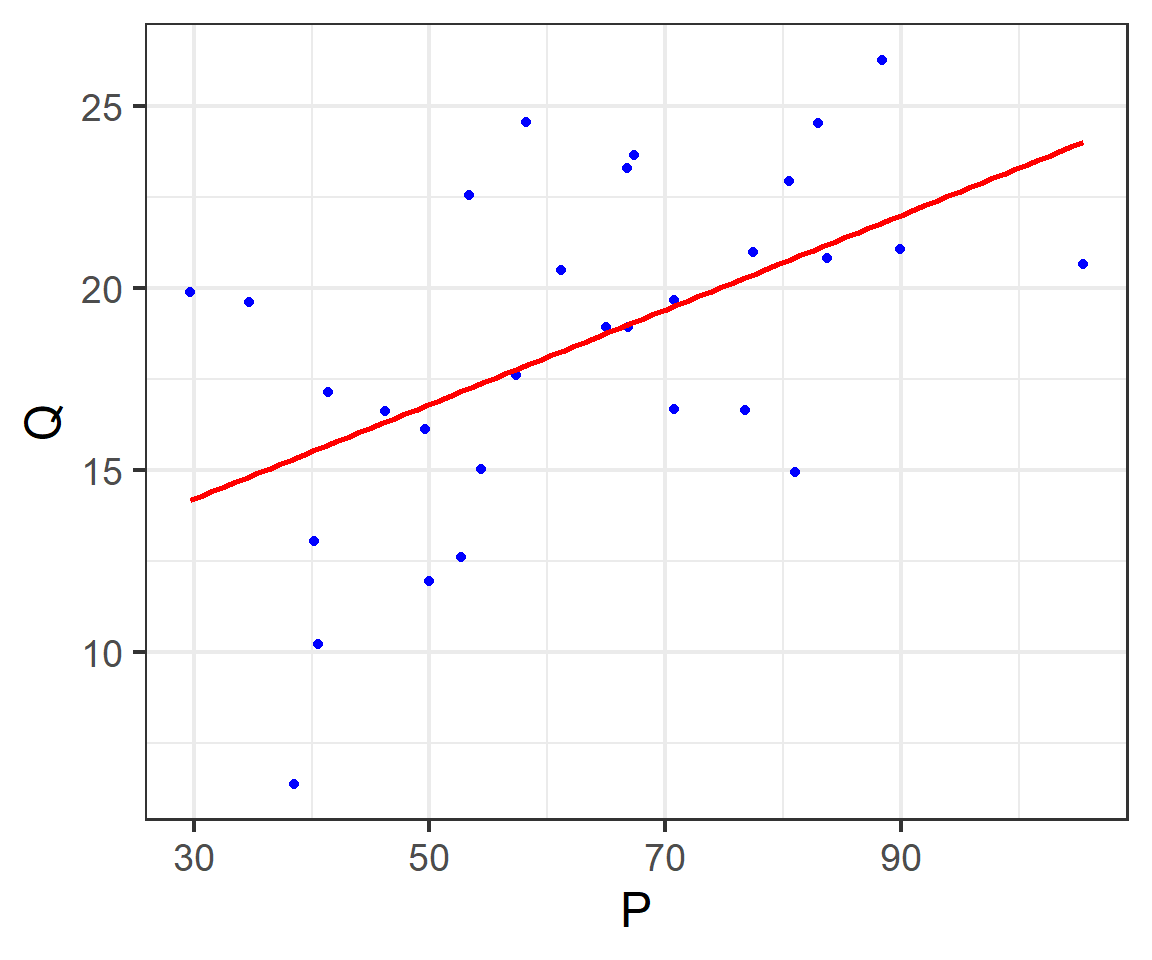

The simple linear regression

Let’s start with the simplest linear regression model.

Generally, we use price (P) and output (Q) data to directly conduct simple linear regression modeling:

\[ \begin{cases} \begin{align} P & = \hat{\beta}_1+\hat{\beta}_2Q +e_1 && \text{(simple P model)}\\ Q & = \hat{\beta}_1+\hat{\beta}_2P +e_2 && \text{(simple Q model)} \end{align} \end{cases} \]

The simple linear regression

As we all know, the linear regression of two variables is asymmetrical, so there is:

- the simple Price regression is:

\[ \begin{alignedat}{999} \begin{split} &\widehat{P}=&&+23.23&&+2.14Q_i\\ &(s)&&(12.3885)&&(0.6518)\\ &(t)&&(+1.87)&&(+3.28)\\ &(fit)&&R^2=0.2780&&\bar{R}^2=0.2522\\ &(Ftest)&&F^*=10.78&&p=0.0028 \end{split} \end{alignedat} \]

- the simple Quantity regression is:

\[ \begin{alignedat}{999} \begin{split} &\widehat{Q}=&&+10.31&&+0.13P_i\\ &(s)&&(2.5863)&&(0.0396)\\ &(t)&&(+3.99)&&(+3.28)\\ &(fit)&&R^2=0.2780&&\bar{R}^2=0.2522\\ &(Ftest)&&F^*=10.78&&p=0.0028 \end{split} \end{alignedat} \]

The sample regression line (SRL)

The multi-variables regression model (1/2)

Of course, we can also use more independent variables X to build the regression models:

\[ \begin{cases} \begin{align} P & = \hat{\beta}_1+\hat{\beta}_2Q +\hat{\beta}_3DI+\hat{\beta}_2PS +e_1 && \text{(added P model)}\\ Q & = \hat{\beta}_1+\hat{\beta}_2P +\hat{\beta}_2PF+e_2 && \text{(added Q model)} \end{align} \end{cases} \]

The multi-variables regression model (2/2)

- Result of multi-vars Price regression model is:

\[ \begin{alignedat}{999} \begin{split} &\widehat{P}=&&-48.68&&+2.05Q_i&&+3.16DI_i\\ &(s)&&(5.0047)&&(0.2731)&&(1.1409)\\ &(t)&&(-9.73)&&(+7.50)&&(+2.77)\\ &(cont.)&&+0.36PS_i&&+2.39PF_i &&\\ &(s)&&(0.2674)&&(0.2184) &&\\ &(t)&&(+1.36)&&(+10.96) &&\\ &(fit)&&R^2=0.9658&&\bar{R}^2=0.9603 &&\\ &(Ftest)&&F^*=176.23&&p=0.0000 && \end{split} \end{alignedat} \]

- Result of multi-vars Quantity regression model:

\[ \begin{alignedat}{999} \begin{split} &\widehat{Q}=&&+18.88&&+0.34P_i&&-0.40DI_i\\ &(s)&&(2.3480)&&(0.0451)&&(0.5238)\\ &(t)&&(+8.04)&&(+7.50)&&(-0.77)\\ &(cont.)&&+0.08PS_i&&-0.96PF_i &&\\ &(s)&&(0.1115)&&(0.0918) &&\\ &(t)&&(+0.71)&&(-10.51) &&\\ &(fit)&&R^2=0.9069&&\bar{R}^2=0.8920 &&\\ &(Ftest)&&F^*=60.88&&p=0.0000 && \end{split} \end{alignedat} \]

18.2 Notations and Definitions

Structural SEM

Algebraic expression (A)

Structural equations: System of equations that directly characterize economic structure or behavior.

