Advanced Econometrics III

(Econometrics III)

Chapter 17. Endogeneity and Instumental Variables

Hu Huaping (胡华平)

huhuaping01 at hotmail.com

School of Economics and Management (经济管理学院)

2025-04-19

Part 2:Simultaneous Equation Models (SEM)

Chapter 17. Endogeneity and Instrumental Variables

Chapter 18. Why Should We Concern SEM ?

Chapter 19. What is the Identification Problem ?

Chapter 20. How to Estimate SEM ?

Chapter 17. Endogeneity and Instumental Variables

17.1 Definition and source of endogeneity

17.2 Estimation problem with endogeneity

17.4 Two-stage least squares method

17.1 Definition and sources of endogeneity

Review

The CLRM assumptions

Let’s revise the classic linear regression model assumptions (CLRM):

A1: The true model is \(\boldsymbol{y= X \beta+\epsilon}\).

A2: \(\forall i, E(\epsilon_i|X) = 0\) (conditional zero mean) more about this later.

A3: \(Var(\epsilon|X) = E(\epsilon \epsilon^{\prime}|X) = \sigma^2I\) (identical conditional variance ).

A4: \(\boldsymbol{X}\) has full column rank.

A5: (for inference purposes,\(\boldsymbol{\epsilon} \sim N(\boldsymbol{0}, σ^2\boldsymbol{I}))\).

Under A1-A4(also namely CLRM), the OLS is Gauss-Markov efficient.

Under A1-A5, we donote N-CLRM.

The A2 assumptions

For the population regression model(PRM):

\[ \begin{align} Y_i &= \beta_1 +\beta_2X_i + u_i && \text{(PRM)} \end{align} \]

- CLRM A2 assumes that \(X\) is fixed (given) or independent of the error term. The regressors \(X\) are not random variables. At this point, we can use the OLS method and get BLUE (Best Linear Unbiased Estimator).

\[ \begin{align} Cov(X_i, u_i)= 0; \quad E(X_i u_i)= 0 \end{align} \]

- If the above A2 assumption is violated, the independent variable \(X\) is related to the random disturbance term. In this case, OLS estimation will no longer get BLUE, and instrumental variable method (IV) should be used for estimation.

\[ \begin{align} Cov(X_i, u_i) \neq 0 ; \quad E(X_i u_i) \neq 0 \end{align} \]

Good model & Random experiment

Randomized controlled experiment : Ideally, the value of the independent variable \(X\) is randomly changed (refer to the reason), and then we look at the change in the dependent variable \(Y\) (refer to the result).

\[ \begin{equation} \boldsymbol{y= X \beta+u} \end{equation} \]

If \(Y_i\) and \(X_i\) does exist systematic relationship (linear relationship), then change \(X_i\) causes the corresponding change of \(Y_i\).

Any other random factors will be added to the random disturbance \(u_i\). The effect of the random disturbance on the change of \(Y_i\) should be independent to the effect of \(X_i\) on the change of \(Y_i\).

Exogenous regressors

Exogenous regressors: If independent variables \(X_i\) is perfectly random (randomly assigned) as mentioned above , then they are called exogenous regressor. More precisely, they can be defined as:

Strictly Exogeneity:

\[ E\left(u_{i} \mid X_{1}, \ldots, X_{N}\right)=E\left(u_{i} \mid \mathbf{x}\right)=0 \]

Endogeneity

Definition of endogeneity

The concept of endogeneity is used broadly to describe any situation where a regressor is correlated with the error term.

- Assume that we have the bivariate linear model

\[ \begin{equation} Y_{i}=\beta_{0}+\beta_{1} X_{i}+\epsilon_{i} \end{equation} \]

- The explanatory variable \(X\) is said to be Endogenous if it is correlated with \(\epsilon\).

\[ \begin{align} Cov(X_i, \epsilon_i) \neq 0 ; \quad E(X_i \epsilon_i) \neq 0 \end{align} \]

- And if \(X\) is uncorrelated with\(\epsilon\), it is said to be Exogenous.

\[ \begin{align} Cov(X_i, \epsilon_i) = 0 ; \quad E(X_i \epsilon_i) = 0 \end{align} \]

Sources of endogeneity

In applied econometrics, endogeneity usually arises in one of four ways:

Omitted variables: when the model is set incorrectly.

Measurement errors in the regressors.

Autocorrelation of the error term in autoregressive models.

Simultaneity: when \(\boldsymbol{Y}\) and \(\boldsymbol{X}\) are simultaneously determined, as in the supply/demand model (we will go to explain it in the next three chapter).

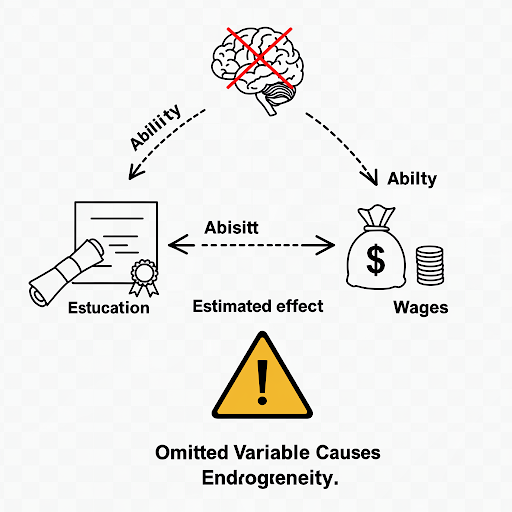

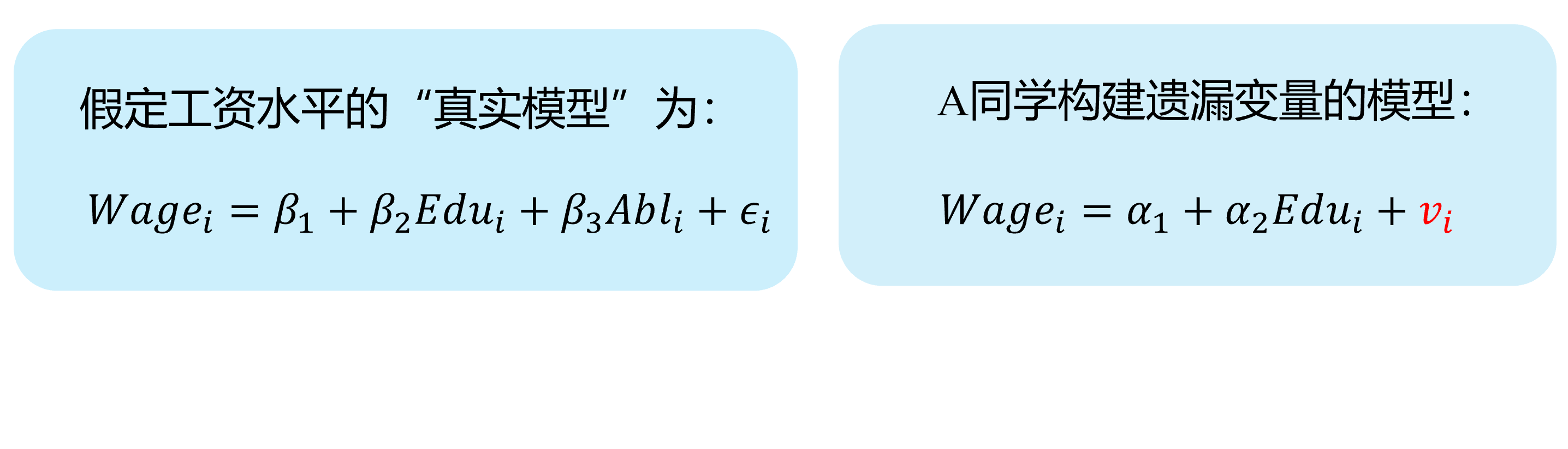

Source 1: Omitted variables

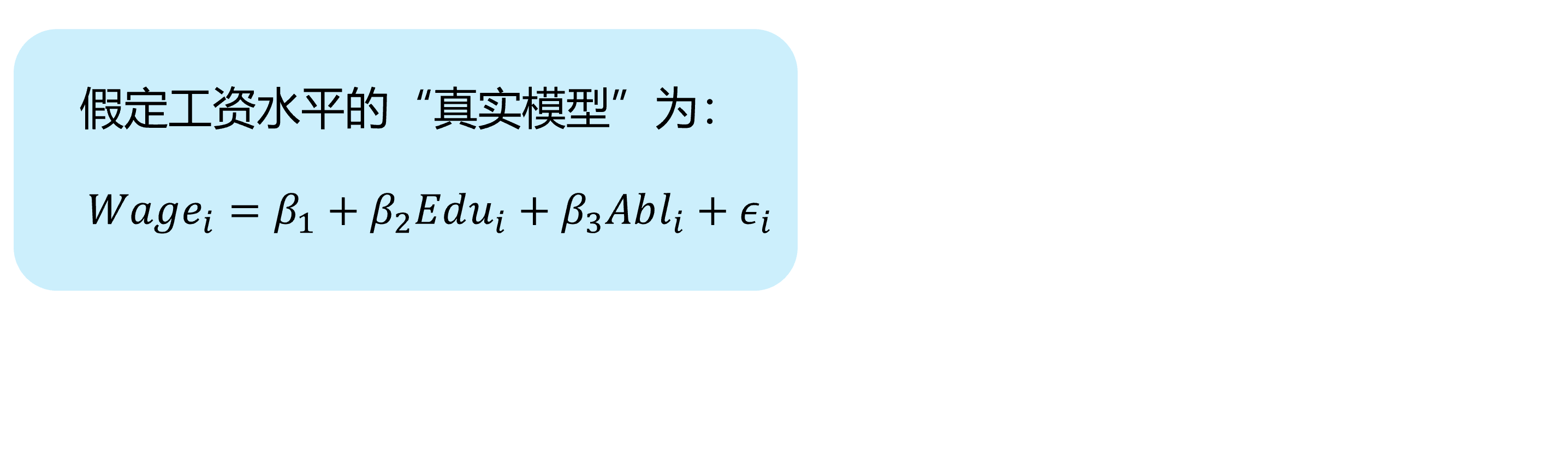

The assumed true model & mis-specified model

Suppose that the “assumed true model” for wage determination is:

\[ \begin{align} Wage_{i}=\beta_{1}+\beta_{2} Edu_{i}+\beta_{3} Abl_{i}+\epsilon_{i} \quad \text{(the assumed true model)} \end{align} \]

However, because the individual’s ability variable (\(Abl\)) is often not directly observed, so we often can’t put it into the model, and build a mis-specified model.

\[ \begin{align} Wage_{i}=\alpha_{1}+\alpha_{2} Edu_{i}+v_{i} \quad \text{(the mis-specified model)} \end{align} \]

Where ability variable (\(Abl\)) is included in the new disturbance \(v_i\), and \(v_{i}=\beta_{3} abl_{i}+u_{i}\)

Obviously, in the mis-specified model, we ignore the ability variable (\(Abl\)), while variable years of education (\(Edu\)) is actually related to it.

So in the mis-specified model, \(cov(Edu_i, v_i) \neq 0\), thus years of education (\(Edu\)) may cause the endogenous problem.

Omitted variables (demo 1/4)

Here we show a visual demonstration on this situation:

Assumed “TRUE MODEL”:

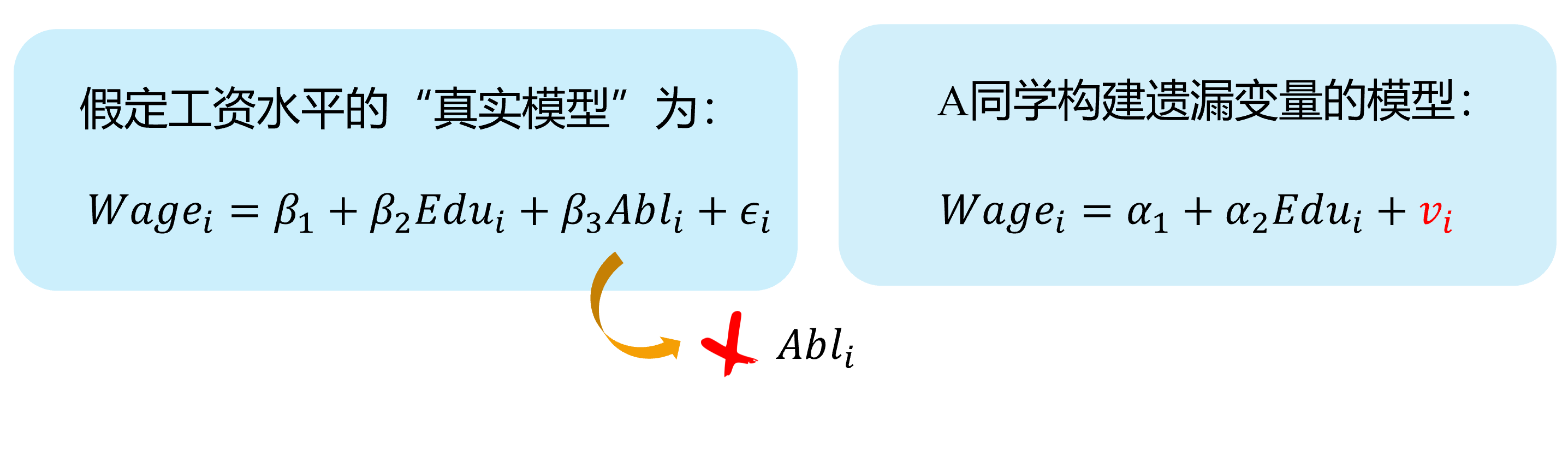

Omitted variables (demo 2/4)

Here we show a visual demonstration on this situation:

Assumed “TRUE MODEL”:

“A’s mis-specification MODEL”:

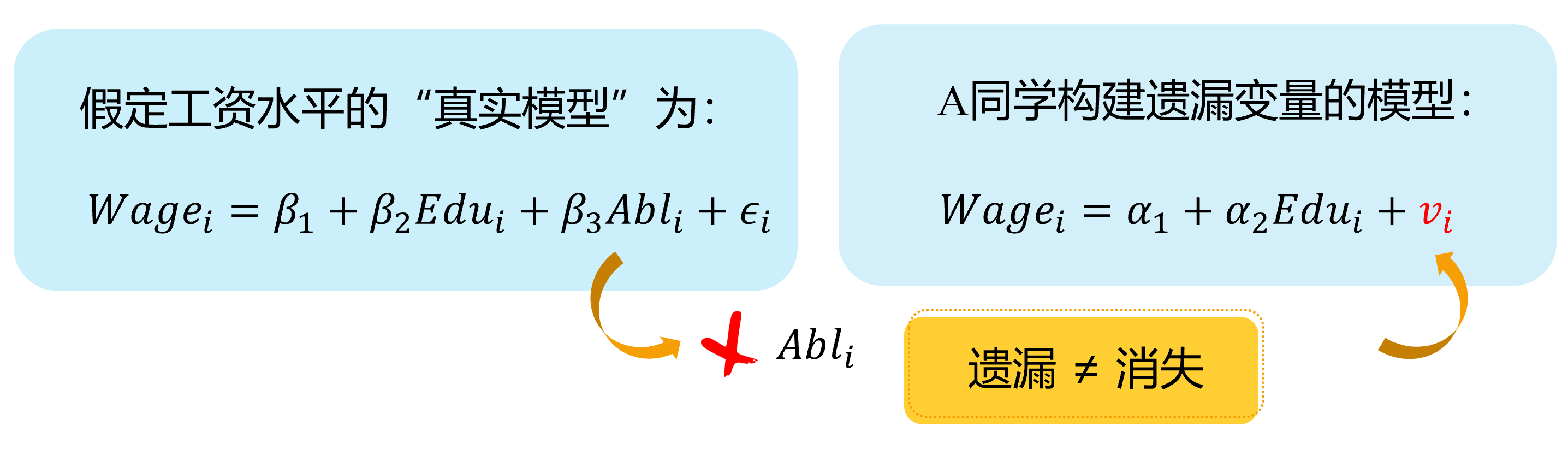

Omitted variables (demo 3/4)

Here we show a visual demonstration on this situation:

Assumed “TRUE MODEL”:

“A’s mis-specification MODEL”:

Omitted variables (demo 4/4)

Here we show a visual demonstration on this situation:

Assumed “TRUE MODEL”:

“A’s mis-specification MODEL”:

Omitted\(\neq\) Disappeared

Source 2: Measurement errors

test show

The assumed true model & mis-specified model

Again, let’s consider the “assumed true model”:

\[ \begin{align} Wage_{i}=\beta_{1}+\beta_{2} Edu_{i}+\beta_{3} Abl_{i}+\epsilon_{i} \quad \text{(the assumed true model)} \end{align} \]

It is hard to observe individual’s ability variable(\(Abl\)), and somebody will instead to use the variable IQ score(\(IQ_i\)), and construct the mis-specified “proxy variable” model:

\[ \begin {align} Wage_i=\alpha_{1}+\alpha_{2} Edu_i+\alpha_{3} IQ_i+v_i \quad \text{(the mis-specified model)} \end {align} \]

It should exist stuffs (\(Abl\_other_i\)) which the model does not include (due to the measurement error). So the measurement errors (\(Abl\_other_i\)) will go to the disturbance term\(v_i\) in the mis-specified model.

And we know that measurement errors (\(Abl\_other_i\)) will be correlated with the education variable. Thus \(cov(Edu_i, v_i) \neq 0\), and the education variable(\(Edu\)) may cause the endogenouse problem.

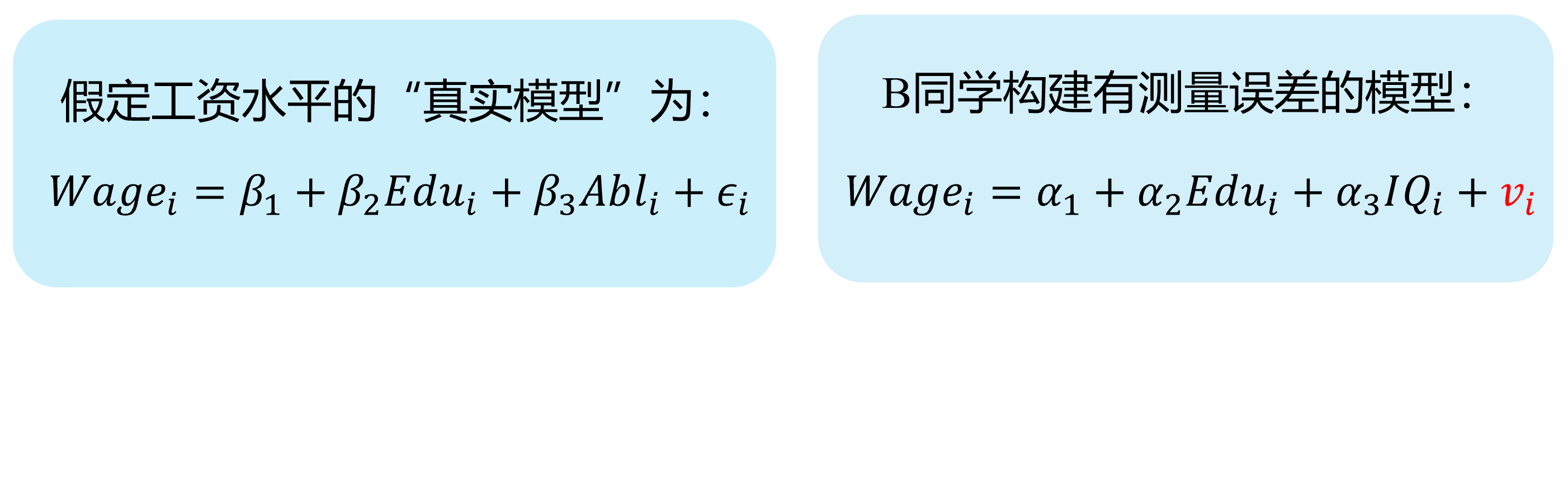

Measurement errors (demo 1/4)

Here we show a visual demonstration on this situation:

Assumed TRUE MODEL:

Measurement errors (demo 2/4)

Here we show a visual demonstration on this situation:

Assumed TRUE MODEL:

B’s mis-specification MODEL:

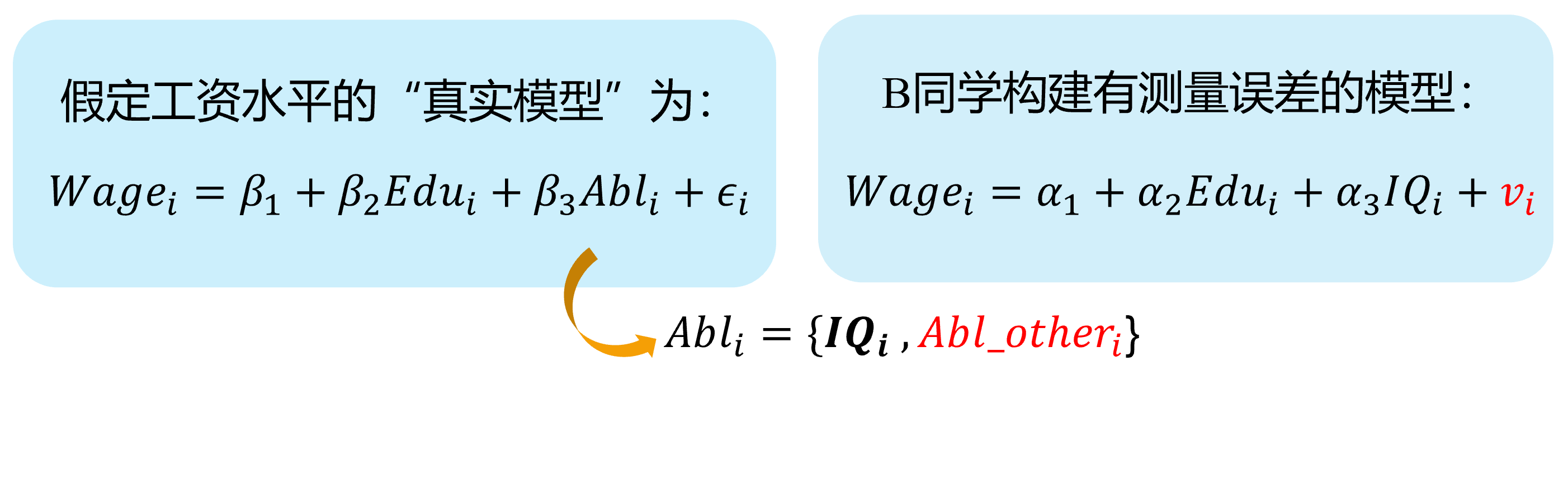

Measurement errors (demo 3/4)

Here we show a visual demonstration on this situation:

Assumed TRUE MODEL:

B’s mis-specification MODEL:

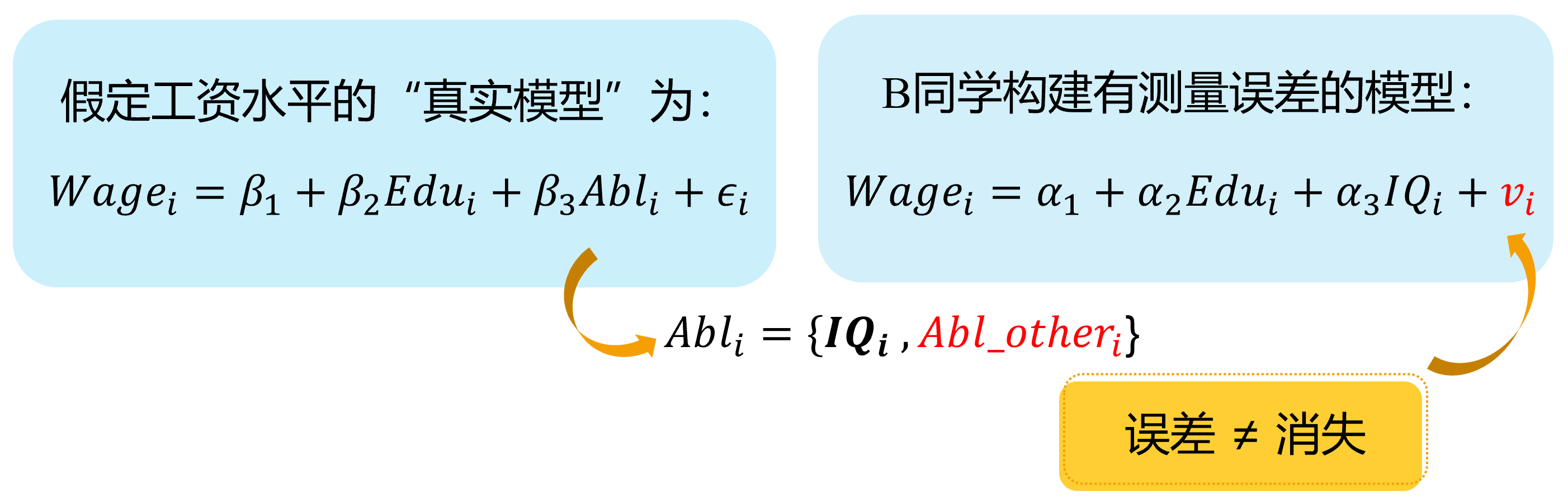

Measurement errors (demo 4/4)

Here we show a visual demonstration on this situation:

Assumed TRUE MODEL:

B’s mis-specification MODEL:

Measure Error\(\neq\) Disappeared

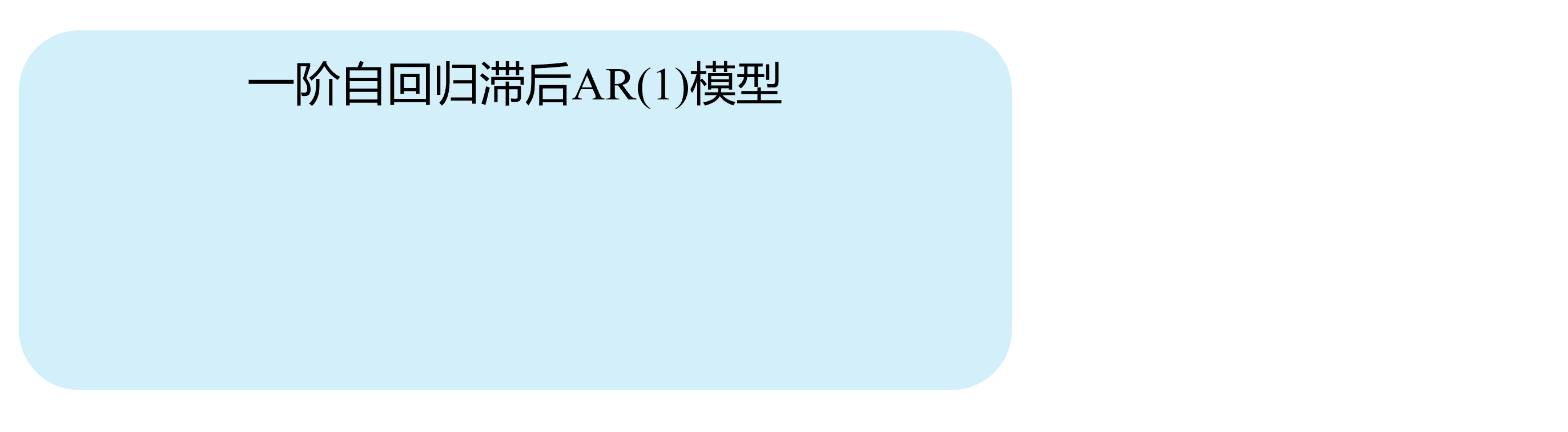

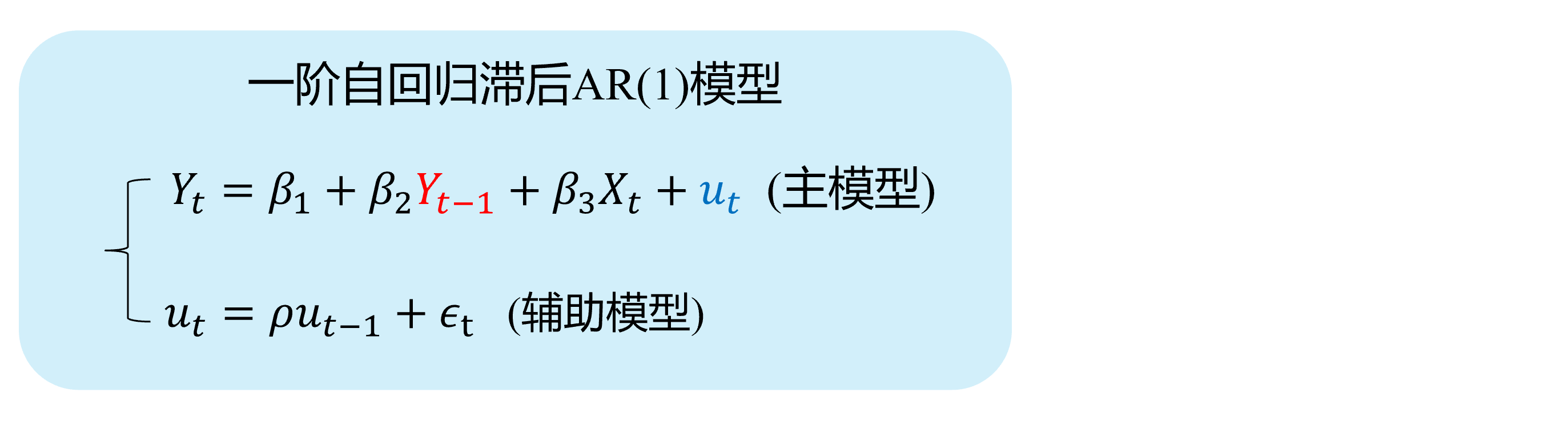

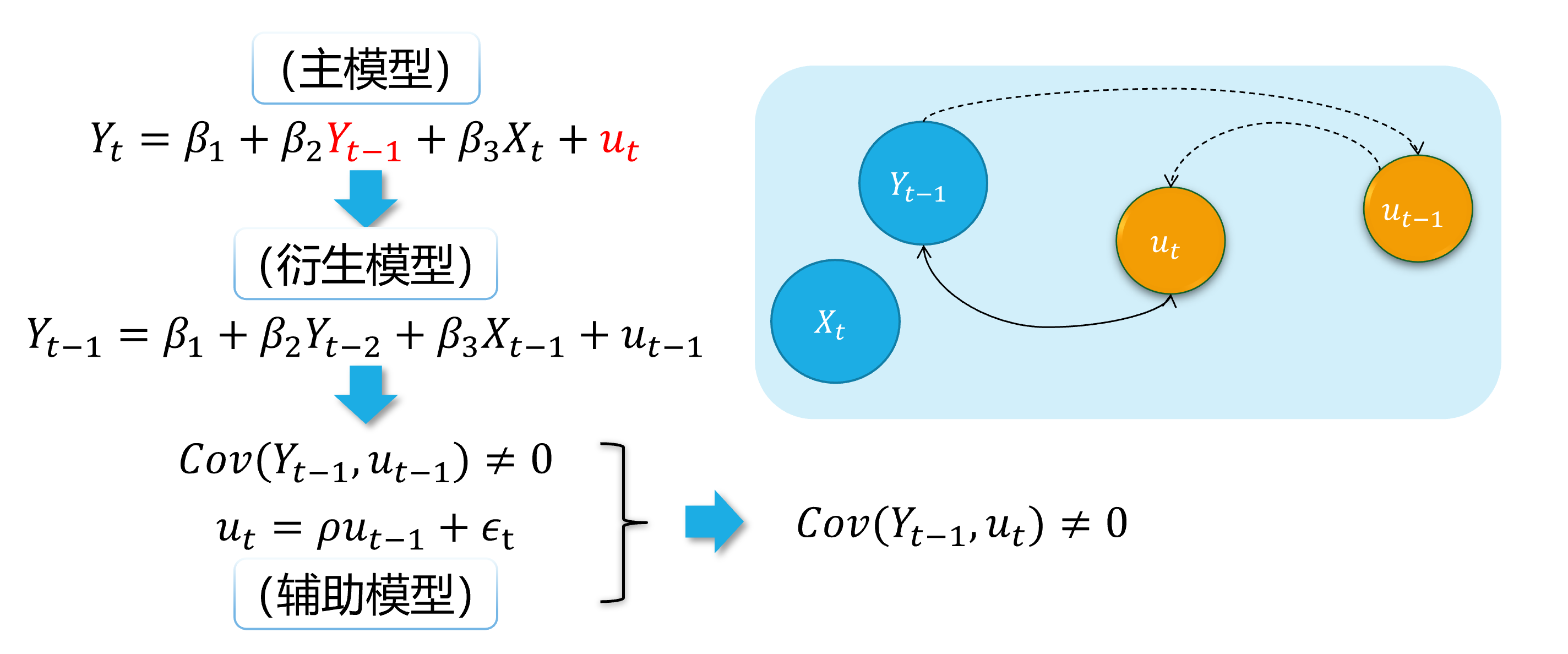

Source 3: Autocorrelation

The autoregressive model with AR(1)

Autoregressive model: Lag variable of dependent variable(\(Y_{t-1}, \ldots, Y_{t-p},\ldots\)) appears in the model as regressors.

\[ \begin {align} Y_t=\beta_{1}+\beta_{2} Y_{t-1}+\beta_{3}X_t+u_t \end {align} \]

If the disturbance term determined following a first-order autocorrelation AR(1):

\[ \begin {align} u_t=\rho u_{t-1}+ \epsilon_t \end {align} \]

Then, it is obvious that \(cov(Y_{t-1}, u_{t-1}) \neq 0\) and \(cov(Y_{t-1}, u_{t}) \neq 0\).

Thus the lag dependent variable (\(Y_{t-1}\)) will cause the endogeneity problem in the Autoregressive model.

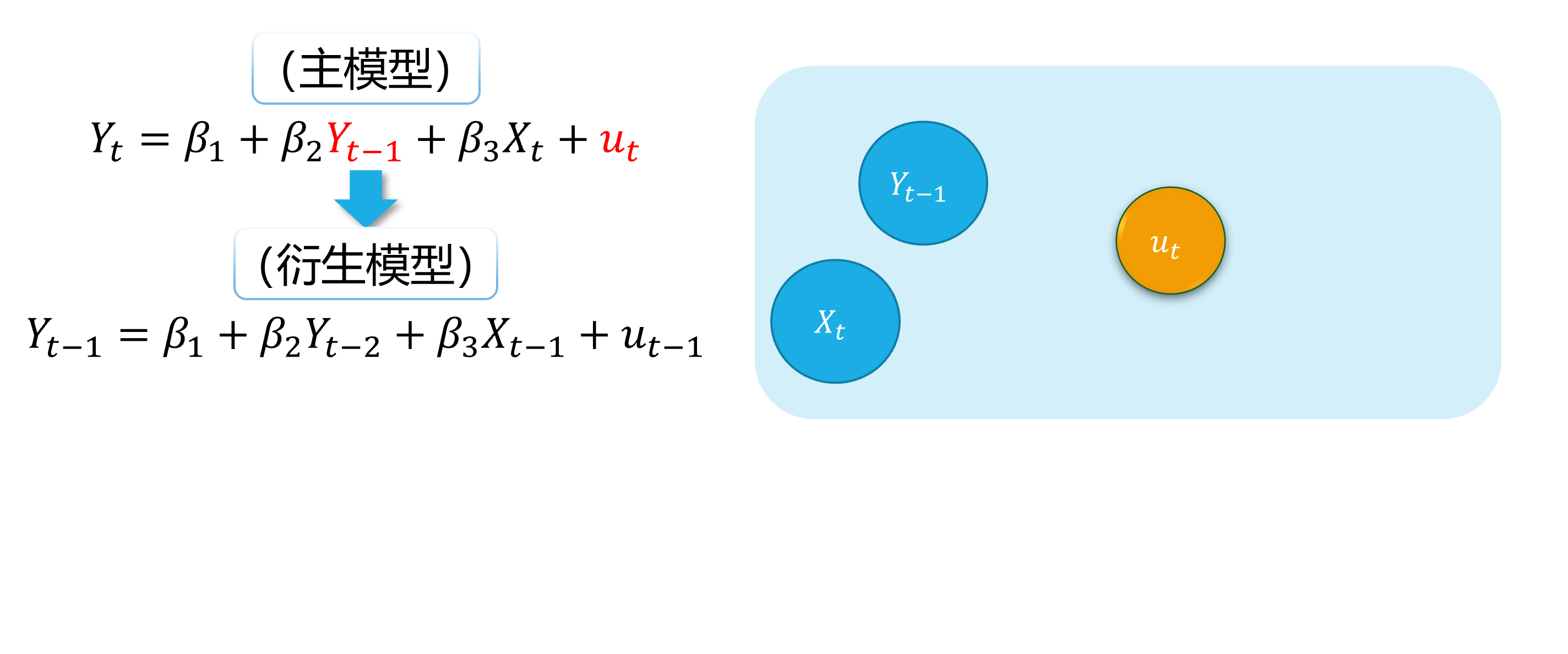

Autocorrelation (demo 1) 1/4

Here we show a visual demonstration on this situation:

Assumed TRUE MODEL: AR(1)

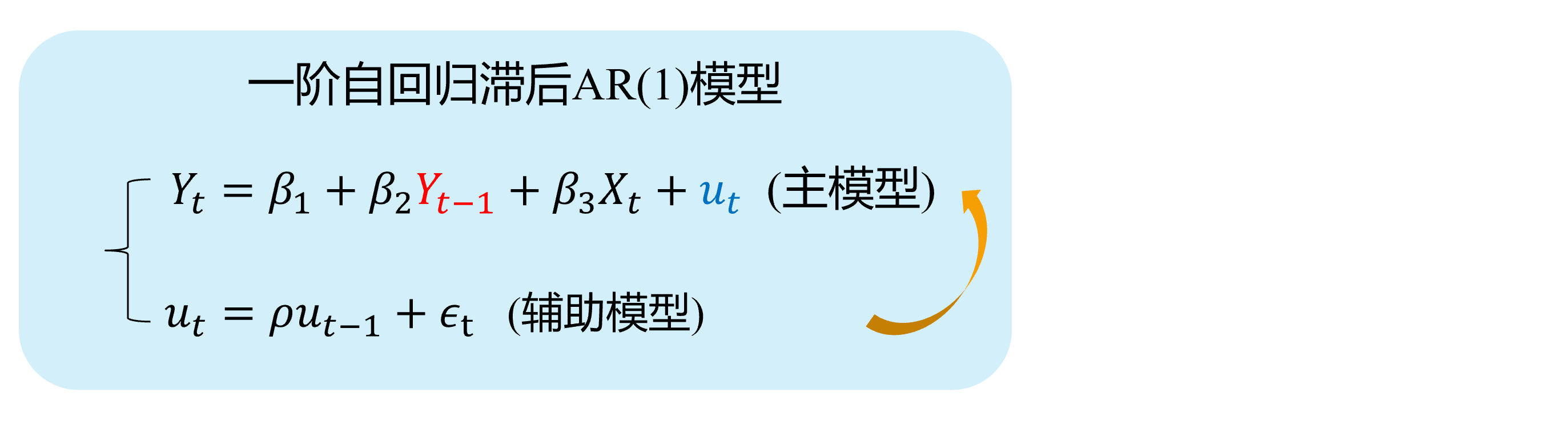

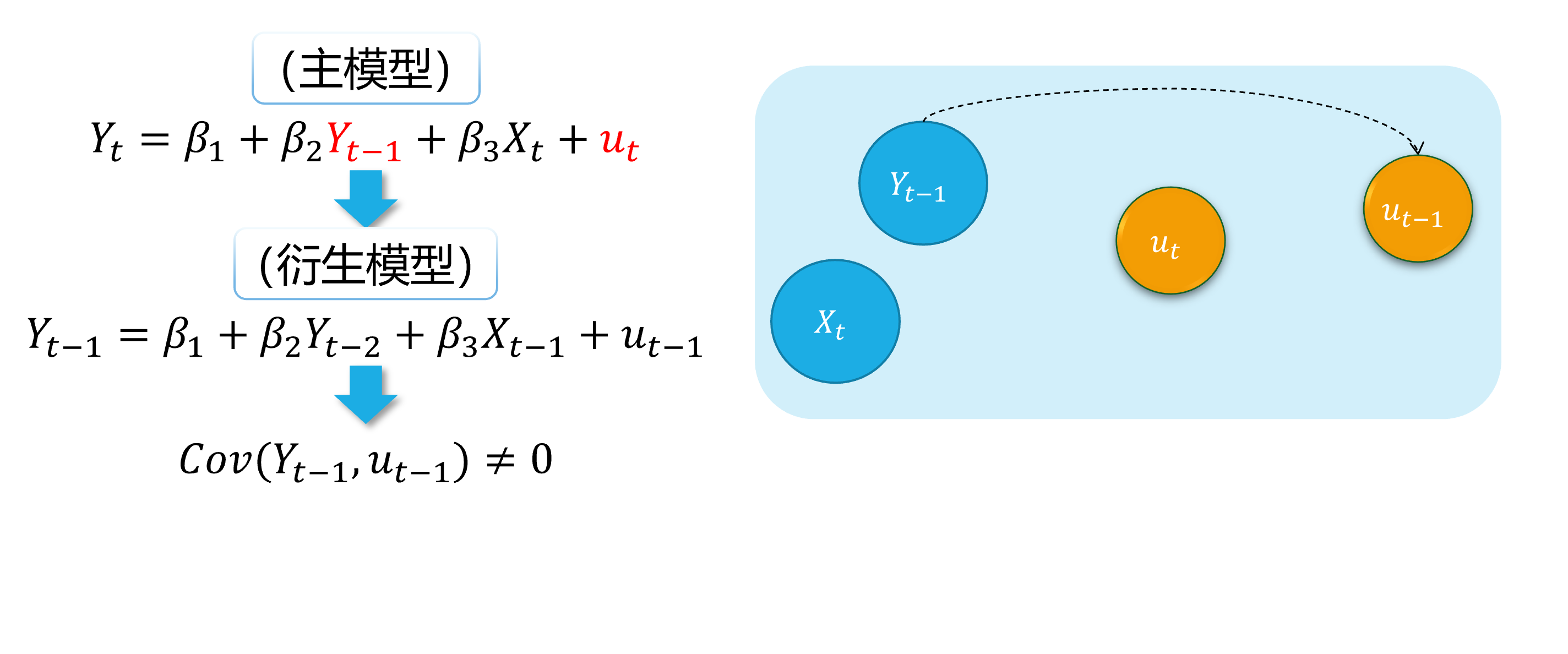

Autocorrelation (demo 1)2/4

Here we show a visual demonstration on this situation:

Assumed TRUE MODEL: AR(1)

(main model)

(auxiliary model)

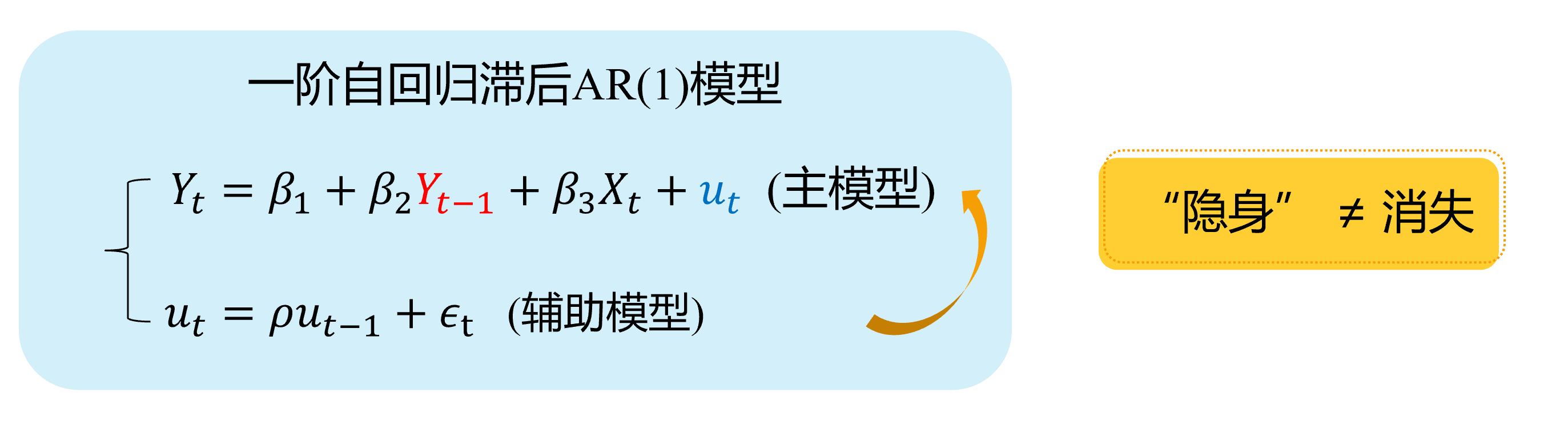

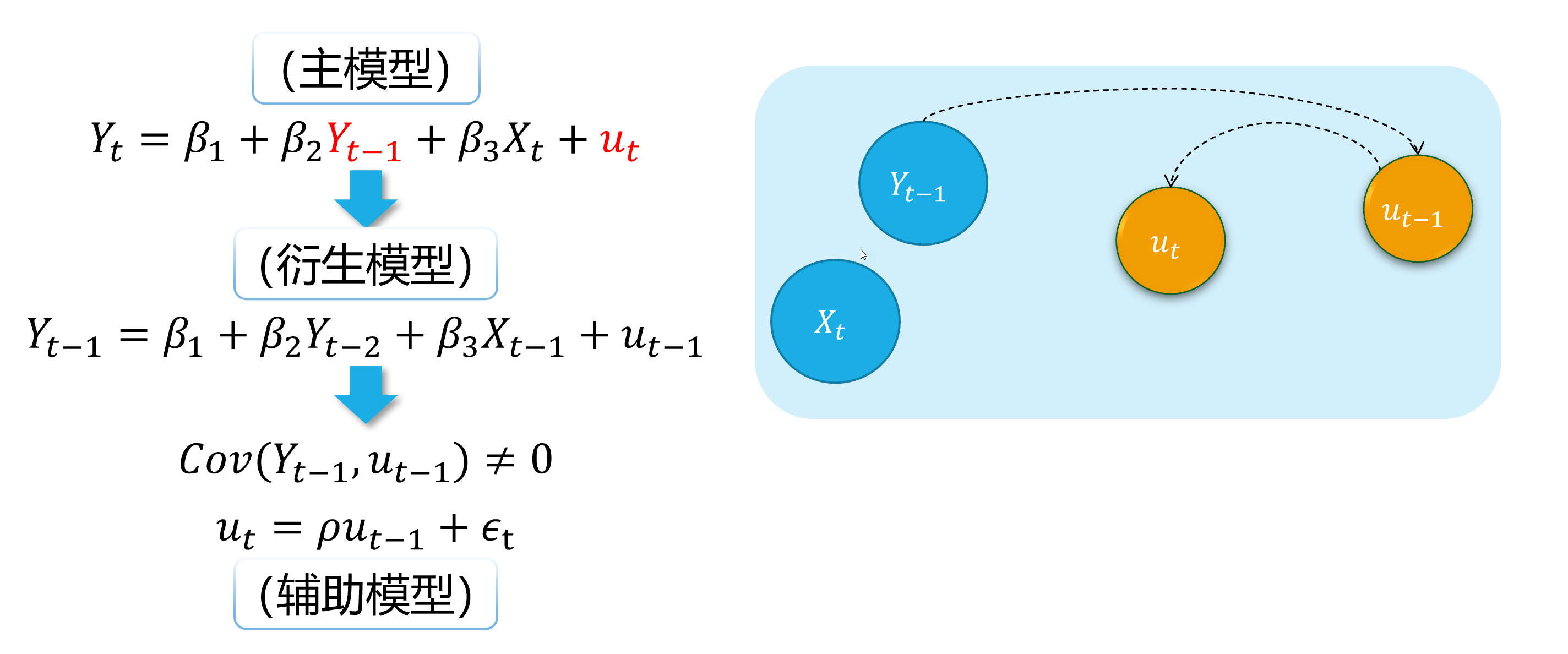

Autocorrelation (demo 1)3/4

Here we show a visual demonstration on this situation:

Assumed TRUE MODEL: AR(1)

(main model)

(auxiliary model)

Autocorrelation (demo 1) 4/4

Here we show a visual demonstration on this situation:

Assumed TRUE MODEL: AR(1)

(main model)

(auxiliary model)

Hidden\(\neq\) Disappeared

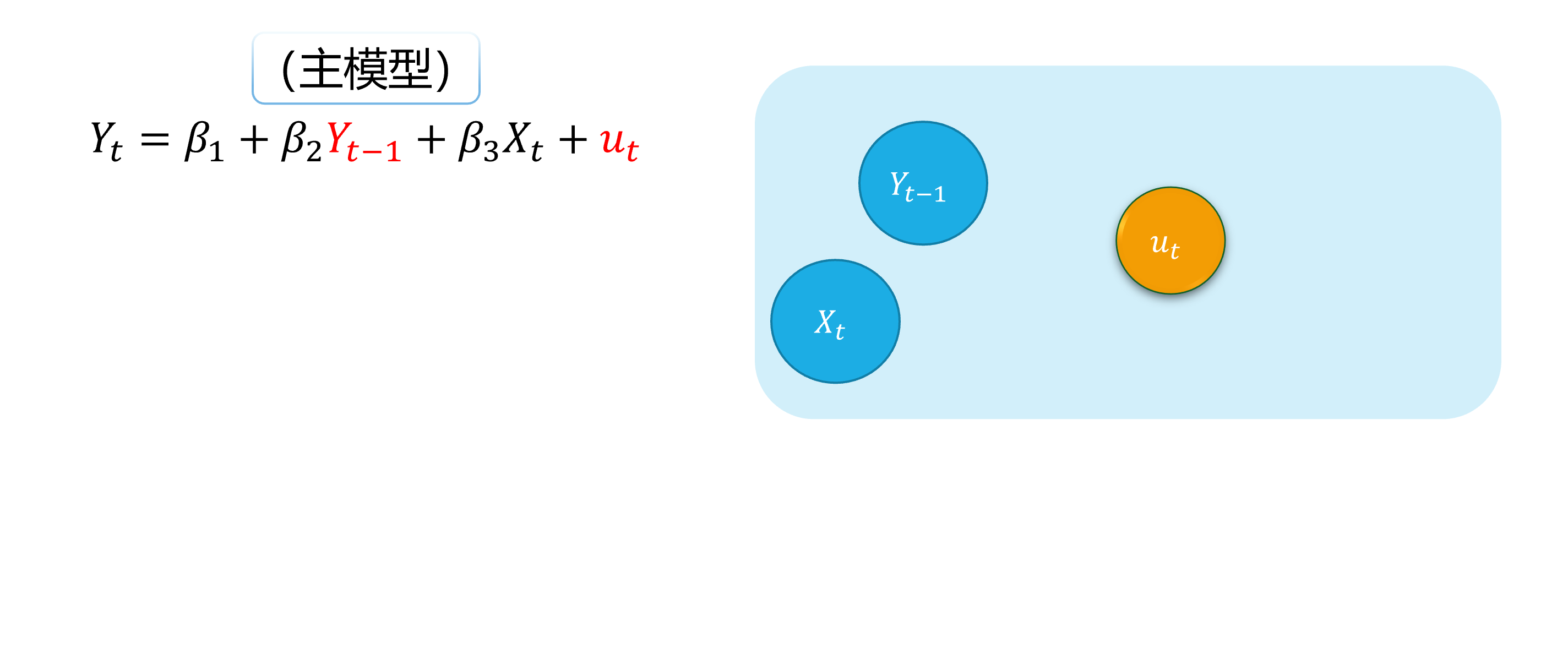

Autocorrelation (demo 2) 1/5

An intuitive demonstration is show as follows:

(main model)

Autocorrelation (demo 2) 2/5

An intuitive demonstration is show as follows:

(main model)

(derived model)

Autocorrelation (demo 2) 3/5

An intuitive demonstration is show as follows:

(main model)

(derived model)

Autocorrelation (demo 4) 1/5

An intuitive demonstration is show as follows:

(main model)

(derived model)

(auxiliary model)

Autocorrelation (demo 2) 5/5

An intuitive demonstration is show as follows:

(main model)

(derived model)

(auxiliary model)