The algebraic expression of structural SEM is:

\[ \begin{cases} \begin{alignat}{5} Y_{t1}&= & &+\gamma_{21}Y_{t2}+&\cdots &+\gamma_{m1}Y_{tm} & +\beta_{11}X_{1t}+\beta_{21}X_{t2} &+\cdots+\beta_{k1}X_{tk} &+\varepsilon_{t1} \\ Y_{t2}&=&\gamma_{12}Y_{t1} &+ & \cdots &+\gamma_{m2}Y_{tm}&+\beta_{12}X_{t1}+\beta_{22}X_{t2} &+\cdots+\beta_{k2}X_{tk} &+\varepsilon_{t2}\\ & \vdots &\vdots &&\vdots &&\vdots \\ Y_{tm}&=&\gamma_{1m}Y_{t1}&+\gamma_{2m}Y_{t2}+& \cdots & &+\beta_{1m}X_{t1} +\beta_{2m}X_{t2} &+\cdots+\beta_{km}X_{tk} &+\varepsilon_{tm} \end{alignat} \end{cases} \]

Structural coefficients

Structural coefficients: Parameters in structural equation that represents an economic outcome or behavioral relationship, including:

\[ \begin{cases} \begin{alignat}{5} Y_{t1}&= & &+\gamma_{21}Y_{t2}+&\cdots &+\gamma_{m1}Y_{tm} & +\beta_{11}X_{1t}+\beta_{21}X_{t2} &+\cdots+\beta_{k1}X_{tk} &+\varepsilon_{t1} \\ Y_{t2}&=&\gamma_{12}Y_{t1} &+ & \cdots &+\gamma_{m2}Y_{tm}&+\beta_{12}X_{t1}+\beta_{22}X_{t2} &+\cdots+\beta_{k2}X_{tk} &+\varepsilon_{t2}\\ & \vdots &\vdots &&\vdots &&\vdots \\ Y_{tm}&=&\gamma_{1m}Y_{t1}&+\gamma_{2m}Y_{t2}+& \cdots & &+\beta_{1m}X_{t1} +\beta_{2m}X_{t2} &+\cdots+\beta_{km}X_{tk} &+\varepsilon_{tm} \end{alignat} \end{cases} \]

- Endogenous structural coefficients: \(\gamma_{11}, \gamma_{21},\cdots, \gamma_{m1}; \cdots; \gamma_{1m}, \gamma_{2m},\cdots, \gamma_{mm}\)

- Exogenous structural coefficients: \(\beta_{11}, \beta_{21},\cdots, \beta_{m1}; \cdots; \beta_{1m}, \beta_{2m},\cdots, \beta_{mm};\)

Structural variables

Endogenous variables: Variables determined by the model.

Predetermined variables:Variables which values are not determined by the model in the current time period.

\[ \begin{cases} \begin{alignat}{5} Y_{t1}&= & &+\gamma_{21}Y_{t2}+&\cdots &+\gamma_{m1}Y_{tm} & +\beta_{11}X_{1t}+\beta_{21}X_{t2} &+\cdots+\beta_{k1}X_{tk} &+\varepsilon_{t1} \\ Y_{t2}&=&\gamma_{12}Y_{t1} &+ & \cdots &+\gamma_{m2}Y_{tm}&+\beta_{12}X_{t1}+\beta_{22}X_{t2} &+\cdots+\beta_{k2}X_{tk} &+\varepsilon_{t2}\\ & \vdots &\vdots &&\vdots &&\vdots \\ Y_{tm}&=&\gamma_{1m}Y_{t1}&+\gamma_{2m}Y_{t2}+& \cdots & &+\beta_{1m}X_{t1} +\beta_{2m}X_{t2} &+\cdots+\beta_{km}X_{tk} &+\varepsilon_{tm} \end{alignat} \end{cases} \]

Endogenous variables:

- Such as: \(Y_{t1};Y_{t2}; \cdots; Y_{tm}\)

Predetermined variables:

- Such as: \(X_{..}\)

Predetermined variables

Predetermined variables: Variables which values are not determined by the model in the current time period, including:

the exogenous variables

the lagged endogenous variables.

\[ \begin{cases} \begin{alignat}{5} Y_{t1}&= & &+\gamma_{21}Y_{t2}+&\cdots &+\gamma_{m1}Y_{tm} & +\beta_{11}X_{1t}+\beta_{21}X_{t2} &+\cdots+\beta_{k1}X_{tk} &+\varepsilon_{t1} \\ Y_{t2}&=&\gamma_{12}Y_{t1} &+ & \cdots &+\gamma_{m2}Y_{tm}&+\beta_{12}X_{t1}+\beta_{22}X_{t2} &+\cdots+\beta_{k2}X_{tk} &+\varepsilon_{t2}\\ & \vdots &\vdots &&\vdots &&\vdots \\ Y_{tm}&=&\gamma_{1m}Y_{t1}&+\gamma_{2m}Y_{t2}+& \cdots & &+\beta_{1m}X_{t1} +\beta_{2m}X_{t2} &+\cdots+\beta_{km}X_{tk} &+\varepsilon_{tm} \end{alignat} \end{cases} \]

Predetermined variables

Exogenous variables: The variables not determined by the model, neither in the current period nor in the lagged period.

Lagged endogenous variables: The lag variable of the endogenous variable in the current period。

current period exogenous: - \(X_{t1}, X_{t2},\cdots, X_{tk}\) .

lagged period exdogenous: - lagged from \(X_{t1}\) : \(X_{t-1,1}; X_{t-2,1};\cdots; X_{t-(T-1),1}\) - and lagged from \(X_{tk}\) : \(X_{t-1,k}; X_{t-2,k};\cdots; X_{t-(T-1),k}\) - \(\cdots\)

lagged endogenous: - lagged from \(Y_{t1}\) : \(Y_{t-1,1}; Y_{t-2,1}; \cdots, Y_{t-(T-1),1}\) - and lagged from \(Y_{tm}\) : \(Y_{t-1,m}; Y_{t-2,m}; \cdots;Y_{t-(T-1),m}\) - \(\cdots\)

Predetermined coefficients

Predetermined coefficients: coefficients before predetermined variables.

\[ \begin{cases} \begin{alignat}{5} Y_{t1}&= & &+\gamma_{21}Y_{t2}+&\cdots &+\gamma_{m1}Y_{tm} & +\beta_{11}X_{1t}+\beta_{21}X_{t2} &+\cdots+\beta_{k1}X_{tk} &+\varepsilon_{t1} \\ Y_{t2}&=&\gamma_{12}Y_{t1} &+ & \cdots &+\gamma_{m2}Y_{tm}&+\beta_{12}X_{t1}+\beta_{22}X_{t2} &+\cdots+\beta_{k2}X_{tk} &+\varepsilon_{t2}\\ & \vdots &\vdots &&\vdots &&\vdots \\ Y_{tm}&=&\gamma_{1m}Y_{t1}&+\gamma_{2m}Y_{t2}+& \cdots & &+\beta_{1m}X_{t1} +\beta_{2m}X_{t2} &+\cdots+\beta_{km}X_{tk} &+\varepsilon_{tm} \end{alignat} \end{cases} \]

Such as: \(\beta_{11}, \beta_{21},\cdots, \beta_{12}; \cdots; \beta_{k2}, \beta_{1m},\cdots, \beta_{km}\)

Algebraic expression (B)

By simple transformation, the algebraic expression of SEM can also show as:

\[ A: \begin{cases} \begin{alignat}{5} Y_{t1}&= & &+\gamma_{21}Y_{t2}+&\cdots &+\gamma_{m1}Y_{tm} & +\beta_{11}X_{1t}+\beta_{21}X_{t2} &+\cdots+\beta_{k1}X_{tk} &+\varepsilon_{t1} \\ Y_{t2}&=&\gamma_{12}Y_{t1} &+ & \cdots &+\gamma_{m2}Y_{tm}&+\beta_{12}X_{t1}+\beta_{22}X_{t2} &+\cdots+\beta_{k2}X_{tk} &+\varepsilon_{t2}\\ & \vdots &\vdots &&\vdots &&\vdots \\ Y_{tm}&=&\gamma_{1m}Y_{t1}&+\gamma_{2m}Y_{t2}+& \cdots & &+\beta_{1m}X_{t1} +\beta_{2m}X_{t2} &+\cdots+\beta_{km}X_{tk} &+\varepsilon_{tm} \end{alignat} \end{cases} \]

\[ B: \begin{cases} \begin{alignat}{5} \gamma_{11}Y_{t1} &+ \gamma_{21}Y_{t2}&+\cdots &+\gamma_{m-1,1}Y_{t,m-1} &+\gamma_{m1}Y_{tm} & +\beta_{11}X_{t1}+\beta_{21}X_{t2} &+\cdots+\beta_{k1}X_{tk} &=\varepsilon_{t1} \\ \gamma_{12}Y_{t1} &+\gamma_{22}Y_{t2} &+ \cdots&+\gamma_{m-1,2}Y_{t,m-1} &+\gamma_{m2}Y_{tm}&+\beta_{12}X_{t1}+\beta_{22}X_{t2} &+\cdots+\beta_{k2}X_{tk} &= \varepsilon_{t2}\\ & \vdots &\vdots &&\vdots &&\vdots \\ \gamma_{1m}Y_{t1}&+\gamma_{2m}Y_{t2}&+ \cdots &+\gamma_{m-1,m}Y_{t,m-1} & +\gamma_{mm}Y_{tm} &+\beta_{1m}X_{t1} +\beta_{2m}X_{t2} &+\cdots+\beta_{km}X_{tk} &=\varepsilon_{tm} \end{alignat} \end{cases} \]

Matrix expression (1/2)

With the Matrix language, the matrix expression of SEM was noted as:

\[ \begin{equation} \begin{bmatrix} Y_1 & Y_2 & \cdots & Y_m \\ \end{bmatrix} _t \begin{bmatrix} \gamma_{11} & \gamma_{12} & \cdots & \gamma_{1m} \\ \gamma_{21} & \gamma_{22} & \cdots & \gamma_{2m} \\ \cdots & \cdots & \cdots & \cdots \\ \gamma_{m1} & \gamma_{m2} & \cdots & \gamma_{mm} \\ \end{bmatrix} + \\ \begin{bmatrix} X_1 & X_2 & \cdots & X_m \\ \end{bmatrix} _t \begin{bmatrix} \beta_{11} & \beta_{12} & \cdots & \beta_{1m} \\ \beta_{21} & \beta_{22} & \cdots & \beta_{2m} \\ \cdots & \cdots & \cdots & \cdots\\ \beta_{k1} & \beta_{k2} & \cdots & \beta_{km} \\ \end{bmatrix} \\ = \begin{bmatrix} \varepsilon_1 & \varepsilon_2 & \cdots & \varepsilon_m \\ \end{bmatrix} _t \end{equation} \]

Matrix expression (2/2)

For Simplicity, we can generized the matrix expression of SEM :

\[ \begin{aligned} & \boldsymbol{y^{\prime}_t} \boldsymbol{\Gamma} &+ & \boldsymbol{x^{\prime}_t} \boldsymbol{B} &= & \boldsymbol{{\varepsilon^{\prime}_t}} \\ &(1 \ast m)(m \ast m) & & (1 \ast k)(k \ast m) & & (1 \ast m) \end{aligned} \]

where:

Bold upper letter and greek means a matrix

Bold lower letter and greek means a column vector

Endogenous coefficients matrix

For the Endogenous parameter matrix \(\boldsymbol{\Gamma}\) , To ensure that each equation has a dependent variable, then the matrix \(\boldsymbol{\Gamma}\) each column has at least one element of 1

\[ \begin{equation} \boldsymbol{\Gamma} = \begin{bmatrix} \gamma_{11} & \gamma_{12} & \cdots & \gamma_{1m} \\ \gamma_{21} & \gamma_{22} & \cdots & \gamma_{2m} \\ \cdots & \cdots & \cdots & \cdots \\ \gamma_{m1} & \gamma_{m2} & \cdots & \gamma_{mm} \\ \end{bmatrix} \\ \text{if }\Rightarrow \begin{bmatrix} \gamma_{11} & \gamma_{12} & \cdots & \gamma_{1m} \\ 0 & \gamma_{22} & \cdots & \gamma_{2m} \\ \cdots & \cdots & \cdots & \cdots \\ 0 & 0 & \cdots & \gamma_{mm} \\ \end{bmatrix} \end{equation} \]

\[ \begin{cases} \begin{aligned} y_{1t} &=& f_{1}\left(\mathbf{x}_{t}\right)+\varepsilon_{t1} \\ y_{2t} &=& f_{2}\left(y_{t1}, \mathbf{x}_{t}\right)+\varepsilon_{t2} \\ & \vdots & \vdots \\ y_{mt} &=& f_{m}\left(y_{t1}, y_{t2}, \ldots, \mathbf{x}_{t}\right)+\varepsilon_{mt} \end{aligned} \end{cases} \]

If matrix \(\boldsymbol{\Gamma}\) is upper triangular matrix, then the SEM is a recursive model system.

For the SEM solution to exist, \(\boldsymbol{\Gamma}\) must be nonsingular.

Exdogenous coefficients matrix

The Exogenous coefficients matrix \(\boldsymbol{B}\) :

\[ \begin{equation} \boldsymbol{B} = \begin{bmatrix} \beta_{11} & \beta_{12} & \cdots & \beta_{1m} \\ \beta_{21} & \beta_{22} & \cdots & \beta_{2m} \\ \cdots & \cdots & \cdots & \cdots\\ \beta_{k1} & \beta_{k2} & \cdots & \beta_{km} \\ \end{bmatrix} \end{equation} \]

Reduced SEM

Algebraic expression

Reduced equations: The equation expresses an endogenous variable with all the predetermined variables and the stochastic disturbances.

\[ \begin{cases} \begin{alignat}{5} Y_{t1}&= & +\pi_{11}X_{t1}+\pi_{21}X_{t2} &+\cdots+\pi_{k1}X_{tk} & + v_{t1} \\ Y_{t2}&=&+\pi_{12}X_{t1}+\pi_{22}X_{t2} &+\cdots+\pi_{k2}X_{tk} & + v_{t2}\\ & \vdots &\vdots &&\vdots & \\ Y_{tm}&=&+\pi_{1m}X_{t1} +\pi_{2m}X_{t2} &+\cdots+\pi_{km}X_{tk} & + v_{tm} \end{alignat} \end{cases} \]

Reduced coefficients and disturbance

Reduced coefficients: parameters in the reduced SEM.