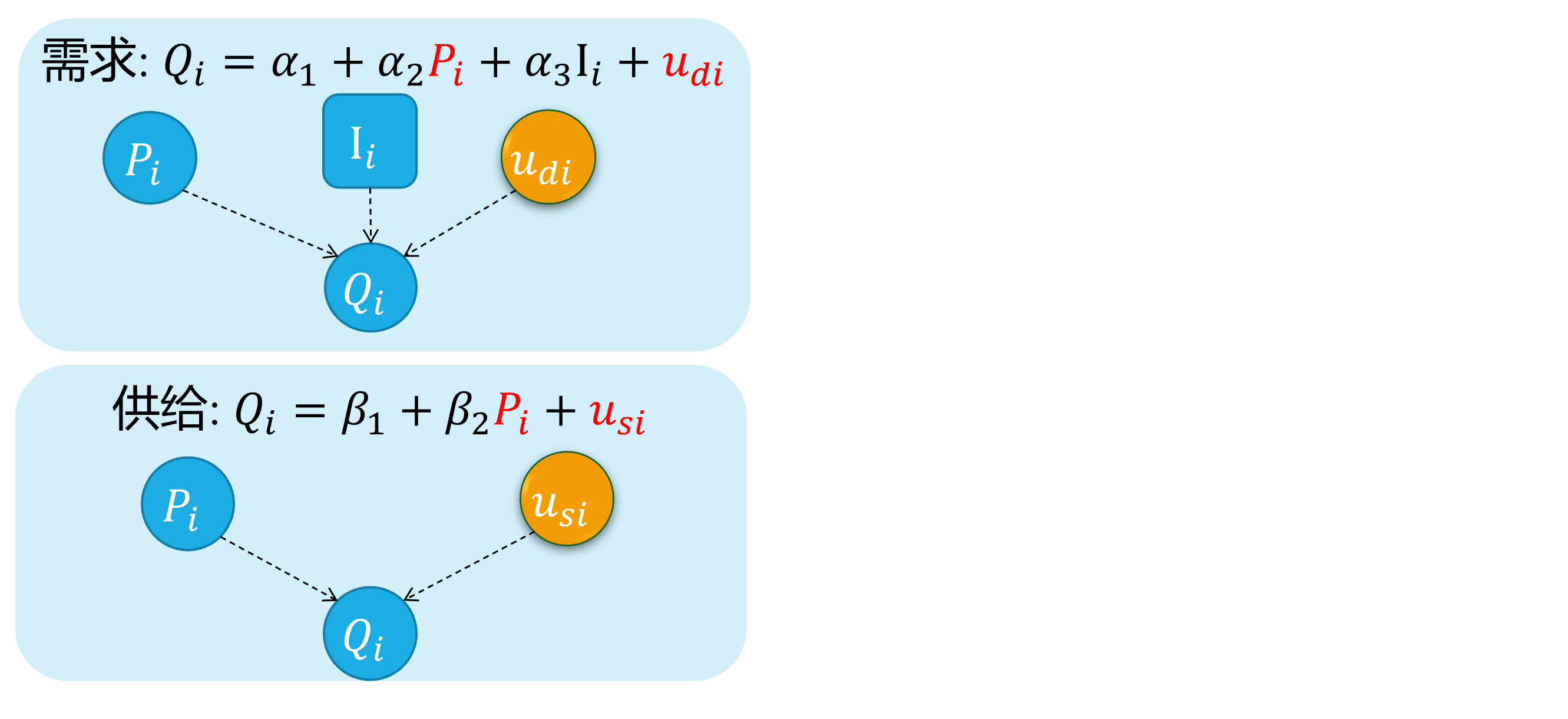

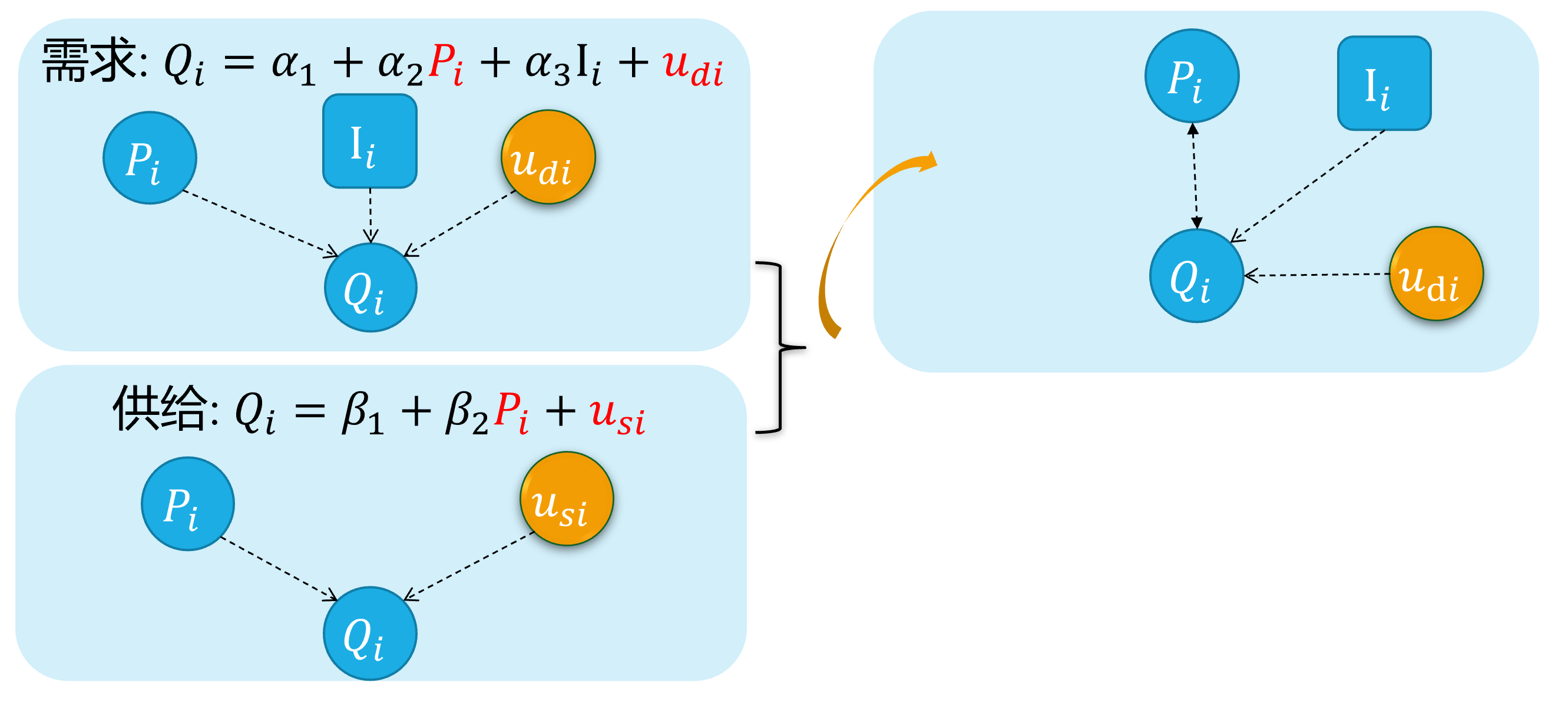

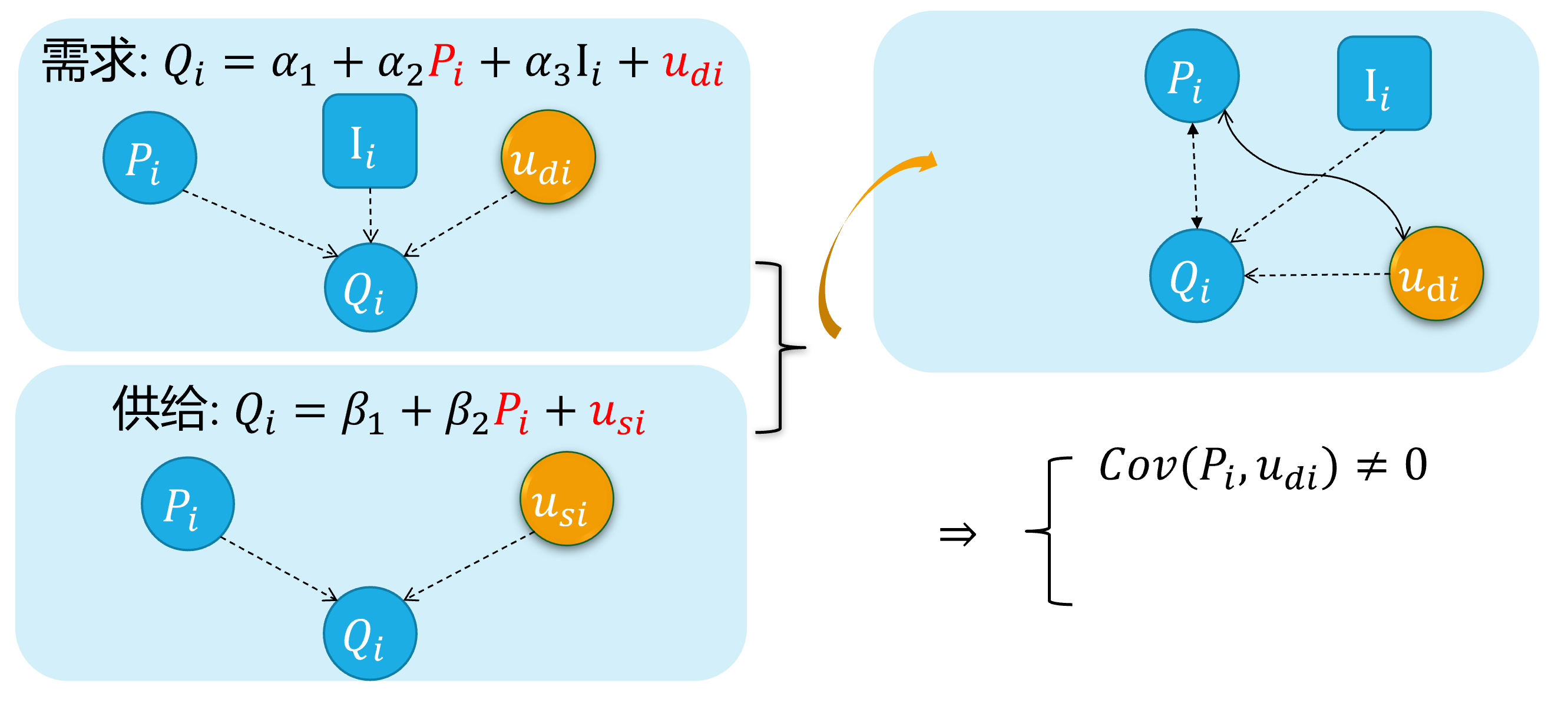

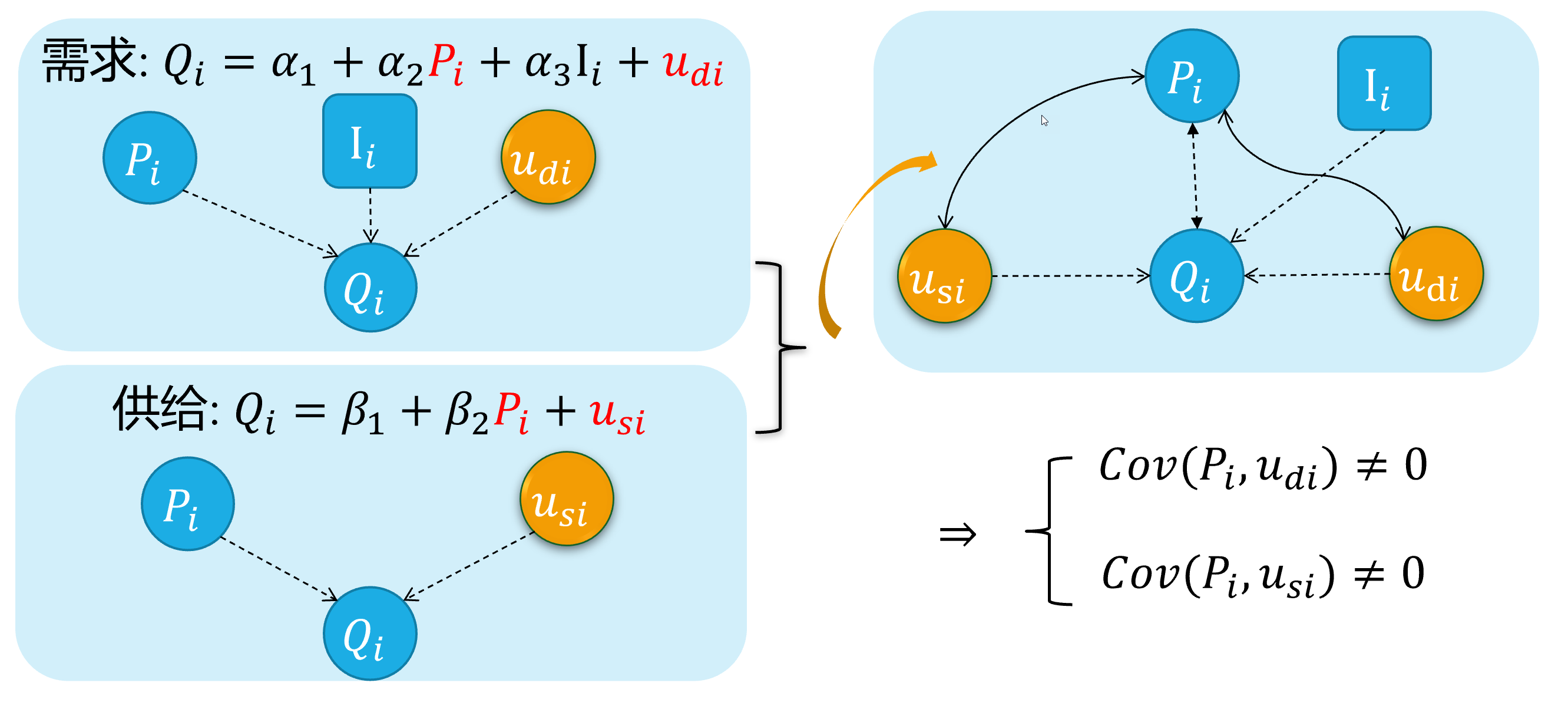

Source 4: Simultaneity

The simultaneous equation model system

For the equations system of supply and demand:

\[ \begin{cases} \begin{align} \text { Demand: } & Q_{i}=\alpha_{1}+\alpha_{2} P_{i}+u_{d i} \\ \text { Supply: } & Q_{i}=\beta_{1}+\beta_{2} P_{i} + u_{s i} \end{align} \end{cases} \]

As we all know, because of the price \(P_i\) will both affect supply and the demand \(Q_i\), And vice versa. There is a feedback cycle mechanism in this system.

So, we can get \(cov(P_i, u_{di}) \neq 0\), and \(cov(P_i, u_{si}) \neq 0\), which will cause the endogenous problem finally.

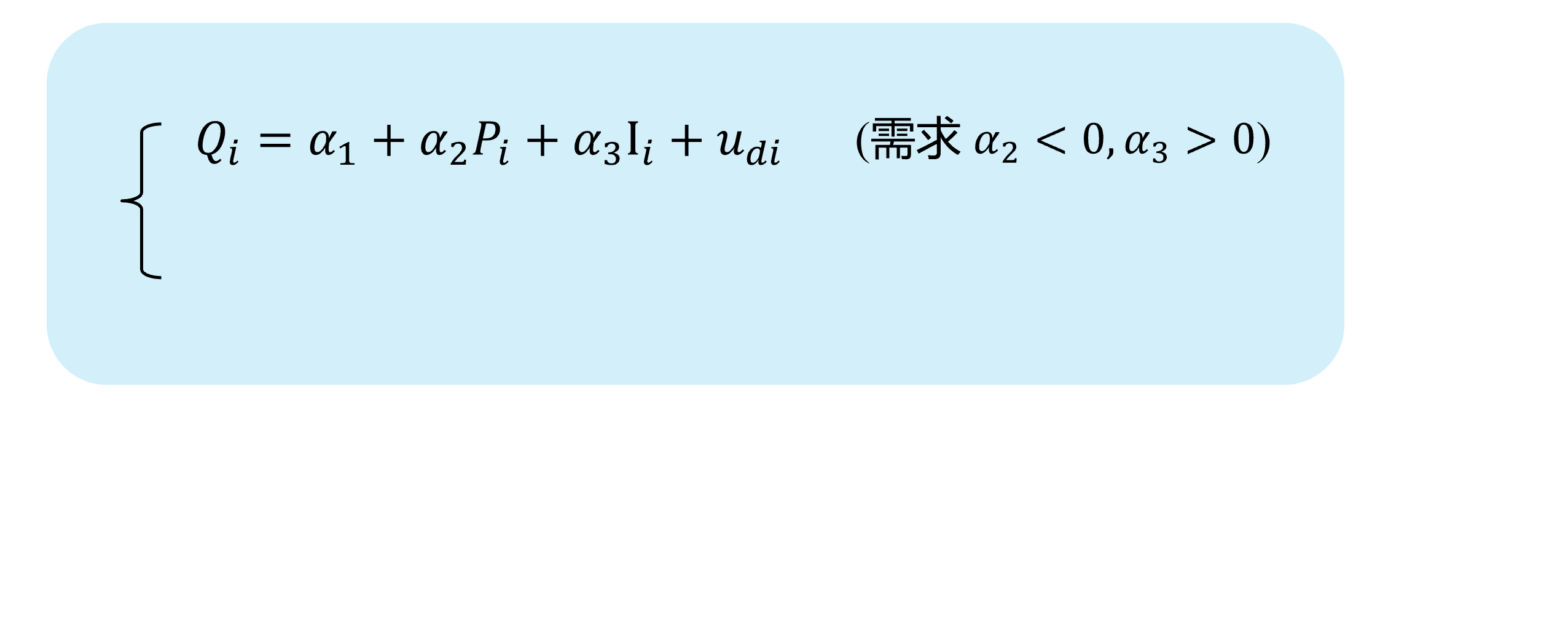

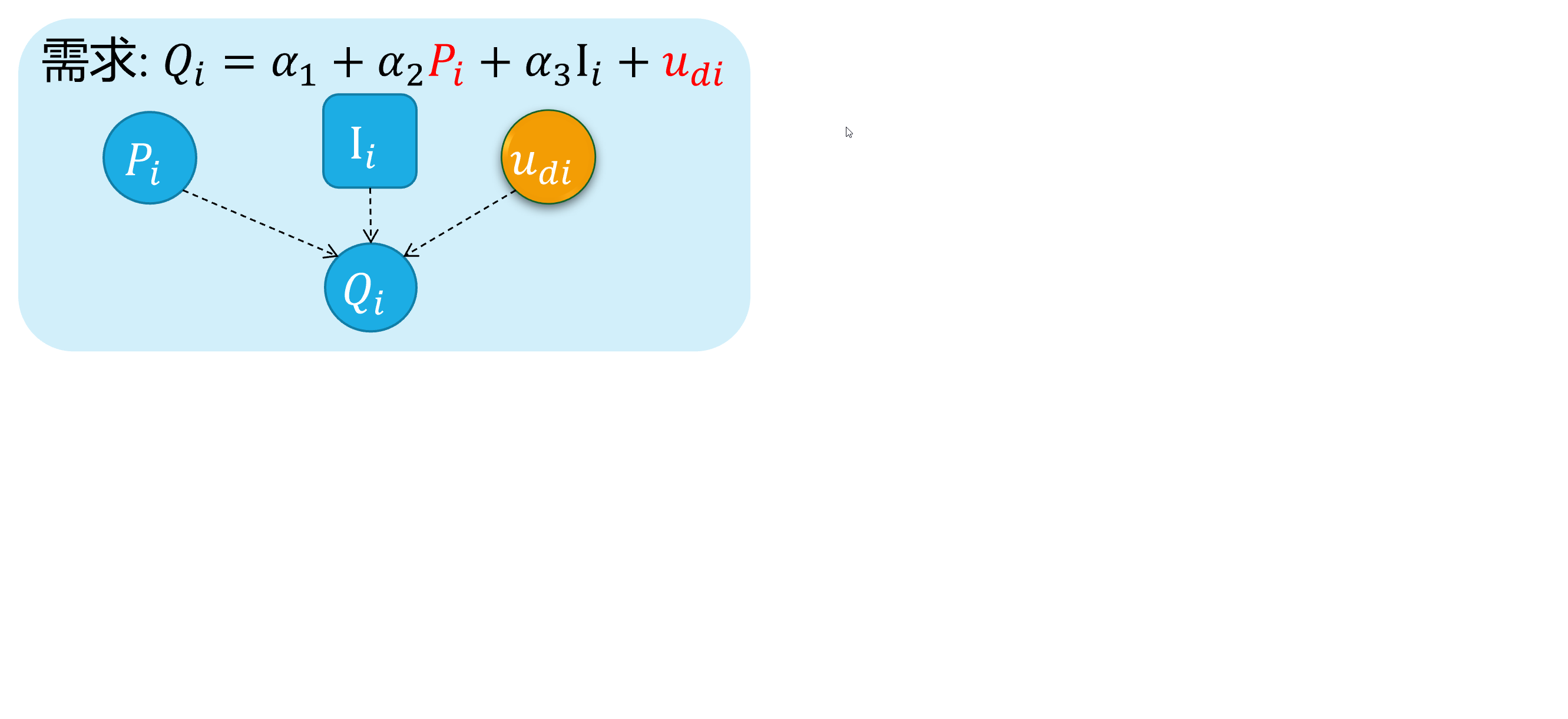

Simultaneity (demo 1) 1/4

Here we show a visual demonstration on this situation:

(Demand

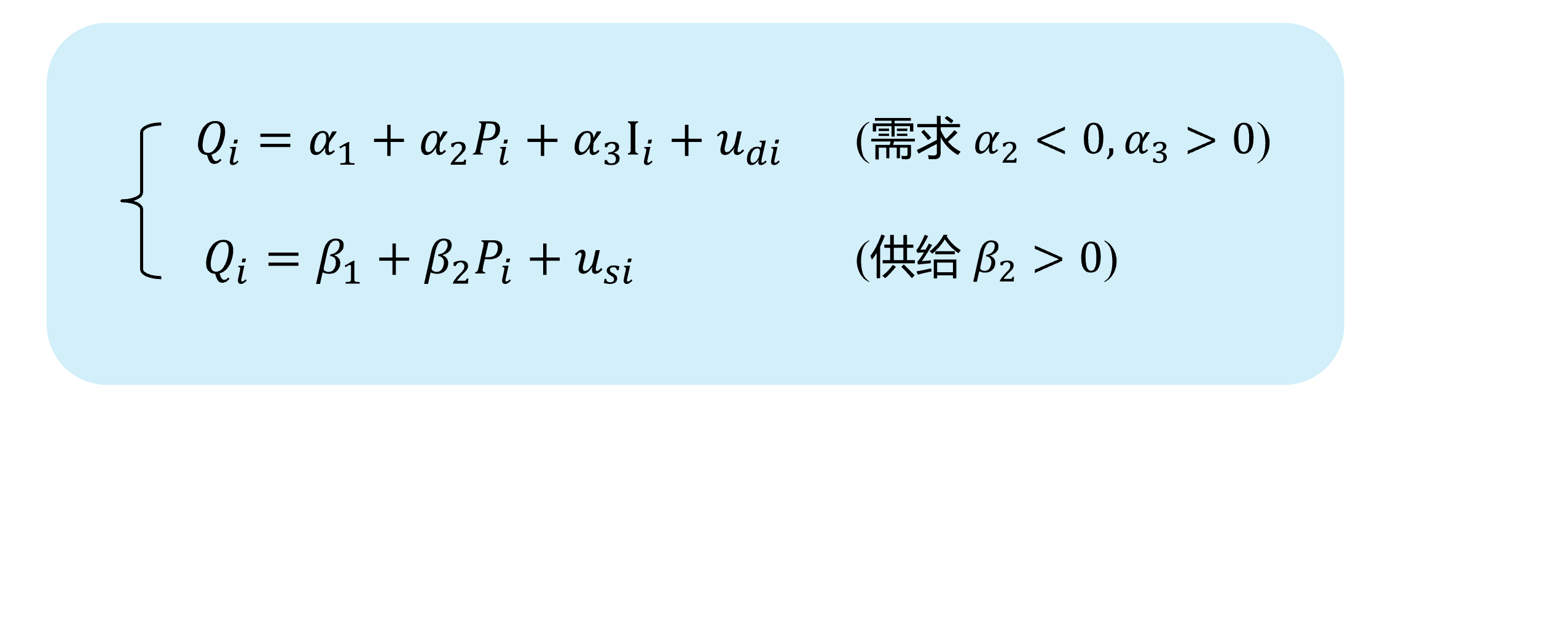

Simultaneity (demo 1) 2/4

Here we show a visual demonstration on this situation:

(Demand

(Supply

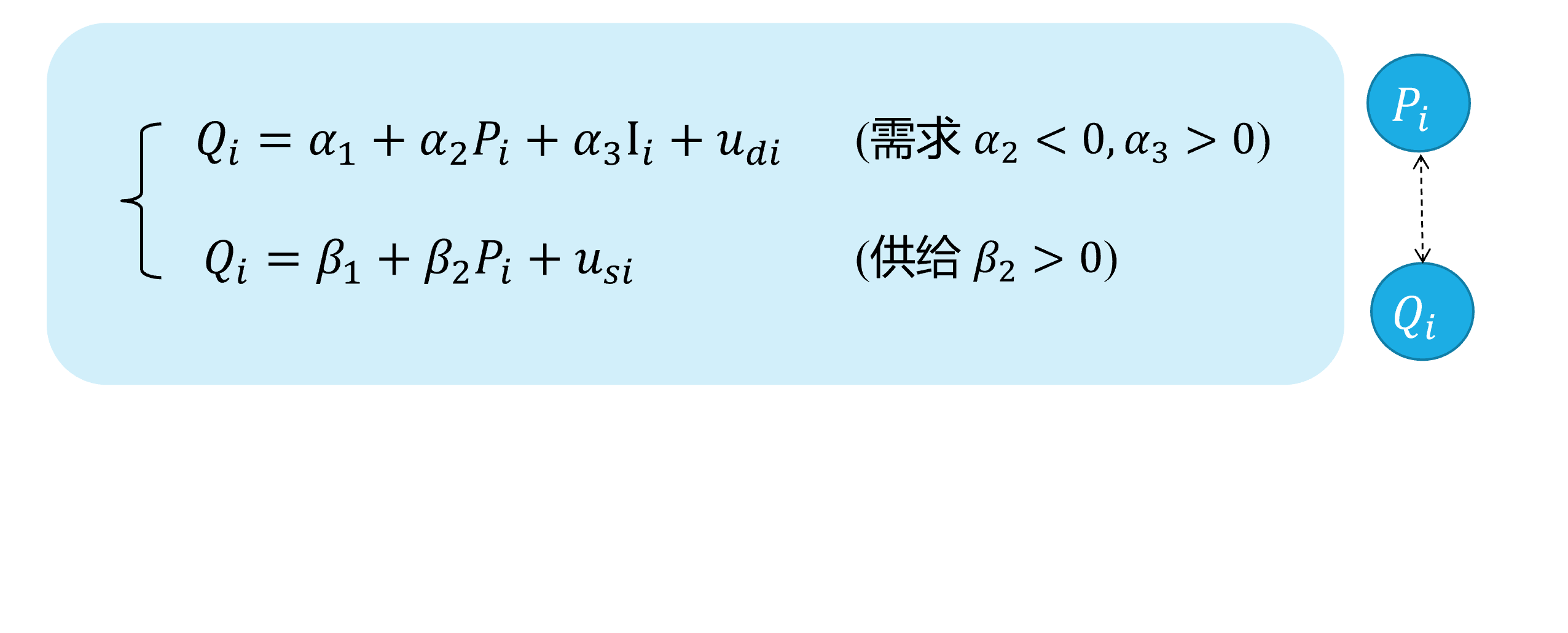

Simultaneity (demo 1) 3/4

Here we show a visual demonstration on this situation:

(Demand

(Supply

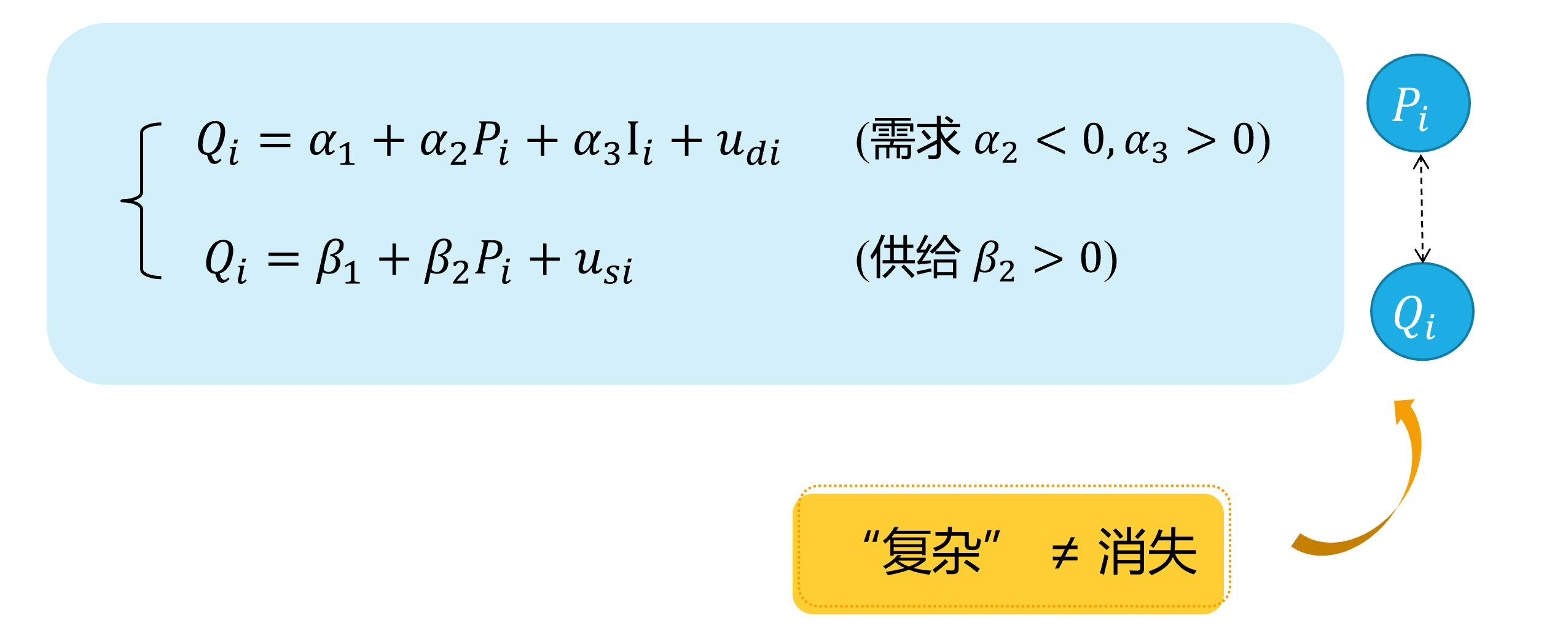

Simultaneity (demo 1) 4/4

Here we show a visual demonstration on this situation:

(Demand

(Supply

Hidden\(\neq\) Disappeared

Simultaneity (demo 2) 1/5

D:

Simultaneity (demo 2) 2/5

D:

S:

Simultaneity (demo 2) 3/5

D:

S:

Simultaneity (demo 2) 4/5

D:

S:

Simultaneity (demo 2) 5/5

D:

S:

17.2 Estimation problem with endogeneity

Inconsistent estimates

mis-specified model with measurement error

Consider the simple regression model:

\[ \begin{align} Y_{i}=\beta_{0}+\beta_{1} X_{i}+\epsilon_{i} \quad \text{(1)} \end{align} \]

We would like to measure the effect of the variable\(X\) on\(Y\), but we can observe only an imperfect measure of it (i.e. a proxy variable), which is

\[ \begin{align} X^{\ast}_{i}=X_{i} - v_{i} \quad \text{(2)} \end{align} \]

Where\(v_i\) is a random disturbance with mean 0 and variance\(\sigma_{v}^{2}\).