Reduced disturbance: stochastic disturbance terms in the reduced SEM.

\[ \begin{cases} \begin{alignat}{5} Y_{t1}&= & +\pi_{11}X_{t1}+\pi_{21}X_{t2} &+\cdots+\pi_{k1}X_{tk} & + v_{t1} \\ Y_{t2}&=&+\pi_{12}X_{t1}+\pi_{22}X_{t2} &+\cdots+\pi_{k2}X_{tk} & + v_{t2}\\ & \vdots &\vdots &&\vdots & \\ Y_{tm}&=&+\pi_{1m}X_{t1} +\pi_{2m}X_{t2} &+\cdots+\pi_{km}X_{tk} & + v_{tm} \end{alignat} \end{cases} \]

Reduced coefficients: - \(\pi_{11},\pi_{21},\cdots, \pi_{k1}\) - \(\pi_{1m},\pi_{2m},\cdots, \pi_{km}\) .

Reduced disturbance: - \(v_{1},v_2,\cdots, v_m\) 。

Matrix expression (1/2)

\[ \begin{cases} \begin{alignat}{5} Y_{t1}&= & +\pi_{11}X_{t1}+\pi_{21}X_{t2} &+\cdots+\pi_{k1}X_{tk} & + v_{t1} \\ Y_{t2}&=&+\pi_{12}X_{t1}+\pi_{22}X_{t2} &+\cdots+\pi_{k2}X_{tk} & + v_{t2}\\ & \vdots &\vdots &&\vdots & \\ Y_{tm}&=&+\pi_{1m}X_{t1} +\pi_{2m}X_{t2} &+\cdots+\pi_{km}X_{tk} & + v_{tm} \end{alignat} \end{cases} \]

For this algebraic reduced SEM, we can note its matrix form as:

\[ \begin{equation} \begin{bmatrix} Y_1 & Y_2 & \cdots & Y_m \\ \end{bmatrix} _t = \\ \begin{bmatrix} X_1 & X_2 & \cdots & X_m \\ \end{bmatrix} _t \begin{bmatrix} \pi_{11} & \pi_{12} & \cdots & \pi_{1m} \\ \pi_{21} & \pi_{22} & \cdots & \pi_{2m} \\ \cdots & \cdots & \cdots & \cdots \\ \pi_{m1} & \pi_{m2} & \cdots & \pi_{mm} \\ \end{bmatrix} + \begin{bmatrix} v_1 & v_2 & \cdots & v_m \\ \end{bmatrix} _t \end{equation} \]

Matrix expression (2/2)

For simplicity, the matrix expression of reduced SEM can be noted further.

\[ \begin{aligned} & \boldsymbol{y^{\prime}_t} & = &\boldsymbol{x^{\prime}_t} \boldsymbol{\Pi} & + & \boldsymbol{{v^{\prime}_t}} \\ &(1 \ast m) & & (1 \ast k)(k \ast m) & & (1 \ast m) \end{aligned} \]

- the reduced coefficients matrix is :

\[ \begin{equation} \boldsymbol{\Pi} = \begin{bmatrix} \pi_{11} & \pi_{12} & \cdots & \pi_{1m} \\ \pi_{21} & \pi_{22} & \cdots & \pi_{2m} \\ \cdots & \cdots & \cdots & \cdots \\ \pi_{m1} & \pi_{m2} & \cdots & \pi_{mm} \\ \end{bmatrix} \end{equation} \]

- the reduced disturbances vector is:

\[ \begin{equation} \boldsymbol{{v^{\prime}_t}}= \begin{bmatrix} v_1 & v_2 & \cdots & v_m \\ \end{bmatrix}_t \end{equation} \]

Structural VS Reduced SEM

The two systems

We can induce Reduced Equations from Structural Equations:

\[ \begin{cases} \begin{alignat}{5} Y_{t1}&= & &+\gamma_{21}Y_{t2}+&\cdots &+\gamma_{m1}Y_{tm} & +\beta_{11}X_{1t}+\beta_{21}X_{t2} &+\cdots+\beta_{k1}X_{tk} &+\varepsilon_{t1} \\ Y_{t2}&=&\gamma_{12}Y_{t1} &+ & \cdots &+\gamma_{m2}Y_{tm}&+\beta_{12}X_{t1}+\beta_{22}X_{t2} &+\cdots+\beta_{k2}X_{tk} &+\varepsilon_{t2}\\ & \vdots &\vdots &&\vdots &&\vdots \\ Y_{tm}&=&\gamma_{1m}Y_{t1}&+\gamma_{2m}Y_{t2}+& \cdots & &+\beta_{1m}X_{t1} +\beta_{2m}X_{t2} &+\cdots+\beta_{km}X_{tk} &+\varepsilon_{tm} \end{alignat} \end{cases} \]

\[ \Rightarrow\begin{cases} \begin{alignat}{5} Y_{t1}&= & +\pi_{11}X_{t1}+\pi_{21}X_{t2} &+\cdots+\pi_{k1}X_{tk} & + v_{t1} \\ Y_{t2}&=&+\pi_{12}X_{t1}+\pi_{22}X_{t2} &+\cdots+\pi_{k2}X_{tk} & + v_{t2}\\ & \vdots &\vdots &&\vdots & \\ Y_{tm}&=&+\pi_{1m}X_{t1} +\pi_{2m}X_{t2} &+\cdots+\pi_{km}X_{tk} & + v_{tm} \end{alignat} \end{cases} \]

Coefficients

The Structural SEM :

\[ \begin{aligned} \boldsymbol{y^{\prime}_t} \boldsymbol{\Gamma} + \boldsymbol{x^{\prime}_t} \boldsymbol{B} = \boldsymbol{{\varepsilon^{\prime}_t}} \end{aligned} \]

The Reduced SEM:

\[ \begin{aligned} \boldsymbol{y^{\prime}_t} = \boldsymbol{x^{\prime}_t} \boldsymbol{\Pi} + \boldsymbol{{v^{\prime}_t}} \end{aligned} \]

- where:

\[ \begin{align} \boldsymbol{\Pi} &= - \boldsymbol{B} \boldsymbol{\Gamma^{-1}}\\ \boldsymbol{{v^{\prime}_t}} &= \boldsymbol{{\varepsilon^{\prime}_t}} \boldsymbol{\Gamma}^{-1} \end{align} \]

- and:

\[ \begin{equation} \boldsymbol{\Gamma} = \begin{bmatrix} \gamma_{11} & \gamma_{12} & \cdots & \gamma_{1m} \\ \gamma_{21} & \gamma_{22} & \cdots & \gamma_{2m} \\ \cdots & \cdots & \cdots & \cdots \\ \gamma_{m1} & \gamma_{m2} & \cdots & \gamma_{mm} \\ \end{bmatrix} \end{equation} \]

Moments

Now we concern the first and second moments of the disturbance:

- first , let us assumed the moments of structural disturbances satisfy:

\[ \begin{align} \mathbf{E[\varepsilon_t | x_t]} &= \mathbf{0} \\ \mathbf{E[\varepsilon_t \varepsilon^{\prime}_t |x_t]} &= \mathbf{\Sigma} \\ E\left[\boldsymbol{\varepsilon}_{t} \boldsymbol{\varepsilon}_{s}^{\prime} | \mathbf{x}_{t}, \mathbf{x}_{s}\right] &=\mathbf{0}, \quad \forall t, s \end{align} \]

- then, we can prove that the reduced disturbances satify:

\[ \begin{align} E\left[\mathbf{v}_{t} | \mathbf{x}_{t}\right] &=\left(\mathbf{\Gamma}^{-1}\right)^{\prime} \mathbf{0}=\mathbf{0} \\ E\left[\mathbf{v}_{t} \mathbf{v}_{t}^{\prime} | \mathbf{x}_{t}\right] &=\left(\mathbf{\Gamma}^{-1}\right)^{\prime} \mathbf{\Sigma} \mathbf{\Gamma}^{-1}=\mathbf{\Omega} \\ \text{where: }\mathbf{\Sigma} &=\mathbf{\Gamma}^{\prime} \mathbf{\Omega} \mathbf{\Gamma} \end{align} \]

Useful expression* (1/2)

In a sample of data, each joint observation will be one row in a data matrix ( with \(T\) observations):

\[ \begin{align} \left[\begin{array}{lll}{\mathbf{Y}} & {\mathbf{X}} & {\mathbf{E}}\end{array}\right]=\left[\begin{array}{ccc}{\mathbf{y}_{1}^{\prime}} & {\mathbf{x}_{1}^{\prime}} & {\boldsymbol{\varepsilon}_{1}^{\prime}} \\ {\mathbf{y}_{2}^{\prime}} & {\mathbf{x}_{2}^{\prime}} & {\boldsymbol{\varepsilon}_{2}^{\prime}} \\ {\vdots} & {} \\ {\mathbf{y}_{T}^{\prime}} & {\mathbf{x}_{T}^{\prime}} & {\boldsymbol{\varepsilon}_{T}^{\prime}}\end{array}\right] \end{align} \]

then the structural SEM is:

\[ \begin{align} \mathbf{Y} \mathbf{\Gamma}+\mathbf{X} \mathbf{B}=\mathbf{E} \end{align} \]

the first and second moment of structural disturbances is:

\[ \begin{align} E[\mathbf{E} | \mathbf{X}] &=\mathbf{0} \\ E\left[(1 / T) \mathbf{E}^{\prime} \mathbf{E} | \mathbf{X}\right] &=\mathbf{\Sigma} \end{align} \]

Useful expression*

Assume that:

\[ \begin{align} (1 / T) \mathbf{X}^{\prime} \mathbf{X} & \rightarrow \mathbf{Q} \text{ ( a finite positive definite matrix)} \\ (1 / T) \mathbf{X}^{\prime} \mathbf{E} & \rightarrow \mathbf{0} \end{align} \]

then the reduced SEM can be noted as:

\[ \begin{align} \mathbf{Y} & =\mathbf{X} \boldsymbol{\Pi}+\mathbf{V} && \leftarrow \mathbf{V}=\mathbf{E} \mathbf{\Gamma}^{-1} \end{align} \]

And we may have following useful results:

\[ \begin{align} \frac{1}{T} \begin{bmatrix} {\mathbf{Y}^{\prime}} \\ {\mathbf{X}^{\prime}} \\ {\mathbf{V}^{\prime}} \end{bmatrix} \begin{bmatrix} {\mathbf{Y}} & {\mathbf{X}} & {\mathbf{V}} \end{bmatrix} \quad \rightarrow \quad \begin{bmatrix} {\mathbf{I}^{\prime} \mathbf{Q} \mathbf{I}+\mathbf{\Omega}} & {\mathbf{I} \mathbf{I}^{\prime} \mathbf{Q}} & {\mathbf{\Omega}} \\ {\mathbf{Q} \mathbf{I}} & {\mathbf{Q}} & {\mathbf{0}^{\prime}} \\ {\mathbf{\Omega}} & {\mathbf{0}} & {\mathbf{\Omega}} \end{bmatrix} \end{align} \]

Case 1: Keynesian income model

Structural SEM

The Keynesian model of income determination (structural SEM):

\[ \begin{cases} \begin{align} C_t &= \beta_0+\beta_1Y_t+\varepsilon_t &&\text{(consumption function)}\\ Y_t &= C_t+I_t &&\text{(income equity)} \end{align} \end{cases} \]

So the structural SEM contains:

2 endogenous variables: - \(c_t;Y_t\)

1 predetermined variables:

1 exogenous variables: \(I_t\)

0 lagged endogenous variable.

Exercise: can you get the reduced SEM from this structural SEM ?

Reduced SEM

We can get the reduced SEM from the former structural SEM and denoted (the right):

\[ \begin{cases} \begin{align} Y_t &=\frac{\beta_0}{1-\beta_1}+\frac{1}{1-\beta_1}I_t+\frac{\varepsilon_t}{1-\beta_1} \\ C_t &=\frac{\beta_0}{1-\beta_1}+\frac{\beta_1}{1-\beta_1}I_t+\frac{\varepsilon_t}{1-\beta_1} \end{align} \end{cases} \]

\[ \begin{cases} \begin{align} Y_t &= \pi_{11}+\pi_{21}I_t+v_{t1} \\ C_t &= \pi_{12}+\pi_{22}I_t+v_{t2} \end{align} \end{cases} \]

where:

\[ \begin{cases} \begin{alignat}{5} && \pi_{11} = \frac{\beta_0}{1-\beta_1}; \quad && \pi_{21} = \frac{\beta_0}{1-\beta_1}; \quad && v_{t1} = \frac{\varepsilon_t}{1-\beta_1};\\ && \pi_{12} = \frac{1}{1-\beta_1} ; \quad && \pi_{22} = \frac{\beta_1}{1-\beta_1} ; \quad && v_{t2} = \frac{\varepsilon_t}{1-\beta_1}; \end{alignat} \end{cases} \]

there are 2 structural coefficients \(\beta_0;\beta_1\) totally ; and 4 reduced coefficients \(\pi_{11},\pi_{21};\pi_{12},\pi_{22}\) (There are actually three only !)

Case 2: Macroeconomic Model

Structural SEM

Consider the Small Macroeconomic Model (Structural SEM):

\[ \begin{cases} \begin{aligned} \text { consumption: } c_{t} &=\alpha_{0}+\alpha_{1} y_{t}+\alpha_{2} c_{t-1}+\varepsilon_{t, c} \\ \text { investment: } i_{t} &=\beta_{0}+\beta_{1} r_{t}+\beta_{2}\left(y_{t}-y_{t-1}\right)+\varepsilon_{t, j} \\ \text { demand: } y_{t} &=c_{t}+i_{t}+g_{t} \end{aligned} \end{cases} \]

where: \(c_t =\) consumption; \(y_t =\) output; \(i_t =\) investment; \(r_t =\) rate; \(g_t =\) government expenditure.