Further, let’s assume that\(X_i, \epsilon_i\) and\(v_i\) are pairwise independent.

Proxy variable and the composite error term

Given the assumed true model (1):

\[ \begin{align} Y_{i} &=\beta_{0}+\beta_{1} X_{i}+\epsilon_{i} && \text{ eq(1) assumed true model } \end{align} \]

with the proxy variable\(X^{\ast}_i\), we may use the error specified model (4):

\[ \begin{align} X^{\ast}_i &= X_i - v_i && \text{ eq(2) proxy variable }\\ X_i &= X^{\ast}_i + v_i && \text{ eq(3)}\\ Y_{i} &=\beta_{0}+\beta_{1} X^{\ast}_{i}+u_{i} && \text{ eq(4) error specified model} \end{align} \]

We can substitute eq (3) into the model (1) to obtain eq(5)

\[ \begin{align} Y_{i} =\beta_{0}+\beta_{1} X_{i}^{*}+\epsilon_{i} =\beta_{0}+\beta_{1}\left(X^{\ast}_{i} + v_{i}\right)+\epsilon_{i} =\beta_{0}+\beta_{1} X^{\ast}_{i}+\left(\epsilon_{i} + \beta_{1} v_{i}\right) \quad \text{eq(5)} \end{align} \]

which means\(u_{i}=\left(\epsilon_{i}+\beta_{1} v_{i}\right)\) in the error specified model. As we know, the OLS consistent estimator of\(\beta_{1}\) in the last equationrequires\(\operatorname{Cov}\left(X^{\ast}_{i}, u_{i}\right)= 0\).

The error measurement induce problem of endogeneity

Note that\(E\left(u_{i}\right)=E\left(\epsilon_{i} +\beta_{1} v_{i}\right)=E\left(\epsilon_{i}\right)+\beta_{1} E\left(v_{i}\right)=0\)

However,

\[ \begin{aligned} \operatorname{Cov}\left(X^{\ast}_{i}, u_{i}\right) &=E\left[\left(X^{\ast}_{i}-E\left(X^{\ast}_{i}\right)\right)\left(u_{i}-E\left(u_{i}\right)\right)\right] \\ &=E\left(X^{\ast}_{i} u_{i}\right) \\ &=E\left[\left(X_{i}-v_{i}\right)\left(\epsilon_{i} +\beta_{1} v_{i}\right)\right] \\ &=E\left[X_{i} \epsilon_{i}+\beta_{1} X_{i} v_{i}- v_{i}\epsilon_{i}- \beta_{1} v_{i}^{2}\right] \leftarrow \quad \text{(pairwise independent)} \\ &=-E\left(\beta_{1} v_{i}^{2}\right) \\ &=-\beta_{1} \operatorname{Var}\left(v_{i}\right) \\ &=-\beta_{1} \sigma_{v_i}^{2} \neq 0 \end{aligned} \]

Thus,\(X\) in model (4) is endogenous and we expect the OLS estimator of\(\beta_{1}\) to be inconsistent.

OLS estimates will be biased

In general, when A2 is violated, we expect OLS estimates to be biased:

The OLS estimators of \(\hat{\beta}\) is

\[ \begin{align} \widehat{\beta} &=\beta+\left(X^{\prime} X\right)^{-1} X^{\prime} \epsilon && \text{(6)} \end{align} \]

and we can take expectation on both sides.

\[ \begin{equation} \begin{aligned} E(\widehat{\beta}) &=\beta+E\left(\left(X^{\prime} X\right)^{-1} X^{\prime} \epsilon\right) \\ &=\beta+E\left(E\left(\left(X^{\prime} X\right)^{-1} X^{\prime} \epsilon | X\right)\right) \\ &=\beta+E\left(\left(X^{\prime} X\right)^{-1} X^{\prime} E(\epsilon | X)\right) \neq \beta \end{aligned} \end{equation} \]

If A2\(E(\epsilon | X) = 0\) is violated, which means\(E(\epsilon | X) \neq 0\), the OLS estimator is biased.

conditions for consistent estimates

Let’s see under what conditions we can establish consistency.

\[ \begin{equation} \begin{aligned} p \lim \widehat{\beta} &=\beta+p \lim \left(\left(X^{\prime} X\right)^{-1} X^{\prime} \epsilon\right) =\beta+p \lim \left(\left(\frac{1}{n} X^{\prime} X\right)^{-1} \frac{1}{n} X^{\prime} \epsilon\right) \\ &=\beta+p \lim \left(\frac{1}{n} X^{\prime} X\right)^{-1} \times p \lim \left(\frac{1}{n} X^{\prime} \epsilon\right) \end{aligned} \end{equation} \]

By the WLLN (Weak Law of Large Numbers)

\[ \begin{equation} \frac{1}{n} X^{\prime} \epsilon=\frac{1}{n} \sum_{i=1}^{n} X_{i} \epsilon_{i} \xrightarrow{p} E\left(X_{i} \epsilon_{i}\right) \end{equation} \]

Hence\(\widehat{\beta}\) is consistent if\(E\left(X_{i} \epsilon_{i}\right)=0\) for all \(i\). The condition\(E\left(X_{i} \epsilon_{i}\right)=0\) is more likely to be satisfied than A2\(E(\epsilon | X) = 0\). Thus, a large class of estimators that cannot be proved to be unbiased are consistent.

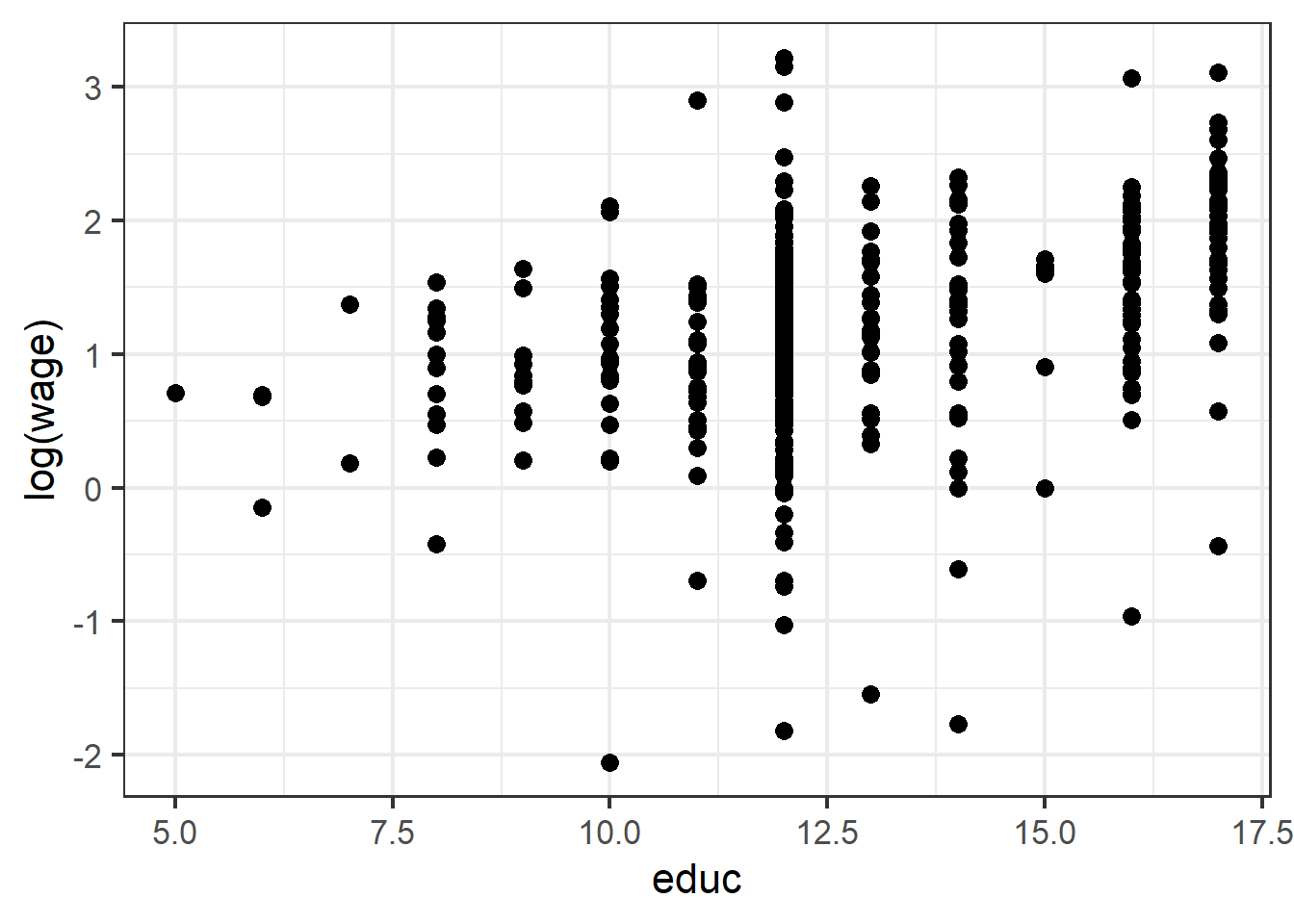

Case: Wage example

The origin model

Consider the following “error specified” wage model:

\[ \begin{align} lwage_i = \beta_1 +\beta_2educ_i + \beta_3exper_i +\beta_4expersq_i + e_i \end{align} \]

The difficulty with this model is that the error term may include some unobserved attributes, such as personal ability, that determine both wage and education.

In other words, the independent variable educ is correlated with the error term. And it is endogenous variable.

Note:

We will use years of schooling as the proxy variable of educ in practice, and it surely bring in error measurement issues as we have mentioned.

Variables in dataset

With data set wooldridge::mroz, researchers were interest in the return to education for married women.

Raw dataset

The scatter

The mis-specified model

The Assumed TRUE model is

\[ \begin{align} log(wage_i)=\beta_{0}+\beta_{1} edu_{i}+\beta_{2} exper_{i}+\beta_{3} exper^2_{i}+\beta_{4} ability_{i}+\epsilon_{i} \end{align} \]

Now, let’s consider the mis-specified model

\[ \begin{align} log(wage_i)=\alpha_{0}+\alpha_{1} edu_{i}+\alpha_{2} exper_{i}+\alpha_{3} exper^2_{i}+u_{i} \quad \text{(omitted ability)} \end{align} \]

In the theory analysis, we have known that this model is mis-specified due to the important omitted variables(

ability) and it will be dropped to the disturbance term\(u_i\).While the regressor

eduis correlated with the disturbance term\(u_i\) (formally the omitted variablesability), thus the regressoreduis endogenous variable!

Using OLS method directly: tidy report

Of course, you can conduct the OLS regression directly without considering problems due to endogeneity, and may obtain the inconsistent estimators (as we have proved).

\[ \begin{aligned} \begin{split} lwage_i=&+\beta_{1}+\beta_{2}educ_i+\beta_{3}exper_i+\beta_{4}expersq_i+u_i \end{split} \end{aligned} \]

The OLS regression resuts is

\[ \begin{alignedat}{999} \begin{split} &\widehat{lwage}=&&-0.52&&+0.11educ_i&&+0.04exper_i&&-0.00expersq_i\\ &(s)&&(0.1986)&&(0.0141)&&(0.0132)&&(0.0004)\\ &(t)&&(-2.63)&&(+7.60)&&(+3.15)&&(-2.06)\\ &(over)&&n=428&&\hat{\sigma}=0.6664 && &&\\ &(fit)&&R^2=0.1568&&\bar{R}^2=0.1509 && &&\\ &(Ftest)&&F^*=26.29&&p=0.0000 && && \end{split} \end{alignedat} \]

This looks good, but we know it is not reliable due to endogeneity behind this “error specified” model.

Using OLS method directly: raw report

17.3 IV and the choices

Instrumental Variable (IV)

problem and the motivation

We have seen that OLS estimator of\(\beta\) is inconsistent when one or more regressors is endogenous .

The problems of OLS arise because we imposed\(E(X_i\epsilon_i)=0\), which means we believe the sample data with

\[ \boldsymbol{X^{\prime} {e}=0} \]

When in fact error terms and regressors are correlated\(E(X_i\epsilon_i) \neq 0\).

conditions review

Suppose we can find a set of explanatory variables\(\boldsymbol{Z}\) satisfying two conditions:

Relevance:\(\boldsymbol{Z}\) is correlated with\(\boldsymbol{X}\)

Exogeneity:\(\boldsymbol{Z}\) is not correlated with\(\boldsymbol{\epsilon}\)

These variables (\(\boldsymbol{Z}\), in matrix form) can be used for consistent estimation and are known as Instrumental Variables (IV) .

IV Estimators

Our instrumental variable estimator,\(\hat{\beta}_{IV}\) is defined in terms of the following “normal equation” (moment condition, to be more precise)

\[ \begin{align} \boldsymbol{Z^{\prime} \hat{\epsilon}=Z^{\prime}\left(y-X \hat{\beta}_{IV}\right)=0} \end{align} \]

and thus, provided that\(Z^{\prime} X\) is square and non singular,

\[ \begin{align} \boldsymbol{\hat{\beta}_{IV}=\left(Z^{\prime} X\right)^{-1} Z^{\prime} y} \end{align} \]

The condition that\(\boldsymbol{Z^{\prime} X}\) is square and non singular, intuitively, is satisfied when we have as many instruments as regressors (a situation that is called exact identification).

However\(\boldsymbol{\hat{\beta}_{IV}}\) is generally biased in finite sample, but we can show that it is still consistent.

Consistent estimator

\(\boldsymbol{\hat{\beta}_{IV}}\) is consistent. Since:

\[ \begin{align} \boldsymbol{\hat{\beta}_{IV} =\left(Z^{\prime} X\right)^{-1} Z^{\prime} y =\left(Z^{\prime} X\right)^{-1} Z^{\prime} (X\beta +\epsilon) =\beta+\left(Z^{\prime} X\right)^{-1} Z^{\prime} \epsilon} \end{align} \]

\[ \begin{align} p \lim \boldsymbol{{\hat{\beta}_{IV}}} &=\boldsymbol{\beta+p \lim \left(\left(Z^{\prime} X\right)^{-1} Z^{\prime} \epsilon\right)} \\ &=\boldsymbol{\beta+\left(p \lim \left(\frac{1}{n} Z^{\prime} X\right)\right)^{-1} \operatorname{plim}\left(\frac{1}{n} Z^{\prime} \epsilon\right) =\beta} \end{align} \]

- Relevance guarantees

\[ \begin{align} p \lim \left(\frac{1}{n} \boldsymbol{Z^{\prime} X}\right) &=p \lim \left(\frac{1}{n} \sum z_{i} X_{i}^{\prime}\right) \\ &=E\left(Z_{i} X_{i}^{\prime}\right) \neq 0 \end{align} \]

- Exogeneity ensures

\[ \begin{align} p \lim \left(\frac{1}{n} \boldsymbol{Z^{\prime} \epsilon}\right) &=p \lim \left(\frac{1}{n} \sum Z_{i} \epsilon_{i}\right) \\ &=E\left(Z_{i} \epsilon_{i}\right)=0 \end{align} \]

Inference

The natural estimator for\(\sigma^{2}\) is

\[ \begin{align} \hat{\sigma}_{I V}^{2} =\frac{\sum e_{i}^{2}}{n-k} =\frac{\boldsymbol{\left(y-X \hat{\beta}_{IV}\right)^{\prime}\left(y-X \hat{\beta}_{I V}\right)}}{n-k} \end{align} \]

can be shown to be consistent (not proved here).

Thus, we can perform hypothesis testing based on IV estimators\(\boldsymbol{\hat{\beta}_{IV}}\).

Choices of instruments

However, finding valid instruments is the most difficult part of IV estimation in practice.

Good instruments need not only to be exogenous, but also need be highly correlative with the regressors.

Joke: If you can find a valid instrumental variable, you can get PhD from MIT.

Without a proof, we say that the asymptotic variance of\(\hat{\beta}_{I V}\) is

\[ \begin{align} \operatorname{Var}\left(\boldsymbol{\hat{\beta}_{I V}}\right)=\sigma^{2}\boldsymbol{\left(Z^{\prime} X\right)^{-1}\left(Z^{\prime} Z\right)\left(X^{\prime} Z\right)^{-1}} \end{align} \]

Where\(\boldsymbol{X^{\prime} Z}\) is the matrix of covariances between instruments and regressors.

If such correlation is low,\(\boldsymbol{X^{\prime} Z}\) will have elements close to zero and hence\(\boldsymbol{\left(X^{\prime} Z\right)^{-1}}\) will have huge elements. Thus,\(\operatorname{Var}\left(\boldsymbol{\hat{\beta}_{IV}}\right)\) will be very large.

Extension of choices

The common strategy is to construct\(\boldsymbol{Z}=(X_{ex}, X^{\ast})\) generally.

Variables\(X_{ex}\) in\(\boldsymbol{X}=(X_{ex}, X_{en})\) are the assumed exogenous variables included in model.

Other exogenous variables\(\boldsymbol{X^{\ast}}\) are “close” to the model, but do not enter the model explicitly.

If\(X\) can be shown to be exogenous, then\(X=Z\) and Gauss-Markov efficiency is recovered.

Instrumental Variable Estimators do not have any efficiency properties .

We can only talk about relative efficiency. It means that we can only choose the optimal set of instruments. Such that our estimator is the best we can obtain within all the class of possible instrumental variable estimators.

IV: Many available instruments

In case there are more instruments than endogenous variables (over-identification), we want to choose those instruments that have the highest correlation with\(X\) and hence give the lowest possible variance.