3 endogenous variables: \(c_t;i_t;Y_t\)

4 predetermined variables:

- 2 exogenous variables: \(r_t;g_t\) . - 2 lagged endogenous variables: \(y_{t-1};c_{t-1}\)

totally 6 strutural coefficients: \(\alpha_0,\alpha_1,\alpha_2;\beta_0,\beta_1,\beta_2;\)

Reduced SEM

We can get the reduced SEM from the former structural SEM: (HOW TO??)

\[ \begin{cases} \begin{align} c_{t} = & [{\alpha_{0}}{\left(1-\beta_{2}\right)}+\beta_{0} \alpha_{1}+\alpha_{1} \beta_{1} r_{t}+\alpha_{1} g_{t}+\alpha_{2}\left(1-\beta_{2}\right) c_{t-1}-\alpha_{1} \beta_{2} y_{t-1} \\ +&\left(1-\beta_{2}\right) \varepsilon_{t, c}+\alpha_{1} \varepsilon_{t, j}] /{\Lambda} \\ i_{t} = & [\alpha_{0} \beta_{2}+\beta_{0}\left(1-\alpha_{1}\right)+\beta_{1}\left(1-\alpha_{1}\right) r_{t}+\beta_{2} g_{t}+\alpha_{2} \beta_{2} c_{t-1}-\beta_{2}\left(1-\alpha_{1}\right) y_{t-1} \\ +&\beta_{2} \varepsilon_{t, c}+\left(1-\alpha_{1}\right) \varepsilon_{t, j}]/{\Lambda} \\ y_{t} = & [\alpha_{0}+\beta_{0}+\beta_{1} r_{t}+g_{t}+\alpha_{2} c_{t-1}-\beta_{2} y_{t-1} +\varepsilon_{t, c}+\varepsilon_{t, j}] /{\Lambda} \end{align} \end{cases} \]

where: \(\Lambda = 1- \alpha_1 -\beta_2\) 。For simplicity, denote the reduced SEM as:

\[ \begin{cases} \begin{aligned} c_{t} & = \pi_{11} +\pi_{21}r_t +\pi_{31}g_t +\pi_{41}c_{t-1} +\pi_{51}y_{t-1} +v_{t1} \\ i_{t} & = \pi_{12} +\pi_{22}r_t +\pi_{32}g_t +\pi_{42}c_{t-1} +\pi_{52}y_{t-1} +v_{t2} \\ i_{t} & = \pi_{13} +\pi_{23}r_t +\pi_{33}g_t +\pi_{43}c_{t-1} +\pi_{53}y_{t-1} +v_{t3} \end{aligned} \end{cases} \]

So we have 15 reduced coefficients totally!

Thinking

Thinking:

What are the purposes of structural SEM and reduced SEM respectively?

Note the consumption function (in structural SEM): the rate \(i_t\) does not impact the consumption \(c_t\) !

It will be obvious from the reduced SEM that \(\frac{\Delta c_t}{\Delta r_t} = \frac{\alpha_1 \beta_1}{\Lambda}\)

Note the consumption function (in structural SEM): What are the reasons for the impact of income \(y_t\) on consumption \(c_t\) ?

It’s also easy to get the answer by transformation: \(\frac{\Delta c_t}{ \Delta y_t} = \frac{\Delta c_t / \Delta r_t}{\Delta y_t / \Delta r_t} = \frac{\alpha_1 \beta_1 / \Lambda}{ \beta_1 / \Lambda} = \alpha_1\)

The relationship

According to the relationship between Structural SEM and Reduced SEM:

\[ \begin{aligned} \boldsymbol{y^{\prime}_t} = &-\boldsymbol{x^{\prime}_t} \boldsymbol{\Pi} + \boldsymbol{{v^{\prime}_t}} = -\boldsymbol{x^{\prime}_t} \boldsymbol{B} \boldsymbol{\Gamma^{-1}} + \boldsymbol{{\varepsilon^{\prime}_t}} \boldsymbol{\Gamma}^{-1} \end{aligned} \]

Then, the following matrixes can be easily obtained:

\[ \begin{align} \mathbf{y}^{\prime} & = \begin{bmatrix} c & i & y \end{bmatrix}\\ \boldsymbol{x}^{\prime} & = \begin{bmatrix} 1 & r & g & c_{-1} & y_{-1} \end{bmatrix} \end{align} \]

\[ \begin{align} \mathbf{B}= \begin{bmatrix} {-\alpha_{0}} & {-\beta_{0}} & {0} \\ {0} & {-\beta_{1}} & {0} \\ {0} & {0} & {-1} \\ {-\alpha_{2}} & {0} & {0} \\ {0} & {\beta_{2}} & {0} \end{bmatrix} \end{align} \]

\[ \begin{align} \Gamma &= \begin{bmatrix} {1} & {0} & {-1} \\ {0} & {1} & {-1} \\ {-\alpha_{1}} & {-\beta_{2}} & {1} \end{bmatrix} \\ \mathbf{\Gamma}^{-1} &=\frac{1}{\Lambda} \begin{bmatrix} {1-\beta_{2}} & {\beta_{2}} & {1} \\ {\alpha_{1}} & {1-\alpha_{1}} & {1} \\ {\alpha_{1}} & {\beta_{2}} & {1} \end{bmatrix} \end{align} \]

Calculations

We can get the same answers: (It’s so easy!)

\[ \begin{align} \boldsymbol{\Pi=-B\Gamma^{-1}}=\frac{1}{\Lambda} \begin{bmatrix} {\alpha_{0}\left(1-\beta_{2}\right)+\beta_{0} \alpha_{1}} & {\alpha_{0} \beta_{2}+\beta_{0}\left(1-\alpha_{1}\right)} & {\alpha_{0}+\beta_{0}} \\ {\alpha_{1} \beta_{1}} & {\beta_{1}\left(1-\alpha_{1}\right)} & \beta_1 \\ {\alpha_{1}} & {\beta_{2}} & 1 \\ {\alpha_{2}\left(1-\beta_{2}\right)}& {\alpha_{2} \beta_{2}} & \alpha_2\\ {-\beta_{2} \alpha_{1}} & {-\beta_{2}\left(1-\alpha_{1}\right)} &-\beta_2 \end{bmatrix} \end{align} \]

\[ \begin{align} \mathbf{\Pi}^{\prime}=\frac{1}{\Lambda} \begin{bmatrix} \alpha_{0}\left(1-\beta_{2}\right)+\beta_{0} \alpha_{1} & \alpha_{1} \beta_{1} & \alpha_{1} & \alpha_{2}\left(1-\beta_{2}\right) & -\beta_{2} \alpha_{1} \\ \alpha_{0} \beta_{2}+\beta_{0}\left(1-\alpha_{1}\right) & \beta_{1}\left(1-\alpha_{1}\right) & \beta_{2} & \alpha_{2} \beta_{2} & -\beta_{2}\left(1-\alpha_{1}\right) \\ \alpha_{0}+\beta_{0} & \beta_{1} & 1 & \alpha_{2} & -\beta_{2} \end{bmatrix} \end{align} \]

- Where:

\[ \Lambda = 1- \alpha_1 -\beta_2 \]

- Remeber that:

\[ \begin{align} \mathbf{x}^{\prime} = \begin{bmatrix} 1 & r & g & c_{-1} & y_{-1} \end{bmatrix} \end{align} \]

Supplement

Inverse matrix solution and procedure*

Use the elementary row operation (Gauss-Jordan) to find the inverse matrix:

Construct augmented matrix

Transform the augmented matrix for many times until the goal is achieved.

Use cofactor, algebraic cofactor and adjoint matrix to get the inverse matrix:

Calculate cofactor matrix and algebraic cofactor matrix;

Calculate adjoint matrix: it is the transpose of the cofactor matrix;

Calculate the determinant of original matrix : each element of top row in the original matrix is multiplied by its corresponding top row element in the “cofactor matrix”;

Calculated the inverse matrix: 1/ determinant \(\times\) adjoint matrix

18.3 Is the OLS Method Still applicable ?

Endogenous variable problem (1/2)

Consider Keynes’s model of income determination, We will be able to show that \(Y_t\) and \(u_t\) will be correlated, thus violating the CLRM A2 assumption.

\[ \begin{cases} \begin{align} C_t &= \beta_0+\beta_1Y_t+u_t &(0<\beta_1<1) &&\text{( consumption function)}\\ Y_t &= C_t+I_t & &&\text{(Income Identity)} \end{align} \end{cases} \]

By transforming the above structural equation, we obtained:

\[ \begin{align} Y_t &= \beta_0+\beta_1Y_t+ I_t +u_t \\ Y_t &= \frac{\beta_0}{1-\beta_1}+\frac{1}{1-\beta_1}I_t+\frac{1}{1-\beta_1}u_t && \text{(eq1: Reduced equation)}\\ E(Y_t)&=\frac{\beta_0}{1-\beta_1}+\frac{1}{1-\beta_1}I_t && \text{(eq2: Take the expectation for both sides)} \end{align} \]

Endogenous variable problem (2/2)

Further more:

\[ \begin{align} Y_t - E(Y_t)& = \frac{u_t}{1-\beta_1} && \text{(eq 1 - eq 2)}\\ u_t-E(u_t) &= u_t && \text{(eq 3: Expectation is equal to 0)} \\ cov(Y_t,u_t) &= E([Y_t-E(Y_t)][u_t-E(u_t)]) && \text{(eq 4: Covariance definition)}\\ &=\frac{E(u^2_t)}{1-\beta_1} && \text{(eq 5: Variance definition)}\\ &=\frac{\sigma^2}{1-\beta_1}\neq 0 && \text{(eq 6: The variance is not 0)} \end{align} \]

Therefore, the consumption equation of the Keynesian model will not satisfy the CLRM A2 assumption.

Thus, OLS method cannot be used to obtain Best linear unbiased estimator (BLUE) for consumption equation.

The OLS estimator of the coefficient is biased

Furthermore, the OLS estimator is biased to its true \(\beta_1\) , which means \(E(\hat{\beta}_1) \neq \beta_1\) . The proof show as below.

\[ \begin{cases} \begin{align} C_t &= \beta_0+\beta_1Y_t+u_t &(0<\beta_1<1) &&\text{( consumption function)}\\ Y_t &= C_t+I_t & &&\text{(Income Identity)} \end{align} \end{cases} \]

\[ \begin{align} \hat{\beta}_1 = \frac{\sum{c_ty_t}}{\sum{y^2_t}} = \frac{\sum{C_ty_t}}{\sum{y^2_t}} = \frac{\sum{\left [ (\beta_0+\beta_1Y_t+u_t)y_t \right ]}}{\sum{y^2_t}} = \beta_1 + \frac{\sum{u_ty_t}}{\sum{y^2_t}} && \text{(eq 1)} \end{align} \]

Take the expectation of both sides in eq 1, so:

\[ \begin{align} E(\hat{\beta}_1) &= \beta_1 + E \left ( \frac{\sum{u_ty_t}}{\sum{y^2_t}} \right ) \end{align} \]

Question: is the expactation \(E\left (\frac {\sum {u_ty_t}} {\sum {y^2_t}} \right)\) equal to zero?

Supplement

Proof 1/2

\[ \begin{align} \frac{\sum{c_ty_t}}{\sum{y^2_t}} &= \frac{\sum{(C_t-\bar{C})(Y_t - \bar{Y})}}{\sum{y^2_t}} = \frac{\sum{(C_t-\bar{C})y_t}}{\sum{y^2_t}} \\ & =\frac{\sum{C_ty_t}-\sum{\bar{C}y_t}}{\sum{y^2_t}} =\frac{\sum{C_ty_t}-\sum{\bar{C}(Y_t- \bar{Y})}}{\sum{y^2_t}} \\ & = \frac{\sum{C_ty_t}-\bar{C}\sum{Y_t}- \sum{\bar{C}\bar{Y}}}{\sum{y^2_t}} = \frac{\sum{C_ty_t}-\bar{C}\sum{Y_t}- n{\bar{C}\bar{Y}}}{\sum{y^2_t}} = \frac{\sum{C_ty_t}}{\sum{y^2_t}} \end{align} \]

\[ \begin{align} \hat{\beta_1} & = \frac{\sum\left(\beta_{0}+\beta_{1} Y_{t}+u_{t}\right) y_{t}}{\sum y_{t}^{2}} = \frac{\sum{\beta_{0}y_t} +\sum{\beta_1Y_ty_t}+\sum{u_{t}y_t} }{\sum y_{t}^{2}} \\ & = \frac{\beta_1\sum{(y_t+\bar{Y})y_t}+\sum{u_{t}y_t} }{\sum y_{t}^{2}} =\beta_{1}+\frac{\sum y_{t} u_{t}}{\sum y_{t}^{2}} \end{align} \]

\[ \begin{align} \Leftarrow &\sum{y_t} =0 ; && \frac{\sum{Y_ty_t}}{y^2_t} = 1 \end{align} \]

Proof 2/2

Conduct the limit to probability:

\[ \begin{align} \operatorname{plim}\left(\hat{\beta}_{1}\right) &=\operatorname{plim}\left(\beta_{1}\right)+\operatorname{plim}\left(\frac{\sum y_{t} u_{t}}{\sum y_{t}^{2}}\right) \\ &=\operatorname{plim}\left(\beta_{1}\right)+\operatorname{plim}\left(\frac{\sum y_{t} u_{t} / n}{\sum y_{t}^{2} / n}\right) =\beta_{1}+\frac{\operatorname{plim}\left(\sum y_{t} u_{t} / n\right)}{\operatorname{plim}\left(\sum y_{t}^{2} / n\right)} \end{align} \]

And we’ve shown that:

\[ \begin{align} cov(Y_t,u_t) &= E([Y_t-E(Y_t)][u_t-E(u_t)]) =\frac{E(u^2_t)}{1-\beta_1} =\frac{\sigma^2}{1-\beta_1}\neq 0 \end{align} \]

Therefore we finaly prove: \(E \left ( \frac{\sum{u_ty_t}}{\sum{y^2_t}} \right ) \neq 0\)

Simulation

Artificially population

Here, we construct an artificially controlled population for our Keynes’s SEM model.