The best choice is obtained by using the fitted values of an OLS regression of each column of\(\boldsymbol{X}\) on all instruments\(\boldsymbol{Z}\), that is (after running\(k\) regressions, one for each column of\(\boldsymbol{X}\))

\[ \begin{align} \boldsymbol{\hat{X}=Z\left(Z^{\prime} Z\right)^{-1} Z^{\prime} X=ZF} \end{align} \]

We now use\(\boldsymbol{\hat{X}}\) as instrument, which is\(\boldsymbol{\hat{\beta}_{I V}=\left(\hat{X}^{\prime} X\right)^{-1} \hat{X}^{\prime} y}\)

We notice that (try to prove this):

\[ \begin{align} \boldsymbol{\hat{\beta}_{I V} =\left(\hat{X}^{\prime} X\right)^{-1} \hat{X}^{\prime} y=\left(X^{\prime} Z\left(Z^{\prime} Z\right)^{-1} Z^{\prime} X\right)^{-1} X^{\prime} Z\left(Z^{\prime} Z\right)^{-1} Z^{\prime} y } \end{align} \]

IV solution with omitted variables

Revall the wage case

Let’s go back to our example of the wage equation. Assume we are modeling wage as a function of education and ability.

\[ Wage_{i}=\beta_{0}+\beta_{1} Edu_{i}+\beta_{2} Abl_{i}+\epsilon_{i} \]

However, individual’s ability is clearly something that is not observed or measured and hence cannot be included in the model. since, ability is not included in the model it is included in the error term.

\[ Wage_{i}=\beta_{0}+\beta_{1} Edu_{i}+e_{i}, \quad \text {where} \quad e_{i}=\beta_{2} Abl_{i}+\epsilon_{i} \]

The problem is that ability not only affects wages but the more able individuals may spend more years in school, causing a positive correlation between the error term and education,\(\operatorname{cov}(Edu_i, e_i)>0\) .

Thus,\(Educ\) is an endogenous variable.

Conditions for valid instruments

If we can find a valid instrument for Educ we can estimate\(\beta_{1}\) using IV method. Suppose that we have a variable\(Z\) that satisfies the following conditions

\(Z\) does not directly affect wages

\(Z\) is uncorrelated with\(e\) (exogeneity), i.e.

\[ \operatorname{Cov}(e, z)=0 \quad \text{(4)} \]

since\(e_{i}=\beta_{2} Abl_{i}+\epsilon_{i}\),\(Z\) must be uncorrelated with ability.

-\(Z\) is (at least partially) correlated with the endogenous variable,i.e. Education (relevance),

\[ \operatorname{Cov}(Z, Edu) \neq 0 \quad \text{(5)} \]

Such condition can be tested(\(\alpha_2\)) by using a simple regression$:

\[ Edu_{i}=\alpha_{1}+\alpha_{2} Z_{i}+u_{i} \]

Then,\(Z\) is a valid instrument for\(Educ_i\). We showed earlier that the IV estimator of\(\beta_{1}\) is consistent.

Available options of instruments

Several economists have used family background variables as IVs for education.

For example, mother’s education is positively correlated with child’s education, so it may satisfies condition of Relevance.

Also, father’s education is positively correlated with child’s education, and it may satisfies condition of Relevance.

The problem is that mother’s or father ’s education might also be correlated with child’s ability(genetic inherited), in which case the condition of Exogeneity fails.

- Another IV for education that has been used by economists is the number of siblings while growing up.

Typically, having more siblings is associated with lower average levels of education and it should be uncorrelated with innate ability.

proxy variable model

Also, let us consider the case with measurement error in the independent variable.

For some reason, a variable\(X_i\) cannot be directly observed (data is not available), so it is common to find a imperfect measure(the proxy variable) for it.

The “real model” for wage is assumed to be:

\[ \begin {align} \log (Wage_i)=\beta_{0}+\beta_{1} Edu_i+\beta_{2} Abl_i+u_i \end {align} \]

However, since the ability variable (\(Abl_i\)) cannot be observed, we often replace it with the IQ level variable (\(IQ_i\)) and construct the following “proxy variable model” :

\[ \begin {align} \log (Wage_i)=\beta_{0}+\beta_{1} Edu_i+\beta_{2} IQ_i+u_i^{\ast} \end {align} \]

At this point, intelligence level\(IQ_i\) can be considered as a potential instrument for ability\(abil_i\).

17.4 Two-stage least squares method

Two-stage least squares

glance

When we have more instruments than endogenous variables,\(\boldsymbol{\hat{\beta}_{IV}}\) can be computed in 2 steps:

Step 1: Regress each column of\(X\) on all the instruments (\(Z\) ,in matrix form ). For each column of\(X\), get the fitted values and combine them into the matrix\(\hat{X}\).

Step 2: Regress\({Y}\) on\(\hat{X}\)

And, this procedure is named two-stage least squares or 2SLS or TSLS.

indentification

Consider the model setting

\[ \begin{align} Y_{i}=\beta_{0}+\sum_{j=1}^{k} \beta_{j} X_{j i}+\sum_{s=1}^{r} \beta_{k+s} W_{ri}+\epsilon_{i} \end{align} \]

where\(\left(X_{1 i}, \ldots, X_{k i}\right)\) are endogenous regressors,\(\left(W_{1 i}, \ldots, W_{r i}\right)\) are exogenous regressors and there are\(m\) instrumental variables\(\left(Z_{1 i}, \ldots, Z_{m i}\right)\) satisfying instrument relevance and instrument exogeneity conditions.

When\(m=k\) ,the coefficients are exactly identified.

When\(m>k\) ,the coefficients are overidentified.

When\(m<k\), the coefficients are underidentified.

Finnaly, coefficients can be identified only when\(m \geq k\).

The procedure

Stage 1: Regress\(X_{1i}\) on constant, all the instruments\(\left(Z_{1i}, \ldots, Z_{m i}\right)\) and all exogenous regressors\(\left(W_{1i}, \ldots, W_{ri}\right)\) using OLS and obtain the fitted values\(\hat{X}_{1 i}\) . Repeat this to get\(\left(\hat{X}_{1 i}, \ldots, \hat{X}_{k i}\right)\)

Stage 2: Regress\(Y_{i}\) on constant,\(\left(\hat{X}_{1 i}, \ldots, \hat{X}_{k i}\right)\) and \(\left(W_{1 i}, \ldots, W_{r i}\right)\) usingOLS to obtain\(\left(\hat{\beta}_{0}^{IV}, \hat{\beta}_{1}^{IV}, \ldots, \hat{\beta}_{k+r}^{IV}\right)\)

The solutions

We can conduct the 2SLS procedure with following two solutions:

use the “Step-by-Step solution” methods without variance correction.

use the “Integrated solution” with variance correction.

.notes[

Notice:

DO NOT use “Step-by-Step solution” solution in your paper! It is only for teaching purpose here.

In R ecosystem, we have two packages to execute the Integrated solution:

We can use

systemfitpackage functionsystemfit::systemfit().Or we may use

AREpackage functionARE::ivreg().

]

TSLS: Step-by-step solution

Stage 1: model

First, let’s try to use \(matheduc\) as instrument of endogenous variable \(educ\).

Stage 1 of 2SLS: with mother education as instrument

we can obtain the fitted variable \(\widehat{educ}\) by conduct the following step 1 OLS regression

\[ \begin{align} \widehat{educ} = \hat{\gamma}_1 +\hat{\gamma}_2exper + \hat{\gamma}_3expersq +\hat{\gamma}_4mothereduc \end{align} \]

Stage 1: OLS estimate

Here we obtain the OLS results of Stage 1 of 2SLS:

\[ \begin{alignedat}{999} \begin{split} &\widehat{educ}=&&+9.78&&+0.05exper_i&&-0.00expersq_i&&+0.27motheduc_i\\ &(s)&&(0.4239)&&(0.0417)&&(0.0012)&&(0.0311)\\ &(t)&&(+23.06)&&(+1.17)&&(-1.03)&&(+8.60)\\ &(fit)&&R^2=0.1527&&\bar{R}^2=0.1467 && &&\\ &(Ftest)&&F^*=25.47&&p=0.0000 && && \end{split} \end{alignedat} \]

The t -value for coefficient of \(mothereduc\) is so large (larger than 2), indicating a strong correlation between this instrument and the endogenous variable \(educ\) even after controlling for other variables.

Stage 1: OLS predicted values

Along with the regression of Stage 1 of 2SLS, we will extract the fitted value \(\widehat{educ}\) and add them into new data set.

Stage 2: model

Stage 2 of 2SLS: with mother education as instrument

In the second stage, we will regress log(wage) on the \(\widehat{educ}\) from stage 1 and experience and its quadratic term exp square.

\[ \begin{align} lwage = \hat{\beta}_1 +\hat{\beta}_2\widehat{educ} + \hat{\beta}_3exper +\hat{\beta}_4expersq + \hat{\epsilon} \end{align} \]

Stage 2: OLS estimate

By using the new data set (mroz_add), the result of the explicit 2SLS procedure are shown as below.

\[ \begin{alignedat}{999} \begin{split} &\widehat{lwage}=&&+0.20&&+0.05educHat_i&&+0.04exper_i&&-0.00expersq_i\\ &(s)&&(0.4933)&&(0.0391)&&(0.0142)&&(0.0004)\\ &(t)&&(+0.40)&&(+1.26)&&(+3.17)&&(-2.17)\\ &(fit)&&R^2=0.0456&&\bar{R}^2=0.0388 && &&\\ &(Ftest)&&F^*=6.75&&p=0.0002 && && \end{split} \end{alignedat} \]

Keep in mind, however, that the standard errors calculated in this way are incorrect (Why?).

TSLS: Integrated solution

The whole story

We need a Integrated solution for following reasons:

We should obtain the correct estimated error for test and inference.

We should avoid tedious steps in the former step-by-step routine. When the model contains more than one endogenous regressors and there are lots available instruments, then the step-by-step solution will get extremely tedious.

The R toolbox

In R ecosystem, we have two packages to execute the integrated solution:

We can use

systemfitpackage functionsystemfit::systemfit().Or we may use

AREpackage functionARE::ivreg().

Both of these tools can conduct the integrated solution, and will adjust the variance of estimators automatically.

example 1: TSLS with only motheduc as IV

The TSLS model

In order to get the correct estimated error, we need use the “integrated solution” for 2SLS. And we will process the estimation with proper software and tools.

Firstly, let’s consider using \(motheduc\) as the only instrument for \(educ\).

\[ \begin{cases} \begin{align} \widehat{educ} &= \hat{\gamma}_1 +\hat{\gamma}_2exper + \hat{\gamma}_3expersq +\hat{\gamma}_4motheduc && \text{(stage 1)}\\ lwage & = \hat{\beta}_1 +\hat{\beta}_2\widehat{educ} + \hat{\beta}_3exper +\hat{\beta}_4expersq + \hat{\epsilon} && \text{(stage 2)} \end{align} \end{cases} \]

The TSLS results (tidy table)

- The t-test for variable

educis significant (p-value less than 0.05).

The TSLS code: using R function systemfit::systemfit()

The R code using systemfit::systemfit() as follows:

# load pkg

require(systemfit)

# set two models

eq_1 <- educ ~ exper + expersq + motheduc

eq_2 <- lwage ~ educ + exper + expersq

sys <- list(eq1 = eq_1, eq2 = eq_2)

# specify the instruments

instr <- ~ exper + expersq + motheduc

# fit models

fit.sys <- systemfit(

sys, inst=instr,

method="2SLS", data = mroz)

# summary of model fit

smry.system_m <- summary(fit.sys)The TSLS raw result: using R function systemfit::systemfit()

The following is the 2SLS analysis report using systemfit::systemfit():

systemfit results

method: 2SLS

N DF SSR detRCov OLS-R2 McElroy-R2

system 856 848 2085.49 1.96552 0.150003 0.112323

N DF SSR MSE RMSE R2 Adj R2

eq1 428 424 1889.658 4.456742 2.111100 0.152694 0.146699

eq2 428 424 195.829 0.461861 0.679604 0.123130 0.116926

The covariance matrix of the residuals

eq1 eq2

eq1 4.456742 0.304759

eq2 0.304759 0.461861

The correlations of the residuals

eq1 eq2

eq1 1.000000 0.212418

eq2 0.212418 1.000000

2SLS estimates for 'eq1' (equation 1)

Model Formula: educ ~ exper + expersq + motheduc

Instruments: ~exper + expersq + motheduc

Estimate Std. Error t value Pr(>|t|)

(Intercept) 9.77510269 0.42388862 23.06055 < 2e-16 ***

exper 0.04886150 0.04166926 1.17260 0.24161

expersq -0.00128106 0.00124491 -1.02905 0.30404

motheduc 0.26769081 0.03112980 8.59918 < 2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 2.1111 on 424 degrees of freedom

Number of observations: 428 Degrees of Freedom: 424

SSR: 1889.658428 MSE: 4.456742 Root MSE: 2.1111

Multiple R-Squared: 0.152694 Adjusted R-Squared: 0.146699

2SLS estimates for 'eq2' (equation 2)

Model Formula: lwage ~ educ + exper + expersq

Instruments: ~exper + expersq + motheduc

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.198186056 0.472877230 0.41911 0.6753503

educ 0.049262953 0.037436026 1.31592 0.1889107

exper 0.044855848 0.013576817 3.30386 0.0010346 **

expersq -0.000922076 0.000406381 -2.26899 0.0237705 *

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.679604 on 424 degrees of freedom

Number of observations: 428 Degrees of Freedom: 424

SSR: 195.829058 MSE: 0.461861 Root MSE: 0.679604

Multiple R-Squared: 0.12313 Adjusted R-Squared: 0.116926 The TSLS code: using R function ARE::ivreg()

The R code using ARE::ivreg() as follows:

The TSLS code: using R function ARE::ivreg()

The following is the 2SLS analysis report using ARE::ivreg():

Call:

ivreg(formula = mod_iv_m, data = mroz)

Residuals:

Min 1Q Median 3Q Max

-3.10804 -0.32633 0.06024 0.36772 2.34351

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.1981861 0.4728772 0.419 0.67535

educ 0.0492630 0.0374360 1.316 0.18891

exper 0.0448558 0.0135768 3.304 0.00103 **

expersq -0.0009221 0.0004064 -2.269 0.02377 *

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.6796 on 424 degrees of freedom

Multiple R-Squared: 0.1231, Adjusted R-squared: 0.1169

Wald test: 7.348 on 3 and 424 DF, p-value: 8.228e-05 example 2: TSLS with only fatheduc as IV

The TSLS model

Now let’s consider using \(fatheduc\) as the only instrument for \(educ\).

\[ \begin{cases} \begin{align} \widehat{educ} &= \hat{\gamma}_1 +\hat{\gamma}_2exper + \hat{\gamma}_3expersq +\hat{\gamma}_4fatheduc && \text{(stage 1)}\\ lwage & = \hat{\beta}_1 +\hat{\beta}_2\widehat{educ} + \hat{\beta}_3exper +\hat{\beta}_4expersq + \hat{\epsilon} && \text{(stage 2)} \end{align} \end{cases} \]

We will repeat the whole procedure with R.

The TSLS results (tidy table)

- The t-test for variable

educis significant (p-value less than 0.05).

The TSLS code: using R function systemfit::systemfit()

The R code using systemfit::systemfit() as follows:

# load pkg

require(systemfit)

# set two models

eq_1 <- educ ~ exper + expersq + fatheduc

eq_2 <- lwage ~ educ + exper + expersq

sys <- list(eq1 = eq_1, eq2 = eq_2)

# specify the instruments

instr <- ~ exper + expersq + fatheduc

# fit models

fit.sys <- systemfit(

formula = sys, inst=instr,

method="2SLS", data = mroz

)

# summary of model fit

smry.system_f <- summary(fit.sys)The TSLS raw result: using R function systemfit::systemfit()

The following is the 2SLS analysis report using systemfit::systemfit():

systemfit results

method: 2SLS

N DF SSR detRCov OLS-R2 McElroy-R2

system 856 848 2030.11 1.91943 0.172575 0.134508

N DF SSR MSE RMSE R2 Adj R2

eq1 428 424 1838.719 4.336602 2.082451 0.175535 0.169701

eq2 428 424 191.387 0.451384 0.671851 0.143022 0.136959

The covariance matrix of the residuals

eq1 eq2

eq1 4.336602 0.195036

eq2 0.195036 0.451384

The correlations of the residuals

eq1 eq2

eq1 1.000000 0.139402

eq2 0.139402 1.000000

2SLS estimates for 'eq1' (equation 1)

Model Formula: educ ~ exper + expersq + fatheduc

Instruments: ~exper + expersq + fatheduc

Estimate Std. Error t value Pr(>|t|)

(Intercept) 9.88703429 0.39560779 24.99201 < 2e-16 ***

exper 0.04682433 0.04110742 1.13907 0.25532

expersq -0.00115038 0.00122857 -0.93636 0.34962

fatheduc 0.27050610 0.02887859 9.36701 < 2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 2.082451 on 424 degrees of freedom

Number of observations: 428 Degrees of Freedom: 424

SSR: 1838.719104 MSE: 4.336602 Root MSE: 2.082451

Multiple R-Squared: 0.175535 Adjusted R-Squared: 0.169701

2SLS estimates for 'eq2' (equation 2)

Model Formula: lwage ~ educ + exper + expersq

Instruments: ~exper + expersq + fatheduc

Estimate Std. Error t value Pr(>|t|)

(Intercept) -0.061116933 0.436446128 -0.14003 0.8887003

educ 0.070226291 0.034442694 2.03893 0.0420766 *

exper 0.043671588 0.013400121 3.25904 0.0012079 **

expersq -0.000882155 0.000400917 -2.20034 0.0283212 *

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.671851 on 424 degrees of freedom

Number of observations: 428 Degrees of Freedom: 424

SSR: 191.386653 MSE: 0.451384 Root MSE: 0.671851

Multiple R-Squared: 0.143022 Adjusted R-Squared: 0.136959 The TSLS code: using R function ARE::ivreg()

The R code using ARE::ivreg() as follows:

The TSLS raw result: using R function ARE::ivreg()

The following is the 2SLS analysis report using ARE::ivreg():

Call:

ivreg(formula = mod_iv_f, data = mroz)

Residuals:

Min 1Q Median 3Q Max

-3.09170 -0.32776 0.05006 0.37365 2.35346

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -0.0611169 0.4364461 -0.140 0.88870

educ 0.0702263 0.0344427 2.039 0.04208 *

exper 0.0436716 0.0134001 3.259 0.00121 **

expersq -0.0008822 0.0004009 -2.200 0.02832 *

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.6719 on 424 degrees of freedom

Multiple R-Squared: 0.143, Adjusted R-squared: 0.137

Wald test: 8.314 on 3 and 424 DF, p-value: 2.201e-05 example 3: TSLS with both mothedu and fatheduc as IVs

The TSLS model

Also, we can use both \(motheduc\) and \(fatheduc\) as instruments for \(educ\).

\[ \begin{cases} \begin{align} \widehat{educ} &= \hat{\gamma}_1 +\hat{\gamma}_2exper + \hat{\beta}_3expersq +\hat{\beta}_4motheduc + \hat{\beta}_5fatheduc && \text{(stage 1)}\\ lwage & = \hat{\beta}_1 +\hat{\beta}_2\widehat{educ} + \hat{\beta}_3exper +\hat{\beta}_4expersq + \hat{\epsilon} && \text{(stage 2)} \end{align} \end{cases} \]

The TSLS results (tidy table)

The TSLS code: using R function systemfit::systemfit()

The R code using systemfit::systemfit() as follows:

# load pkg

require(systemfit)

# set two models

eq_1 <- educ ~ exper + expersq + motheduc + fatheduc

eq_2 <- lwage ~ educ + exper + expersq

sys <- list(eq1 = eq_1, eq2 = eq_2)

# specify the instruments

instr <- ~ exper + expersq + motheduc + fatheduc

# fit models

fit.sys <- systemfit(

sys, inst=instr,

method="2SLS", data = mroz)

# summary of model fit

smry.system_mf <- summary(fit.sys)The TSLS raw result: using R function systemfit::systemfit()

The following is the 2SLS analysis report using systemfit::systemfit():

systemfit results

method: 2SLS

N DF SSR detRCov OLS-R2 McElroy-R2

system 856 847 1951.6 1.83425 0.204575 0.149485

N DF SSR MSE RMSE R2 Adj R2

eq1 428 423 1758.58 4.157388 2.038967 0.211471 0.204014

eq2 428 424 193.02 0.455236 0.674712 0.135708 0.129593

The covariance matrix of the residuals

eq1 eq2

eq1 4.157388 0.241536

eq2 0.241536 0.455236

The correlations of the residuals

eq1 eq2

eq1 1.000000 0.175571

eq2 0.175571 1.000000

2SLS estimates for 'eq1' (equation 1)

Model Formula: educ ~ exper + expersq + motheduc + fatheduc

Instruments: ~exper + expersq + motheduc + fatheduc

Estimate Std. Error t value Pr(>|t|)

(Intercept) 9.10264011 0.42656137 21.33958 < 2.22e-16 ***

exper 0.04522542 0.04025071 1.12359 0.26182

expersq -0.00100909 0.00120334 -0.83857 0.40218

motheduc 0.15759703 0.03589412 4.39061 1.4298e-05 ***

fatheduc 0.18954841 0.03375647 5.61517 3.5615e-08 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 2.038967 on 423 degrees of freedom

Number of observations: 428 Degrees of Freedom: 423

SSR: 1758.575263 MSE: 4.157388 Root MSE: 2.038967

Multiple R-Squared: 0.211471 Adjusted R-Squared: 0.204014

2SLS estimates for 'eq2' (equation 2)

Model Formula: lwage ~ educ + exper + expersq

Instruments: ~exper + expersq + motheduc + fatheduc

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.048100307 0.400328078 0.12015 0.9044195

educ 0.061396629 0.031436696 1.95302 0.0514742 .

exper 0.044170393 0.013432476 3.28833 0.0010918 **

expersq -0.000898970 0.000401686 -2.23799 0.0257400 *

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.674712 on 424 degrees of freedom

Number of observations: 428 Degrees of Freedom: 424

SSR: 193.020015 MSE: 0.455236 Root MSE: 0.674712

Multiple R-Squared: 0.135708 Adjusted R-Squared: 0.129593 The TSLS code: using R function ARE::ivreg()

The R code using ARE::ivreg() as follows:

The TSLS raw result: using R functionARE::ivreg()

The following is the 2SLS analysis report using ARE::ivreg():

Call:

ivreg(formula = mod_iv_mf, data = mroz)

Residuals:

Min 1Q Median 3Q Max

-3.0986 -0.3196 0.0551 0.3689 2.3493

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.0481003 0.4003281 0.120 0.90442

educ 0.0613966 0.0314367 1.953 0.05147 .

exper 0.0441704 0.0134325 3.288 0.00109 **

expersq -0.0008990 0.0004017 -2.238 0.02574 *

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.6747 on 424 degrees of freedom

Multiple R-Squared: 0.1357, Adjusted R-squared: 0.1296

Wald test: 8.141 on 3 and 424 DF, p-value: 2.787e-05 Solutions comparison

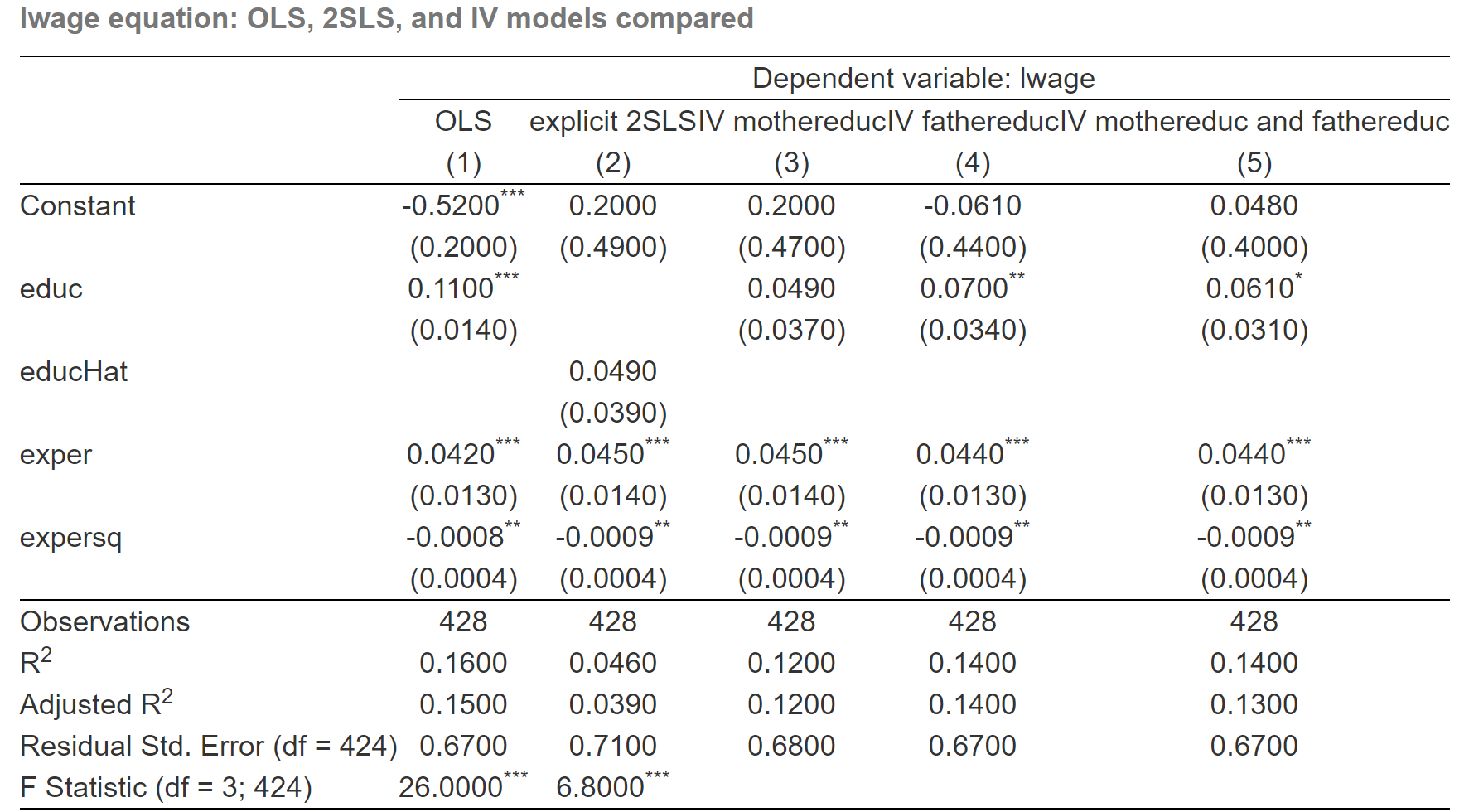

Glance of mutiple models

Until now, we obtain totally Five estimation results with different model settings or solutions:

Error specification model with OLS regression directly.

(Step-by-Step solution) Explicit 2SLS estimation without variance correction (IV regression step by step with only \(matheduc\) as instrument).

(Integrated solution) Dedicated IV estimation with variance correction ( using

Rtools ofsystemfit::systemfit()orARE::ivreg()).

The IV model with only\(motheduc\) as instrument for endogenous variable \(edu\)

The IV model with only\(fatheduc\) as instrument for endogenous variable \(edu\)

The IV model with both\(motheduc\) and\(fatheduc\) as instruments

For the purpose of comparison, all results will show in next slide.

tidy reports (png)

Stidy reports (html)

| Dependent variable: lwage | |||||

| OLS | explicit 2SLS | IV mothereduc | IV fathereduc | IV mothereduc and fathereduc | |

| (1) | (2) | (3) | (4) | (5) | |

| Constant | -0.5220*** | 0.1982 | 0.1982 | -0.0611 | 0.0481 |

| (0.1986) | (0.4933) | (0.4729) | (0.4364) | (0.4003) | |

| educ | 0.1075*** | 0.0493 | 0.0702** | 0.0614* | |

| (0.0141) | (0.0374) | (0.0344) | (0.0314) | ||

| educHat | 0.0493 | ||||

| (0.0391) | |||||

| exper | 0.0416*** | 0.0449*** | 0.0449*** | 0.0437*** | 0.0442*** |

| (0.0132) | (0.0142) | (0.0136) | (0.0134) | (0.0134) | |

| expersq | -0.0008** | -0.0009** | -0.0009** | -0.0009** | -0.0009** |

| (0.0004) | (0.0004) | (0.0004) | (0.0004) | (0.0004) | |

| Observations | 428 | 428 | 428 | 428 | 428 |

| R2 | 0.1568 | 0.0456 | 0.1231 | 0.1430 | 0.1357 |

| Adjusted R2 | 0.1509 | 0.0388 | 0.1169 | 0.1370 | 0.1296 |

| Residual Std. Error (df = 424) | 0.6664 | 0.7090 | 0.6796 | 0.6719 | 0.6747 |

| F Statistic (df = 3; 424) | 26.2862*** | 6.7510*** | |||

Report tips

The second column shows the result of the direct OLS estimation, and the third column shows the result of explicit 2SLS estimation without variance correction.

While the last three column shows the results of IV solution with variance correction.

And we should also remind that the \(educ\) in the IV model is equivalent to the \(educHat\) in 2SLS.

The value within the bracket is the standard error of the estimator.

Report insights

So the key points of this comparison including:

Firstly, the table shows that the importance of education in determining wage decreases in the IV model (3) (4) and (5) with the coefficients 0.049, 0.07, 0.061 respectively. And the standard error also decrease along IV estimation (3) , (4) and (5).

Secondly, It also shows that the explicit 2SLS model (2) and the IV model with only \(motheduc\) instrument yield the same coefficients, but the standard errors are different. The standard error in explicit 2SLS is 0.039, which is little large than the standard error 0.037 in IV estimation.

Thirdly, the t-test of the coefficient on education shows no significance when we use

motheducas the only instrument for education. You can compare this under the explicit 2SLS estimation or IV estimation.Fourthly, we can fully feel and understand the relative estimated efficiency of 2SLS!

Further thinking

After the empirical comparison, we will be even more confused with these results.

While, new question will arise inside our mind.

Which estimation is the best?

How to judge and evaluate different instrument choices?

We will discuss these topics in the next section.

17.5 Testing Instrument validity

Instrument vality

Consider the general model

\[ \begin{align} Y_{i}=\beta_{0}+\sum_{j=1}^{k} \beta_{j} X_{j i}+\sum_{s=1}^{r} \beta_{k+s} W_{ri}+\epsilon_{i} \end{align} \]

- \(Y_{i}\) is the dependent variable

- \(\beta_{0}, \ldots, \beta_{k+1}\) are \(1+k+r\) unknown regression coefficients

- \(X_{1 i}, \ldots, X_{k i}\) are \(k\) endogenous regressors

- \(W_{1 i}, \ldots, W_{r i}\) are \(r\) exogenous regressors which are uncorrelated with \(u_{i}\)

- \(u_{i}\) is the error term

- \(Z_{1 i}, \ldots, Z_{m i}\) are \(m\) instrumental variables

Instrument valid means satisfy both Relevance and Exogeneity conditions.

\[ E\left(Z_{i} X_{i}^{\prime}\right) \neq 0 \]

\[ E\left(Z_{i} \epsilon_{i}\right)=0 \]

Instrument Relevance

In practice, Instrument Relevance also means that:

If there are\(k\) endogenous variables and\(m\) instruments\(Z\), and\(m \geq k\), it must hold that the exogenous vector

\[ \left(\hat{X}_{1 i}^{*}, \ldots, \hat{X}_{k i}^{*}, W_{1 i}, \ldots, W_{r i}, 1\right) \]

should not be perfectly multicollinear.

Where: - \(\hat{X}_{1i}^{\ast}, \ldots, \hat{X}_{ki}^{\ast}\) are the predicted values from the \(k\) first stage regressions. - 1 denotes the constant regressor which equals 1 for all observations.

Weak instrument: introduction

Definition

Instruments that explain little variation in the endogenous regressor \(X\) are called weak instruments.

Formally, When\(\operatorname{corr}\left(Z_{i}, X_{i}\right)\) is close to zero,\(z_{i}\) is called a weak instrument.

Consider a simple one regressor model\(Y_{i}=\beta_{0}+\beta_{1} X_{i}+\epsilon_{i}\)

The IV estimator of\(\beta_{1}\) is\(\widehat{\beta}_{1}^{IV}=\frac{\sum_{i=1}^{n}\left(Z_{i}-\bar{Z}\right)\left(Y_{i}-\bar{Y}\right)}{\sum_{i=1}^{n}\left(Z_{i}-\bar{Z}\right)\left(X_{i}-\bar{X}\right)}\)

Note that\(\frac{1}{n} \sum_{i=1}^{n}\left(Z_{i}-\bar{Z}\right)\left(Y_{i}-\bar{Y}\right) \xrightarrow{p} \operatorname{Cov}\left(Z_{i}, Y_{i}\right)\)

and\(\frac{1}{n} \sum_{i=1}^{n}\left(Z_{i}-\bar{Z}\right)\left(X_{i}-\bar{X}\right) \xrightarrow{p} \operatorname{Cov}\left(Z_{i}, X_{i}\right)\).

- Thus,if\(\operatorname{Cov}\left(Z_{i},X_{i}\right) \approx 0\), then \(\widehat{\beta}_{1}^{IV}\) is useless.

Weak instrument: Birth weight example

Edogeneity and choice of instrument

We focus on the effect of cigarette smoking on the infant birth weight. Without other explanatory variables, the model is

-\(bwght =\) child birth weight, in ounces.

-\(packs =\) packs smoked per day while pregnant.

-\(cigprice=\) cigarette price in home state

\[ \begin{align} \log (\text {bwght})=\beta_{0}+\beta_{1} \text {packs}+u_{i} \end{align} \]

We might worry that packs is cor-related with other health factors or the availability of good prenatal care, so that\(packs\) and\(u_i\) might be correlated.

A possible instrumental variable for\(packs\) is the average price of cigarettes (\(cigprice\)) in the state . We will assume that\(cigprice\) and\(u_i\) are uncorrelated.

TSLS estimation

However, by regressing \(packs\) on \(cigprice\) in stage 1, we find basically no effect.

\[ \begin{alignedat}{999} \begin{split} &\widehat{packs}=&&+0.0674&&+0.0003cigprice_i\\ &(s)&&(0.1025)&&(0.0008)\\ &(t)&&(+0.66)&&(+0.36)\\ &(Ftest)&&F^*=0.13&&p=0.7179 \end{split} \end{alignedat} \]

If we insist to use \(cigprice\) as instrument, and run the stage 2 OLS, we will find

\[ \begin{alignedat}{999} \begin{split} &\widehat{lbwght}=&&+4.4481&&+2.9887packs\_hat_i\\ &(s)&&(0.1843)&&(1.7654)\\ &(t)&&(+24.13)&&(+1.69)\\ &(Ftest)&&F^*=2.87&&p=0.0907 \end{split} \end{alignedat} \]

The strategy with weak instruments

The weak instrument (\(Z_i\) and\(X_i\) is week correlated) led to an important finding: even with very large sample sizes the 2SLS estimator can be biased and a distribution that is very different from standard normal (Staiger and Stock 1997).

There are two ways to proceed if instruments are weak:

- Discard the weak instruments and/or find stronger instruments.

While the former is only an option if the unknown coefficients remain identified when the weak instruments are discarded, the latter can be difficult and even may require a redesign of the whole study.

- Stick with the weak instruments but use methods that improve upon TSLS.

Such as limited information maximum likelihood estimation (LIML).

Weak instrument test (solution 1): Restricted F-test

Test situation: Only one endogenous regressor in the model

In case with a single endogenous regressor, we can take the F-test to check the Weak instrument.

The basic idea of the F-test is very simple:

If the estimated coefficients of all instruments in the first-stage of a 2SLS estimation are zero, the instruments do not explain any of the variation in the\(X\) which clearly violates the relevance assumption.

Test procudure

We may use the following rule of thumb:

- Conduct the first-stage regression of a 2SLS estimation

\[ \begin{align} X_{i}=\hat{\gamma}_{0}+\hat{\gamma}_{1} W_{1 i}+\ldots+\hat{\gamma}_{p} W_{p i}+ \hat{\theta}_{1} Z_{1 i}+\ldots+\hat{\theta}_{q} Z_{q i}+v_{i} \quad \text{(3)} \end{align} \]

Test the restricted joint hypothesis\(H_0: \hat{\theta}_1=\ldots=\hat{\theta}_q=0\) by compute the\(F\)-statistic. We call this Restricted F-test which is different with the Classical overall F-test.

If the\(F\)-statistic is less than critical value, the instruments are weak.

The rule of thumb is easily implemented in R. Run the first-stage regression using lm() and subsequently compute the restricted \(F\)-statistic by R function of car::linearHypothesis().

Weak instrument test (solution 1): Restricted F-test on wage example

Model setting

For all three IV model, we can test instrument(s) relevance respectively.

\[ \begin{align} educ &= \gamma_1 +\gamma_2exper +\gamma_2expersq + \theta_1motheduc +v && \text{(relevance test 1)}\\ educ &= \gamma_1 +\gamma_2exper +\gamma_2expersq + \theta_2fatheduc +v && \text{(relevance test 2)} \\ educ &= \gamma_1 +\gamma_2exper +\gamma_2expersq + \theta_1motheduc + \theta_2fatheduc +v && \text{(relevance test 3)} \end{align} \]

motheduc IV: Restricted F-test(model and hypothesis)

Consider model 1:

\[ \begin{align} educ &= \gamma_1 +\gamma_2exper +\gamma_3expersq + \theta_1motheduc +v \end{align} \]

The restricted F-test’ null hypothesis:\(H_0: \theta_1 =0\).

We will test whether motheduc are week instruments.

motheduc IV: Restricted F-test(R Code and result)

The result show that the p-value of\(F^{\ast}\) is much smaller than 0.01. Null hypothesis \(H_0\) was rejected. motheduc is instruments relevance (exogeneity valid).

Linear hypothesis test:

motheduc = 0

Model 1: restricted model

Model 2: educ ~ exper + expersq + motheduc

Res.Df RSS Df Sum of Sq F Pr(>F)

1 425 2219.2

2 424 1889.7 1 329.56 73.946 < 2.2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1Test comparision: Classic F-test (hypothsis and result)

\[ \begin{align} educ &= \gamma_1 +\gamma_2exper +\gamma_2expersq + \theta_1motheduc +v \end{align} \]

The classic OLS F-test’ null hypothesis:\(H_0: \gamma_2 = \gamma_3= \theta_1 =0\).

The OLS estimation results are:

\[ \begin{alignedat}{999} \begin{split} &\widehat{educ}=&&+9.78&&+0.05exper_i&&-0.00expersq_i&&+0.27motheduc_i\\ &(s)&&(0.4239)&&(0.0417)&&(0.0012)&&(0.0311)\\ &(t)&&(+23.06)&&(+1.17)&&(-1.03)&&(+8.60) \end{split} \end{alignedat} \]

fatheduc IV: Restricted F-test (model and hypothesis)

Consider model 2:

\[ \begin{align} educ &= \gamma_1 +\gamma_2exper +\gamma_3expersq + \theta_1fatheduc +v && \text{(relevance test 2)} \end{align} \]

The restricted F-test’ null hypothesis:\(H_0: \theta_1 =0\).

We will test whether fatheduc are week instruments.

fatheduc IV: Restricted F-test (R Code and result)

The result show that the p-value of\(F^{\ast}\) is much smaller than 0.01. Null hypothesis \(H_0\) was rejected. fatheduc is instruments relevance (exogeneity valid).

Linear hypothesis test:

fatheduc = 0

Model 1: restricted model

Model 2: educ ~ exper + expersq + fatheduc

Res.Df RSS Df Sum of Sq F Pr(>F)

1 425 2219.2

2 424 1838.7 1 380.5 87.741 < 2.2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1motheduc and fatheduc IV: restricted F-test (model and hypothesis)

Consider model 3:

\[ \begin{align} educ &= \gamma_1 +\gamma_2exper +\gamma_3expersq + \theta_1motheduc + \theta_2fatheduc +v && \text{(relevance test 3)} \end{align} \]

The restricted F-test’ null hypothesis:\(H_0: \theta_1 = \theta_2 =0\).

We will test whether motheduc and fatheduc are week instruments.

motheduc and fatheduc IV: restricted F-test (R code and result)

The result show that the p-value of\(F^{\ast}\) is much smaller than 0.01. Null hypothesis \(H_0\) was rejected. fatheduc and motheduc are instruments relevance (exogeneity valid).

Linear hypothesis test:

motheduc = 0

fatheduc = 0

Model 1: restricted model

Model 2: educ ~ exper + expersq + motheduc + fatheduc

Res.Df RSS Df Sum of Sq F Pr(>F)

1 425 2219.2

2 423 1758.6 2 460.64 55.4 < 2.2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1Weak instrument test (solution 2): Cragg-Donald test

Test situation: More than one endogenous regressor in the model

The former test for weak instruments might be unreliable with more than one endogenous regressor, though, because there is indeed one\(F\)-statistic for each endogenous regressor.

Test procedure

An alternative is the Cragg-Donald test based on the following statistic:

\[ \begin{align} F=\frac{N-G-B}{L} \frac{r_{B}^{2}}{1-r_{B}^{2}} \end{align} \]

- where:\(G\) is the number of exogenous regressors;\(B\) is the number of endogenous regressors;\(L\) is the number of external instruments;\(r_B\) is the lowest canonical correlation.