\[ \begin{cases} \begin{align} C_t &= \beta_0+\beta_1Y_t+u_t &(0<\beta_1<1) &&\text{(consumption function)}\\ Y_t &= C_t+I_t & &&\text{(Income Identity)} \end{align} \end{cases} \]

\[ \begin{cases} \begin{align} C_t &= 2+ 0.8Y_t+u_t &(0<\beta_1<1) &&\text{(consumption function)}\\ Y_t &= C_t+I_t & &&\text{(Income Identity)} \end{align} \end{cases} \]

The artificially controlled population is set to:

- \(\beta_0=2, \beta_1=0.8, I_t \leftarrow \text{given values}\)

- \(E(u_t)=0, var(u_t)=\sigma^2=0.04\)

- \(E(u_tu_{t+j})=0,j \neq 0\)

- \(cov(u_t,I_t)=0\)

The data sets

The simulation data under given conditions are:

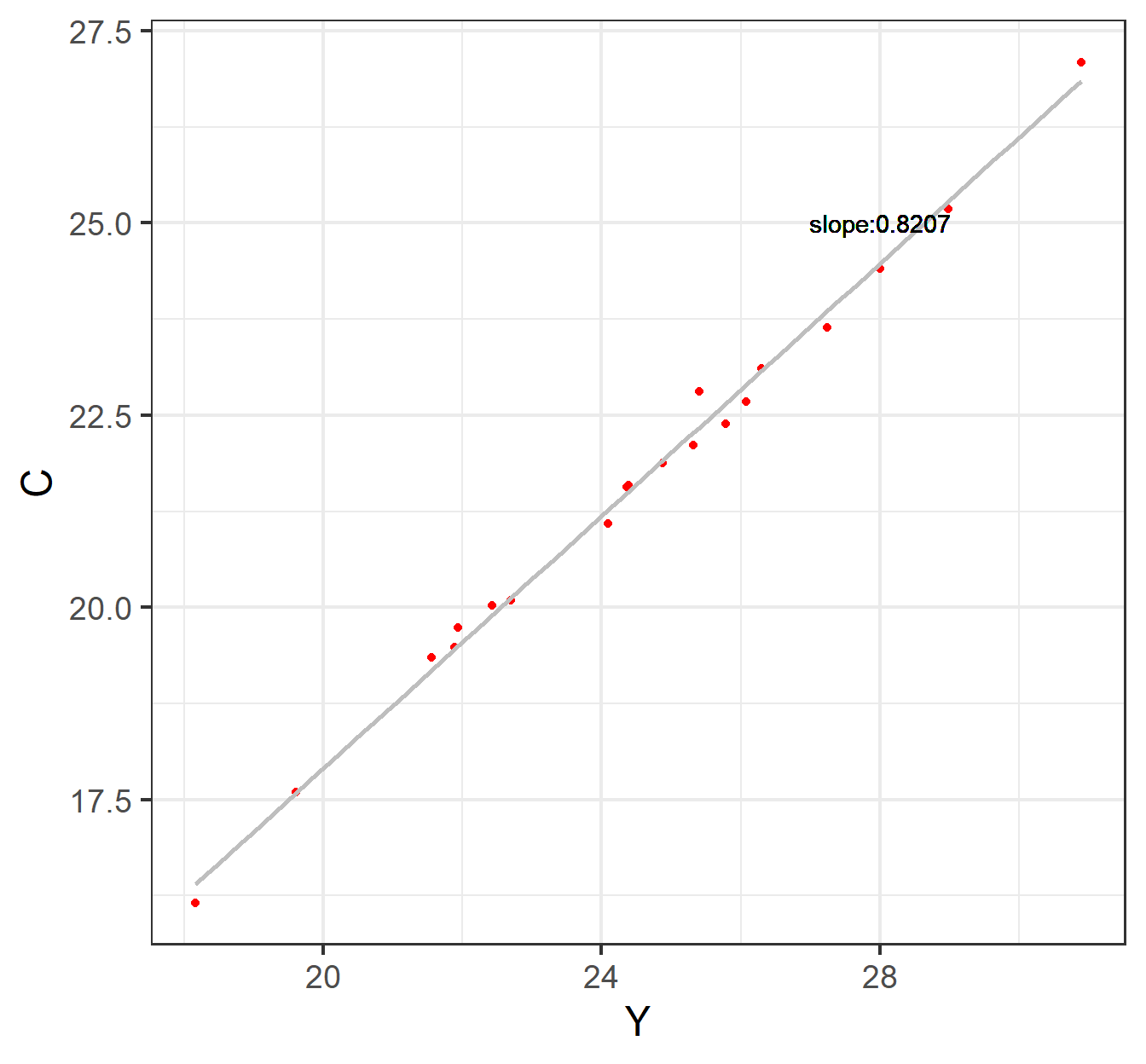

Manual calculation

According to the above formula, the regression coefficient can be calculated as follows:

Easy to calculate: \(\sum{u_ty_t}\) =3.8000

And: \(\sum{y^2_t}\) =184.0000

And: \(\frac{\sum{u_ty_t}}{\sum{y^2_t}}\) =0.0207

Hence: \(\hat{\beta}_1 = \beta_1 + \frac{\sum{u_ty_t}}{\sum{y^2_t}}\) =0.8+0.0207= 0.8207

This also means that \(\hat{\beta_1}\) is different from \(\beta_1=0.8\) , and the differnce is 0.0207.

Scatter plots

Regression report 1

Next, we used the simulated data for R analysis to obtain the original OLS report.

Call:

lm(formula = mod_monte$mod.C, data = monte)

Residuals:

Min 1Q Median 3Q Max

-0.27001 -0.15855 -0.00126 0.09268 0.46310

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 1.49402 0.35413 4.219 0.000516 ***

Y 0.82065 0.01434 57.209 < 2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.1946 on 18 degrees of freedom

Multiple R-squared: 0.9945, Adjusted R-squared: 0.9942

F-statistic: 3273 on 1 and 18 DF, p-value: < 2.2e-16Regression report 2

The tidy report of OLS estimation shows below.

\[ \begin{alignedat}{999} \begin{split} &\widehat{C}=&&+1.49&&+0.82Y_i\\ &(s)&&(0.3541)&&(0.0143)\\ &(t)&&(+4.22)&&(+57.21)\\ &(fit)&&R^2=0.9945&&\bar{R}^2=0.9942\\ &(Ftest)&&F^*=3272.87&&p=0.0000 \end{split} \end{alignedat} \]

\[ \begin{alignedat}{999} &\widehat{C}=&&+1.49&&+0.82Y\\ &\text{(t)}&&(4.2188)&&(57.2090)\\ &\text{(se)}&&(0.3541)&&(0.0143)\\ &\text{(fitness)}&& n=20;&& R^2=0.9945;&& \bar{R^2}=0.9942\\ & && F^{\ast}=3272.87;&& p=0.0000\\ \end{alignedat} \]

Sample regression line (SRL)

Conclusions and points

So let’s summarize this chapter.

Compared with the single-equation model, the SEM involves more than one dependent or endogenous variable. So there must be as many equations as endogenous variables.

SEM always show that the endogenous variables are correlated with stochastic terms in other equations.

Classical OLS may not be appropriate because the estimators are inconsistent.

Reference

End Of This Chapter

Chapter 18. Why Should We Concern SEM?