Canonical correlation is a measure of the correlation between the endogenous and the exogenous variables, which can be calculated by the function

cancor()inR.

Weak instrument test (solution 2): Crag-Donald test on Work hour example

Case backgound

Let us construct another IV model with two endogenous regressors. We assumed the following work hours determination model:

\[ \begin{equation} hushrs=\beta_{1}+\beta_{2} mtr+\beta_{3} educ+\beta_{4} kidsl6+\beta_{5} nwifeinc+e \end{equation} \]

- \(hushrs\): work hours of husband, 1975

- \(mtr\): federal marriage tax rate on woman

- \(kidslt6\): have kids < 6 years (dummy variable)

- \(nwifeinc\): wife’s net income

There are:

- Two endogenous variables: \(educ\) and \(mtr\)

- Two exogenous regressors: \(nwifeinc\) and \(kidslt6\)

- And two external instruments: \(motheduc\) and \(fatheduc\).

Cragg-Donald test: R code

The data set is still mroz, restricted to women that are in the labor force(\(inlf=1\)).

# filter samples

mroz1 <- wooldridge::mroz %>%

filter(wage>0, inlf==1)

# set parameters

N <- nrow(mroz1); G <- 2; B <- 2; L <- 2

# for endogenous variables

x1 <- resid(lm( mtr ~ kidslt6 + nwifeinc, data = mroz1))

x2 <- resid(lm( educ ~ kidslt6 + nwifeinc, data = mroz1))

# for instruments

z1 <-resid(lm(motheduc ~ kidslt6 + nwifeinc, data = mroz1))

z2 <-resid(lm(fatheduc ~ kidslt6 + nwifeinc, data=mroz1))

# column bind

X <- cbind(x1,x2)

Y <- cbind(z1,z2)

# calculate Canonical correlation

rB <- min(cancor(X,Y)$cor)

# obtain the F statistics

CraggDonaldF <- ((N-G-L)/L)/((1-rB^2)/rB^2)Cragg-Donald test: R result

Run these code lines, we can obtain the results:

| G | L | B | N | rb | CraggDonaldF |

|---|---|---|---|---|---|

| 2 | 2 | 2 | 428 | 0.0218 | 0.1008 |

The result show the Cragg-Donald \(F=\) 0.1008 , which is much smaller than the critical value 4.58[1].

This test can not rejects the null hypothesis, thus we may conclude that some of these instruments are weak.

Instrument Exogeneity: Introduction

The difficulty

Instrument Exogeneity means all \(m\) instruments must be uncorrelated with the error term,

\[ Cov{(Z_{1 i}, \epsilon_{i})}=0; \quad \ldots; \quad Cov{(Z_{mi}, \epsilon_{i})}=0. \]

In the context of the simple IV estimator, we will find that the exogeneity requirement can not be tested. (Why?)

However, if we have more instruments than we need, we can effectively test whether some of them are uncorrelated with the structural error.

Over-identification case

Under over-identification\((m>k)\), consistent IV estimation with (multiple) different combinations of instruments is possible.

If instruments are exogenous, the obtained estimates should be similar.

If estimates are very different, some or all instruments may not be exogenous.

The Overidentifying Restrictions Test (J test) formally check this.

- The null hypothesis is Instrument Exogeneity.

\[ H_{0}: E\left(Z_{h i} \epsilon_{i}\right)=0, \text { for all } h=1,2, \dots, m \]

Instrument Exogeneity test: the J-test solution

Procedure of J-test (1/2)

The overidentifying restrictions test (also called the \(J\)-test, or Sargan test) is an approach to test the hypothesis that the additional instruments are exogenous.

Procedure of overidentifying restrictions test is:

- Step 1: Compute the IV regression residuals :

\[ \widehat{\epsilon}_{i}^{IV}=Y_{i}-\left(\hat{\beta}_{0}^{ IV}+\sum_{j=1}^{k} \hat{\beta}_{j}^{IV} X_{j i}+\sum_{s=1}^{r} \hat{\beta}_{k+s}^{IV} W_{s i}\right) \]

- Step 2: Run the auxiliary regression: regress the IV residuals on instruments and exogenous regressors. And test the joint hypothesis\(H_{0}: \alpha_{1}=0, \ldots, \alpha_{m}=0\)

\[ \widehat{\epsilon}_{i}^{IV}=\theta_{0}+\sum_{h=1}^{m} \theta_{h} Z_{h i}+\sum_{s=1}^{r} \gamma_{s} W_{s i}+v_{i} \quad \text{(2)} \]

Procedure of J-test (2/2)

- Step3: Compute the J statistic:\(J=m F\)

where\(F\) is the F-statistic of the\(m\) restrictions\(H_0: \theta_{1}=\ldots=\theta_{m}=0\) in eq(2)

Under the null hypothesis,\(J\) statistic is distributed as\(\chi^{2}(m-k)\) approximately for large samples(\(k=\) numbers of endogenous regressor ).

\[ \boldsymbol{J} \sim \chi^{2}({m-k}) \]

IF \(J\) is less than critical value, it means that all instruments are exogenous.

IF \(J\) is larger than critical value, it mean that some of the instruments are enogenous.

- We can apply the \(J\)-test by using

RfunctionlinearHypothesis().

Instrument Exogeneity test: the J-test solution on wage example

Models and the auxiliary regression

Again, we can use both \(matheduc\) and \(fatheduc\) as instruments for \(educ\).

Thus, the IV model is over-identification, and we can test the exogeneity of both these two instruments by using J-test.

The 2SLS model will be set as below.

\[ \begin{cases} \begin{align} \widehat{educ} &= \hat{\gamma}_1 +\hat{\gamma}_2exper + \hat{\beta}_3expersq +\hat{\beta}_4motheduc + \hat{\beta}_5fatheduc && \text{(stage 1)}\\ lwage & = \hat{\beta}_1 +\hat{\beta}_2\widehat{educ} + \hat{\beta}_3exper +\hat{\beta}_4expersq + \hat{\epsilon} && \text{(stage 2)} \end{align} \end{cases} \]

And the auxiliary regression should be

\[ \begin{align} \hat{\epsilon}^{IV} &= \hat{\alpha}_1 +\hat{\alpha}_2exper + \hat{\alpha}_3expersq +\hat{\theta}_1motheduc + \hat{\theta}_2fatheduc + v && \text{(auxiliary model)} \end{align} \]

TSLS: R code and the residuals

We have done the 2SLS estimation before, here is the R code (by using ivreg::ivreg() function):

After the 2SLS estimation, we can obtain the IV residuals of the second stage:

Residuals and new data set

Run the auxiliary regression

We run the auxiliary regression with R code lines:

Then we can obtain the OLS estimation results.

Call:

lm(formula = mod_jtest, data = mroz_resid)

Residuals:

Min 1Q Median 3Q Max

-3.1012 -0.3124 0.0478 0.3602 2.3441

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 1.096e-02 1.413e-01 0.078 0.938

exper -1.833e-05 1.333e-02 -0.001 0.999

expersq 7.341e-07 3.985e-04 0.002 0.999

motheduc -6.607e-03 1.189e-02 -0.556 0.579

fatheduc 5.782e-03 1.118e-02 0.517 0.605

Residual standard error: 0.6752 on 423 degrees of freedom

Multiple R-squared: 0.0008833, Adjusted R-squared: -0.008565

F-statistic: 0.0935 on 4 and 423 DF, p-value: 0.9845J-test: using the restricted F statistics

As what we have done before, We conduct the restrict F-test for the auxiliary regression.

We will restrict jointly with \(\theta_1 = \theta_2 =0\), and using the R function linearHypothesis():

Linear hypothesis test:

motheduc = 0

fatheduc = 0

Model 1: restricted model

Model 2: resid_iv_mf ~ exper + expersq + motheduc + fatheduc

Res.Df RSS Df Sum of Sq F Pr(>F)

1 425 193.02

2 423 192.85 2 0.1705 0.187 0.8295The restricted F-statistics is 0.1870 (with round digits 4 here ).

J-test: calculate the J statistics by hand

Finally, We can calculate J-statistic by hand or obtain it by using special tools.

- Calculate J-statistic by hand

- The calculated J-statistic is 0.3740 (with round digits 4 here ).

J-test: using the \({\chi^2}\) statistics

Also, We can obtain J-statistic by using special tools.

Linear hypothesis test:

motheduc = 0

fatheduc = 0

Model 1: restricted model

Model 2: resid_iv_mf ~ exper + expersq + motheduc + fatheduc

Res.Df RSS Df Sum of Sq Chisq Pr(>Chisq)

1 425 193.02

2 423 192.85 2 0.1705 0.374 0.8294- We obtain the J-statistic 0.3740 (with round digits 4 here ). It’s the same as what we have calculated by hand!

J-test: adjust the freedoms

Caution: In this case the\(p\)-Value reported by linearHypothesis(., test = "Chisq") is wrong because the degrees of freedom are set to 2, and the correct freedom should be \(f=(m-k)=1\).

We have obtain the J statistics\({\chi^2}^{\ast} =0.3740\), and its correct freedom is \(f=(m-k)=1\).

Then we may compute the correct\(p\)-Value of this the J statistics 0.5408 (by using function

pchisq()inR).

J-test: the conclutions

Now we can get the conclusions of J-test.

Since the p-value of J-test(0.5408)is larger than the criteria value 0.1, we can’t reject the null hypothesis that both instruments are exogenous.

This means both instruments( motheduc and fatheduc) are exogenous.

Class Exercises

Three IVs for educ

For the wage case, and the origin model(Mis-specificated) was assumed to have only one endogenous variable(educ)

\[ \begin{align} lwage = {\beta}_1 +{\beta}_2{educ} + {\beta}_3exper +{\beta}_4expersq + {\epsilon} \end{align} \]

If we add husband’s education(huseduc) to the IV list, then we will have totally three IVs (fatheduc, motheduc and huseduc) for educ.

Use these three IVs to obtain TSLS results. Compare the TSLS results when using two IVs(

fatheducandmotheduc) which we have got.Conduct the over-identification test (J-test).

17.6 Testing Regressor endogeneity

Regressor Endogeneity: Introduction

The concepts

It is the researcher’s responsibility to specify which variables are endogenous and which are exogenous. So, how can we test the regressor endogeneity?

Since OLS is in general more efficient than IV (recall that if Gauss-Markov assumptions hold OLS is BLUE), we don’t want to use IV when we don’t need to get the consistent estimators.

Of course, if we really want to get a consistent estimator, we also need to check whether the endogenous regressors are really endogenous in the model.

So we should test following hypothesis:

\[ H_{0}: \operatorname{Cov}(X, \epsilon)=0 \text { vs. } H_{1}: \operatorname{Cov}(X, \epsilon) \neq 0 \]

Test regressor endogeneity: the Hausman test solution

Introduction of Hausman test

Hausman tells us that we should use OLS if we fail to reject\(H_{0}\). And we should use IV estimation if we reject\(H_{0}\)

Let’s see how to construct a Hausman test. While the idea is very simple.

If\(X\) is exogenous in fact, then both OLS and IV are consistent, but OLS estimates are more efficient than IV estimates.

If\(X\) is endogenous in fact, then the results from OLS estimators are different, while results obtained by IV (eg. 2SLS) are consistent.

The idea Hausman test

We can compare the difference between estimates computed using both OLS and IV.

- If the difference is small, we can conjecture that both OLS and IV are consistent and the small difference between the estimates is not systematic.

- If the difference is large this is due to the fact that OLS estimates are not consistent. We should use IV in this case.

The Hausman statistics

The Hausman test takes the following statistics form (\(k=\) numbers of edogenous regressor )

\[ \begin{align} \hat{H}=n\boldsymbol{\left[\hat{\beta}_{IV}-\hat{\beta}_{\text {OLS}}\right] ^{\prime}\left[\operatorname{Var}\left(\hat{\beta}_{IV}-\hat{\beta}_{\text {OLS}}\right)\right]^{-1}\left[\hat{\beta}_{IV}-\hat{\beta}_{\text {OLS}}\right]} \xrightarrow{d} \chi^{2}(k) \end{align} \]

If\(\hat{H}\) is less than the critical\(\chi^2\) value, we can not reject the null hypothesis, and the regressor should not be endogenous.

If\(\hat{H}\) is larger than the critical\(\chi^2\) value, the null hypothesis is rejected , and the regressor should be endogenous.

The procedure of Hausman test

The origin model is

\[ \begin{align} Y_{i}=\hat{\alpha}_{0} + \alpha_1 X_i+\hat{\beta}_{1} W_{1 i}+\ldots+\hat{\beta}_{p} W_{p i} +u_{i} \quad \text{(origin model)} \end{align} \]

- Conduct the first-stage regression of 2SLS estimation and obtain the residuals \(v_i\).

\[ \begin{align} X_{i}=\hat{\gamma}_{0}+\hat{\gamma}_{1} W_{1 i}+\ldots+\hat{\gamma}_{p} W_{p i}+ \hat{\theta}_{1} Z_{1 i}+\ldots+\hat{\theta}_{q} Z_{q i}+v_{i} \quad \text{(reduced model)} \end{align} \]

- Then estimate the control function by least squares

\[ \begin{align} Y_{i}=\hat{\delta}_{0} + \hat{\delta}_1 X_i + \hat{\delta}_{1} W_{1 i}+\ldots+\hat{\delta}_{p} W_{p i}+ \hat{\lambda}_{1} v_i+ u_{i} \quad \text{(control model)} \end{align} \]

Conduct the Restricted F-test with\(H_0: \lambda_1=0\) (Wu-Hausman F-test).

If the\(F\)-statistic is lager than critical value, the regressor\(X_i\) is Endogenous.

Test regressor endogeneity: the Hausman test on Wage example

The origin model and instruments

The origin model is

\[ \begin{aligned} lwage & = \hat{\alpha}_0 +\hat{\alpha}_1 {educ} + \hat{\beta}_1 exper +\hat{\beta}_2 expersq + u_i && \text{(origin model)} \end{aligned} \]

Again, we use both \(matheduc\) and \(fatheduc\) as instruments for \(educ\) in our IV model setting.

\[ \begin{cases} \begin{align} {educ} &= \hat{\gamma}_0 +\hat{\gamma}_1exper + \hat{\gamma}_2expersq + \hat{\theta}_1motheduc + \hat{\theta}_2fatheduc +v_i && \text{(stage 1)}\\ lwage & = \hat{\eta}_1 +\hat{\eta}_2\widehat{educ} + \hat{\eta}_3exper +\hat{\eta}_4expersq + e_i && \text{(stage 2)} \end{align} \end{cases} \]

The R solutions for Hausman test

In R, we have at least two equivalent solutions to conduct Hausman test:

Solution 1 (Automatically) : We can use IV model diagnose tool to check the Hausman test results. In fact,

Rfunctionsummary(lm_iv_mf, diagnostics = TRUE)by settingdiagnostics = TRUEwill give you these results (Wu-Hausman F).Solution 2 (Calculate by hand) : With Step-by-step calculation according to the procedures, you can obtain the Wu-Hausman F statistics.

So let’s try both of these solutions!

Solution 1: Wu-Hausman test diagnose for the IV model (R code)

Solution 1: Wu-Hausman test diagnose for the IV model (R result)

### ==== solution 1 for Hausman test (full model diagnose) ====

summary(lm_iv_mf, diagnostics = TRUE)

Call:

ivreg(formula = mod_iv_mf, data = mroz)

Residuals:

Min 1Q Median 3Q Max

-3.0986 -0.3196 0.0551 0.3689 2.3493

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.0481003 0.4003281 0.120 0.90442

educ 0.0613966 0.0314367 1.953 0.05147 .

exper 0.0441704 0.0134325 3.288 0.00109 **

expersq -0.0008990 0.0004017 -2.238 0.02574 *

Diagnostic tests:

df1 df2 statistic p-value

Weak instruments 2 423 55.400 <2e-16 ***

Wu-Hausman 1 423 2.793 0.0954 .

Sargan 1 NA 0.378 0.5386

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.6747 on 424 degrees of freedom

Multiple R-Squared: 0.1357, Adjusted R-squared: 0.1296

Wald test: 8.141 on 3 and 424 DF, p-value: 2.787e-05 Solution 2: the equivalent F statistics of Hausman test (R code)

### ==== solution 2 for Hausman test (calculate) ====

## guide with Hansen's chpt 12.29 Endogeneity test

## reduced function for endogenous education

red_mf <- formula(educ ~ exper + expersq + motheduc + fatheduc)

fit_red_mf<- lm(formula = red_mf, data = mroz)

## extract residual u2 and combined new dataset

resid_mf <- data.frame(resid_mf = resid(fit_red_mf))

tbl_mf <- cbind(mroz, resid_mf)

## control function OLS estimation

control_mf <- formula(lwage ~ educ +exper + expersq + resid_mf)

fit_control_mf <- lm(formula = control_mf, data = tbl_mf)

smry_control_mf <- summary(fit_control_mf)

## extract t statistics of alpha

t_star_resid <- pull(

as_tibble(t(smry_control_mf$coefficients[,"t value"])),

"resid_mf")

## calculate equivalent F statistics

restricted_F_mf <- linearHypothesis(model = fit_control_mf, "resid_mf=0")

F_star_resid <- restricted_F_mf$F[2]

p_F_resid <- restricted_F_mf$`Pr(>F)`[2]Solution 2: the equivalent F statistics of Hausman test (R result)

Call:

lm(formula = control_mf, data = tbl_mf)

Residuals:

Min 1Q Median 3Q Max

-3.03743 -0.30775 0.04191 0.40361 2.33303

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.0481003 0.3945753 0.122 0.903033

educ 0.0613966 0.0309849 1.981 0.048182 *

exper 0.0441704 0.0132394 3.336 0.000924 ***

expersq -0.0008990 0.0003959 -2.271 0.023672 *

resid_mf 0.0581666 0.0348073 1.671 0.095441 .

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.665 on 423 degrees of freedom

Multiple R-squared: 0.1624, Adjusted R-squared: 0.1544

F-statistic: 20.5 on 4 and 423 DF, p-value: 1.888e-15Conclusions of Hausman test

The results for the lwage origin equation are as follows:

(Wu-)Hausman test for endogeneity: barely reject the null that the variable of concern is uncorrelated with the error term, indicating that

educis marginally endogenous. The Hausman statistics\(\hat{H}= {\chi^2}^{\ast} = 2.79\), and its p-value is 0.095.Weak instruments test: rejects the null hypothesis(Weak instruments). At least one of these instruments(

motheducorfatheduc) is strong. The restricted F-test statistics\(F^{\ast}_R = 55.4\), and its p-value is 0.0000.Sargan overidentifying restrictions(Instruments exogeneity J-test): does not reject the null. The extra instruments (

motheducandfatheduc) are valid (both are exogenous, and are uncorrelated with the error term).

chapter Summary

Key points

An instrumental variable must have two properties:

- it must be exogenous, that is, uncorrelated with the error term of the structural equation;

- it must be partially correlated with the endogenous explanatory variable.

Finding a variable with these two properties is usually challenging.

Though we can never test whether all IVs are exogenous, we can test that at least some of them are.

When we have valid instrumental variables, we can test whether an explanatory variable is endogenous.

The method of two stage least squares is used routinely in the empirical social sciences.

But when instruments are poor, then 2SLS can be worse than OLS.

Exercise and Computation

Card wage case

Introduction

With data set Card1995.dta, researchers were interest in the return (log(Wage)) to education (edu), and they mainly focus the effect of students living region nearby the college.

In a influential paper David Card (1995) suggested if a potential student lives close to a college this reduces the cost of attendance and thereby raises the likelihood that the student will attend college.

However, college proximity does not directly affect a student’s skills or abilities so should not have a direct effect on his or her market wage.

Origin model

The origin model is

\[ \begin{aligned} lwage & = \hat{\alpha}_0 +\hat{\alpha}_1 {educ} + \hat{\alpha}_3 exp +\hat{\alpha}_4 exp2 +\hat{\alpha}_5 black +\hat{\alpha}_6 south +\hat{\alpha}_7 urban + u_i \end{aligned} \]

variables

Models and IV list sets

Let’s consider following estimation solutions:

Error specification model with OLS regression directly.

Equivalent IVs for endogenous regressors (just- identificaion)

The IV model using

collegeas instruments foreducThe IV model using (

college,age,age2) as instruments for (edu,exp,exp2)

- Abundant IVs for endogenous regressors (over-identification)

The IV model using both (

public,private) as instruments foreducThe IV model using both (